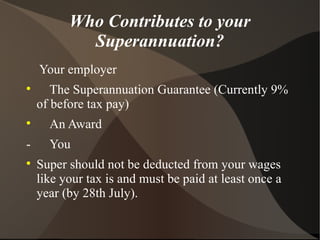

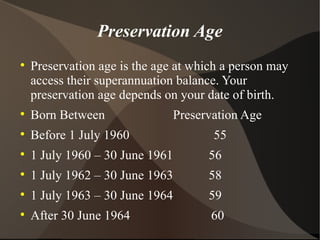

Superannuation, or super, is a retirement savings mechanism that offers tax advantages over regular savings accounts. Contributions come primarily from employers, based on the superannuation guarantee, with limited exceptions for low earners and younger workers. Early access to super is restricted to specific circumstances, and the preservation age for accessing funds varies based on the individual's date of birth.