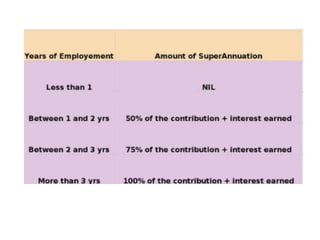

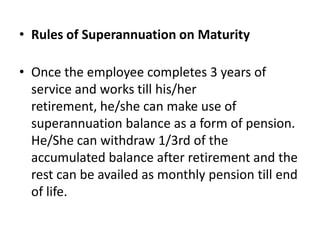

Superannuation refers to a pension granted upon retirement. Retirement plans are typically set up by employers, insurance companies, governments, or other institutions to provide income for people after they stop regular employment. Superannuation funds are retirement benefits contributed by employers, usually a percentage of basic wages, and invested over time to provide pension payments upon retirement. Employees can withdraw some benefits as a lump sum at retirement and receive the rest as monthly annuity payments. Unused superannuation balances can be transferred if employees change employers or withdrawn with tax implications if no longer working.