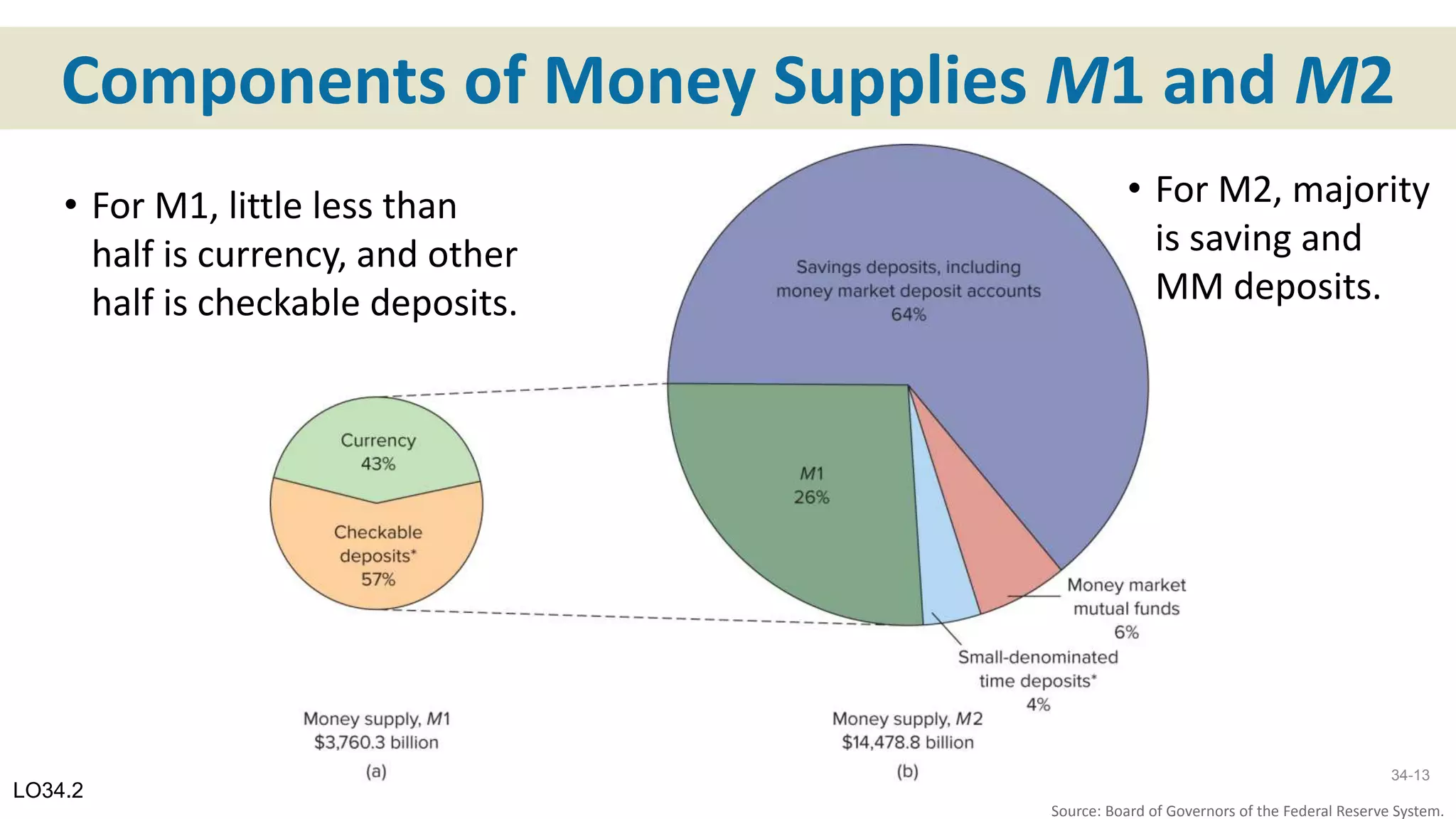

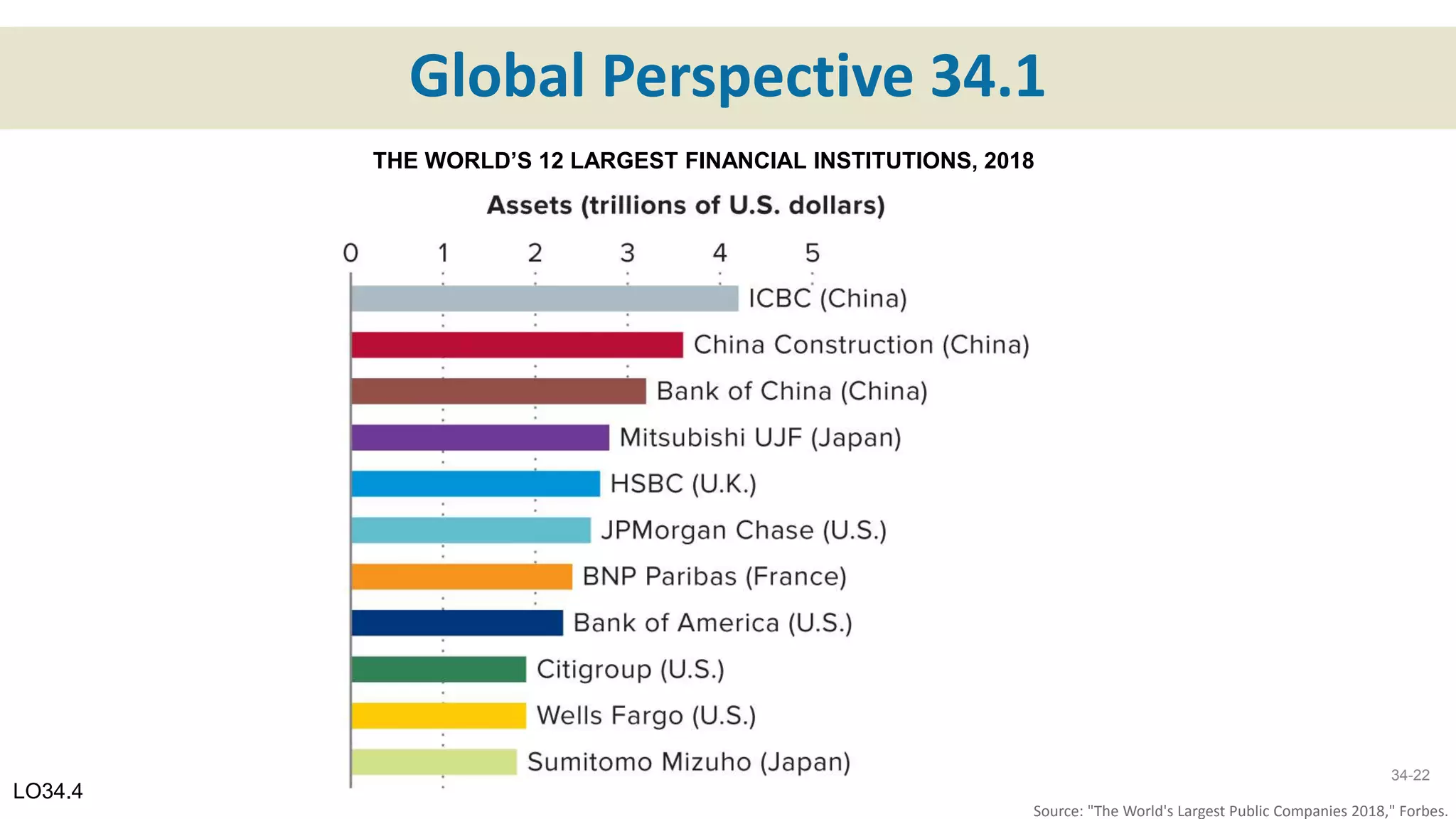

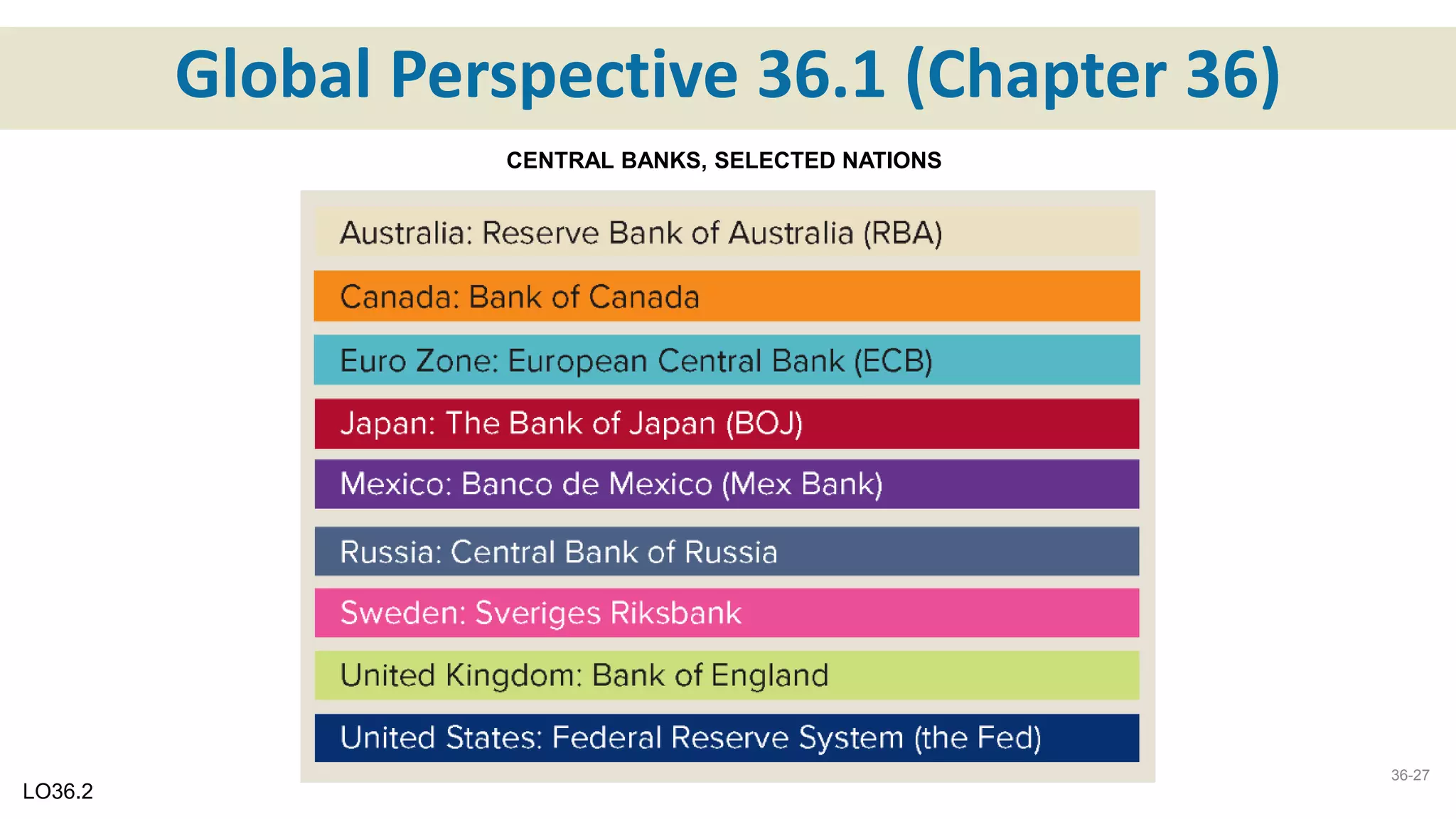

The document provides an overview of money, banking, and financial institutions. It discusses the functions of money as a medium of exchange, unit of account, and store of value. It describes the components of the money supply, including M1 and M2 aggregates. It also outlines the organizational structure of the Federal Reserve System, including the regional Federal Reserve banks, Board of Governors, and Federal Open Market Committee. Additionally, it discusses the Federal Reserve's functions and independence, and provides context on the financial crisis of 2007-2008.