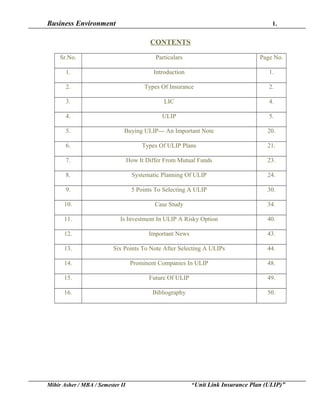

This document provides an overview of Unit Linked Insurance Plans (ULIPs). It begins with explaining what ULIPs are, noting they provide both life insurance and allow investment values to fluctuate based on underlying asset values. It then discusses benefits of ULIPs like flexibility to change coverage and investment allocations. However, it also notes ULIPs may not be ideal for short-term investing due to front-loaded fees. Overall, the document analyzes factors to consider when deciding between ULIPs and other investment/insurance options.