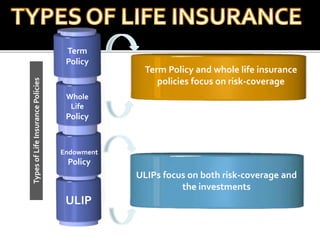

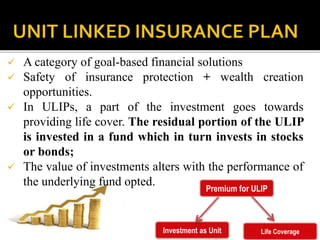

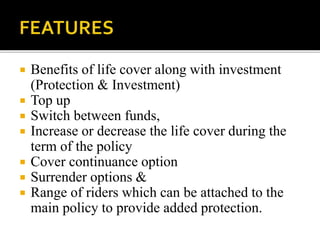

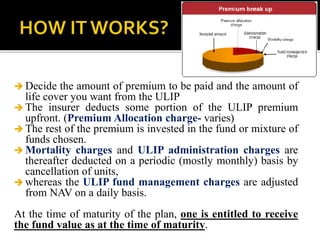

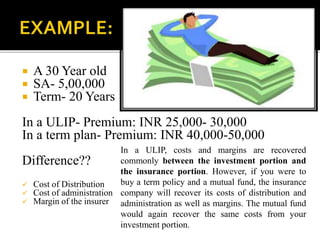

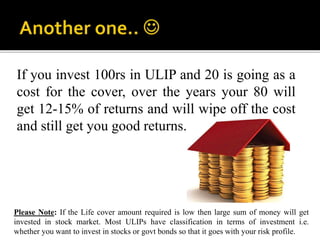

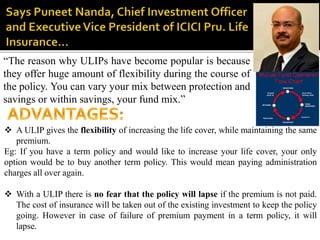

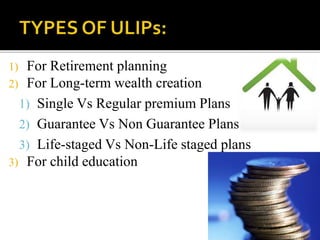

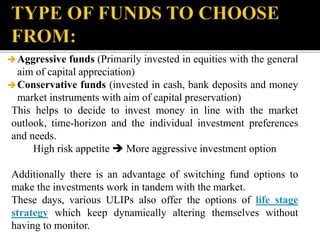

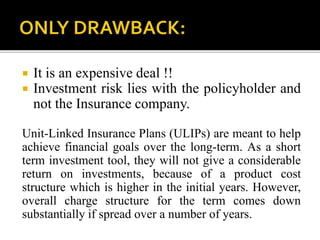

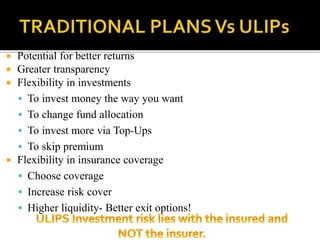

This document provides information about Unit Linked Insurance Plans (ULIPs). It discusses that ULIPs focus on both risk coverage and investments. A portion of ULIP premiums goes towards life insurance coverage, while the remaining amount is invested in funds consisting of stocks and bonds. ULIPs offer flexibility to switch funds and alter life coverage amounts. Charges are deducted from ULIP premiums and ongoing fund values. Overall, ULIPs provide both insurance protection and investment opportunities for long-term goals.