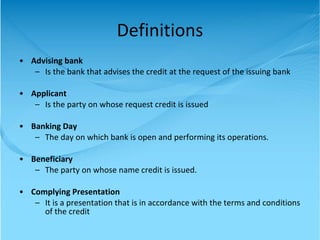

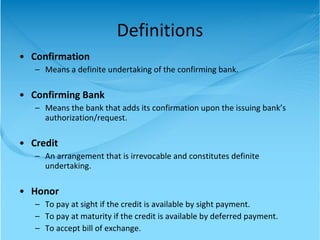

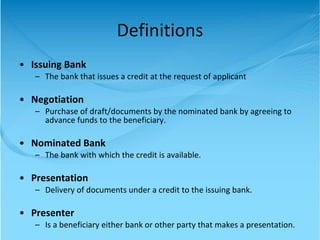

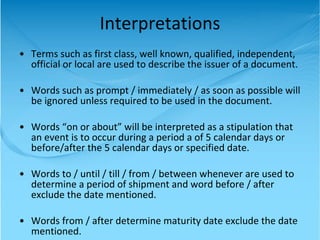

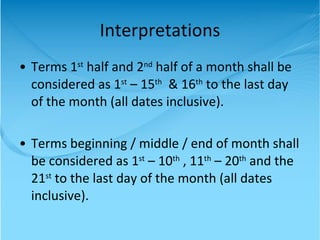

UCP 600 is a set of rules established by the International Chamber of Commerce in 1933 that govern documentary credits, binding all parties involved unless modified. It defines various terms relevant to international trade such as advising bank, beneficiary, and issuing bank, as well as methods of document authentication and interpretation of timelines. The document outlines the irrevocable nature of credits, presentation requirements, and specific terms used in trade transactions.