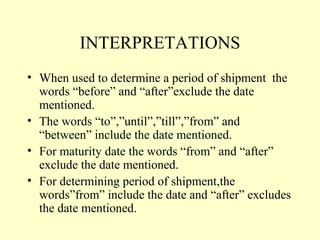

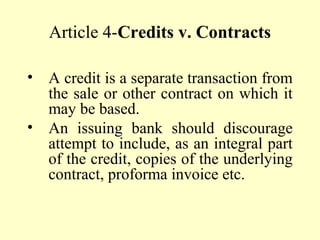

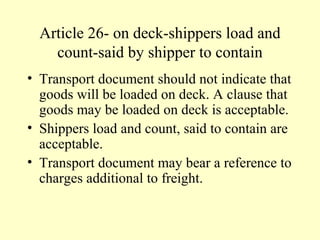

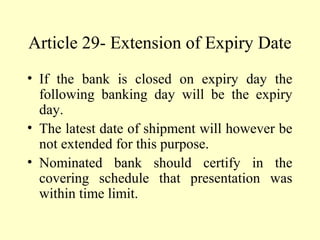

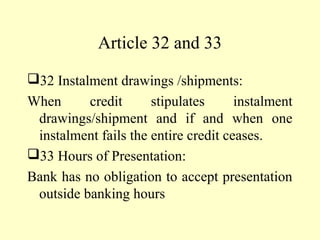

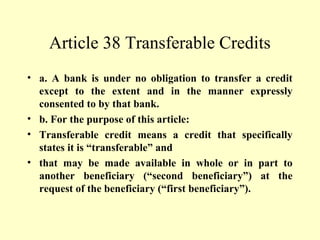

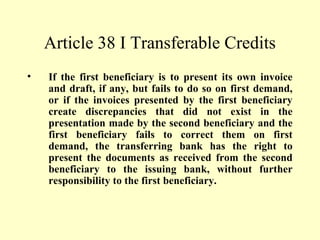

This document provides definitions and guidelines for understanding and applying the Uniform Customs and Practice for Documentary Credits (UCP600). It begins with definitions of key terms like applicant, beneficiary, complying presentation, credit, issuing bank, and nominated bank. It then outlines guidelines for credit requirements, standard examination of documents, complying and discrepant presentations, transport documents, insurance documents, and other issues commonly addressed in documentary credit transactions. The overall purpose is to establish a common framework and shared understanding for parties involved in credits subject to UCP600 rules.