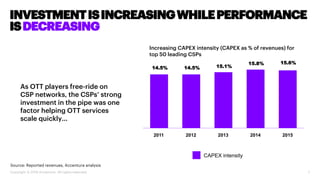

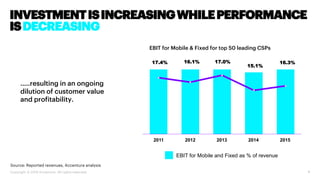

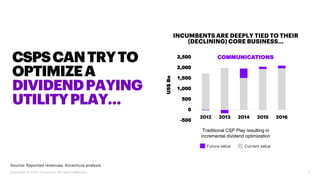

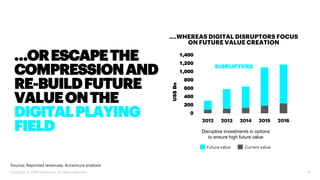

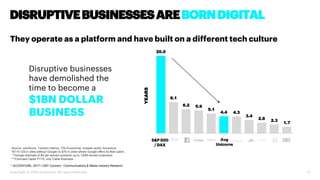

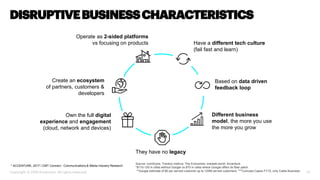

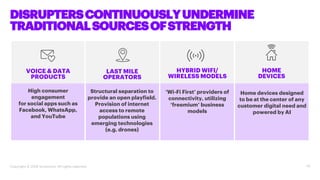

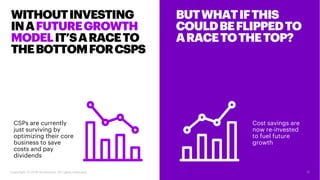

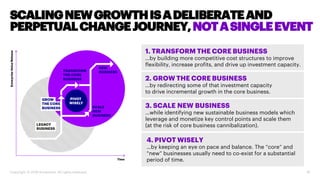

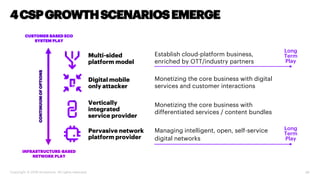

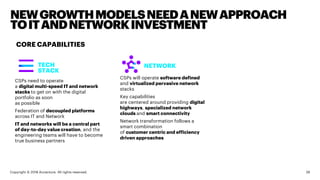

Communications service providers (CSPs) are facing significant challenges due to stagnant revenues and increased competition from digital disruptors, requiring a shift in their business models. To remain relevant, CSPs must embrace new service models, transform their core operations, and invest in innovative technologies while balancing legacy systems. The document emphasizes the necessity for CSPs to develop a customer-centric approach and create partnerships to enhance their digital offerings and competitiveness.