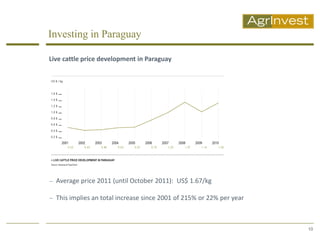

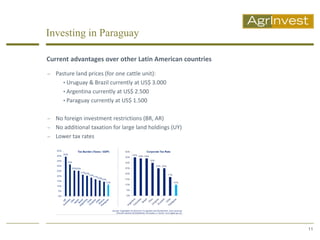

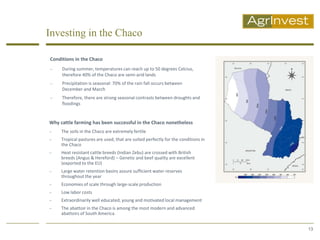

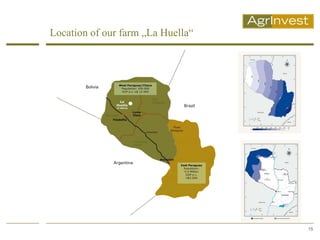

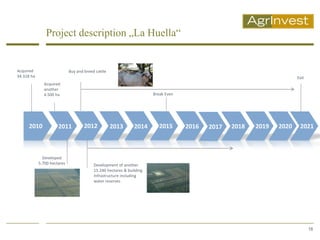

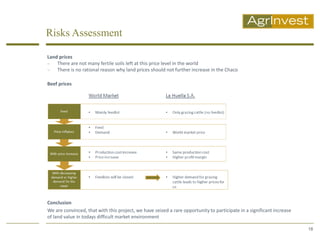

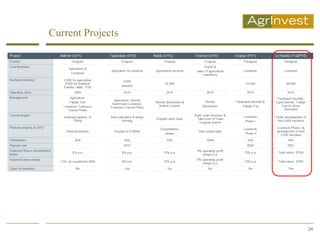

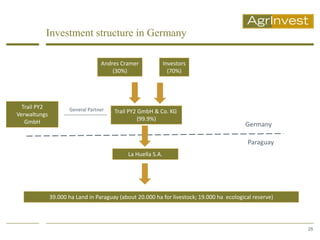

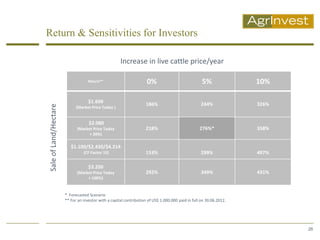

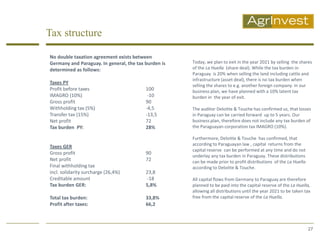

The document provides an overview of an investment in a large-scale cattle farm project in Paraguay. It acquired over 38,000 hectares of land for cattle grazing and plans to develop the land with approximately 14,000 cattle units. The total capital investment is $30 million, with $14 million already secured from private equity investors. It provides details on the investment structure, management team, location of the farm, and projected returns for investors under different scenarios for increases in cattle prices and land values.