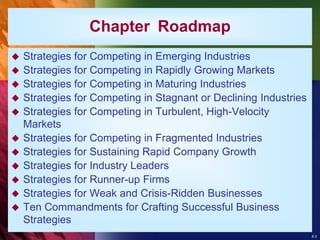

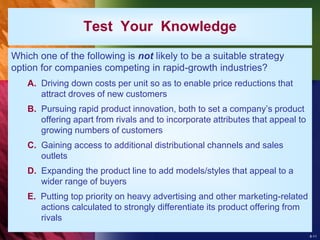

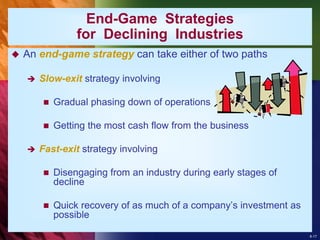

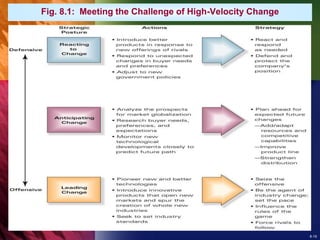

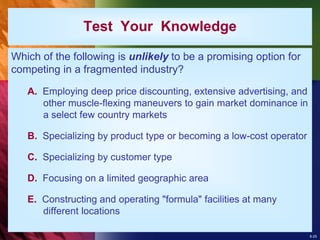

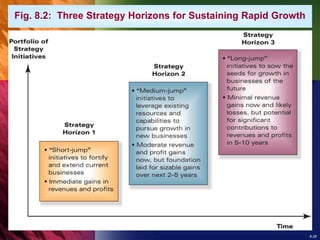

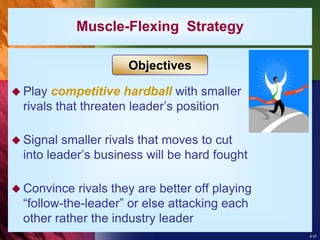

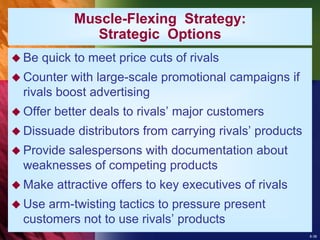

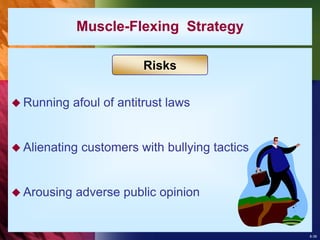

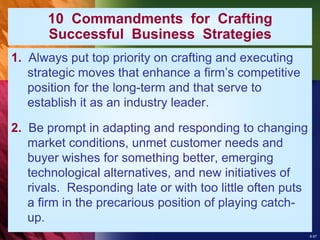

The document provides an overview of strategies for tailoring business strategies to different industry and company situations. It discusses strategic options for competing in emerging, rapidly growing, mature, stagnant/declining, turbulent, and fragmented industries. It also outlines strategies based on a company's market position as an industry leader, runner-up firm, or weak/crisis-ridden business. The document contains chapter roadmaps, descriptions of industry characteristics, strategic considerations, and potential strategic options for various competitive environments.