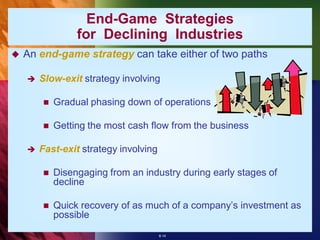

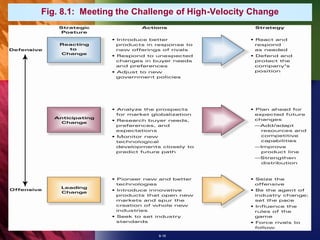

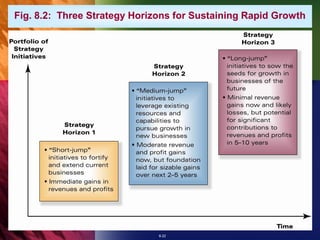

This document discusses strategies for tailoring a company's strategy based on its industry situation. It covers strategies for emerging industries, rapidly growing markets, mature industries, declining industries, high-velocity markets, and fragmented industries. The key strategies discussed include pursuing early leadership, alliances, cost reductions, innovation, international expansion, focus, differentiation, and flexibility. Risks include raising capital, managing rapid growth, responding to competition and changing demand.