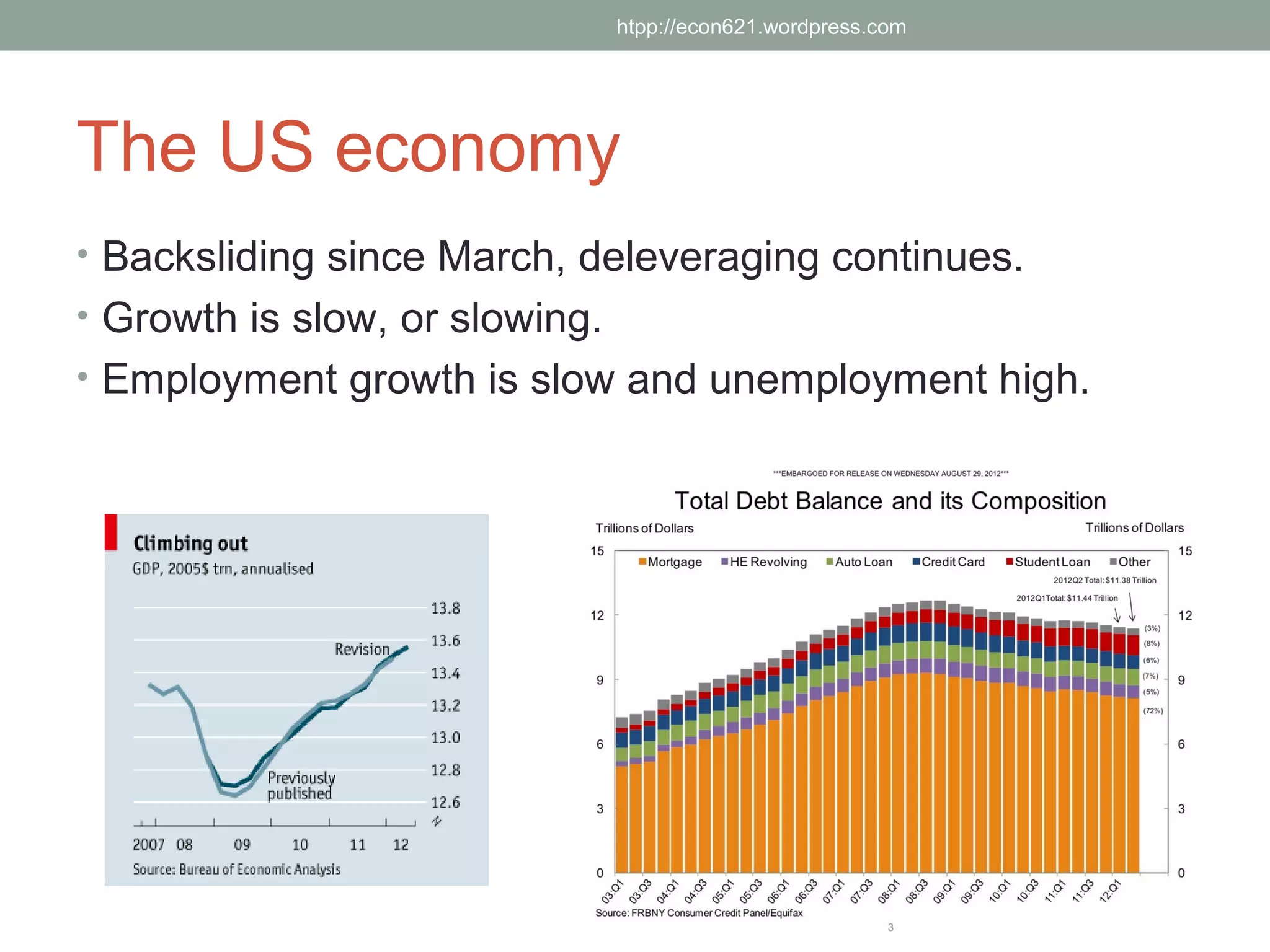

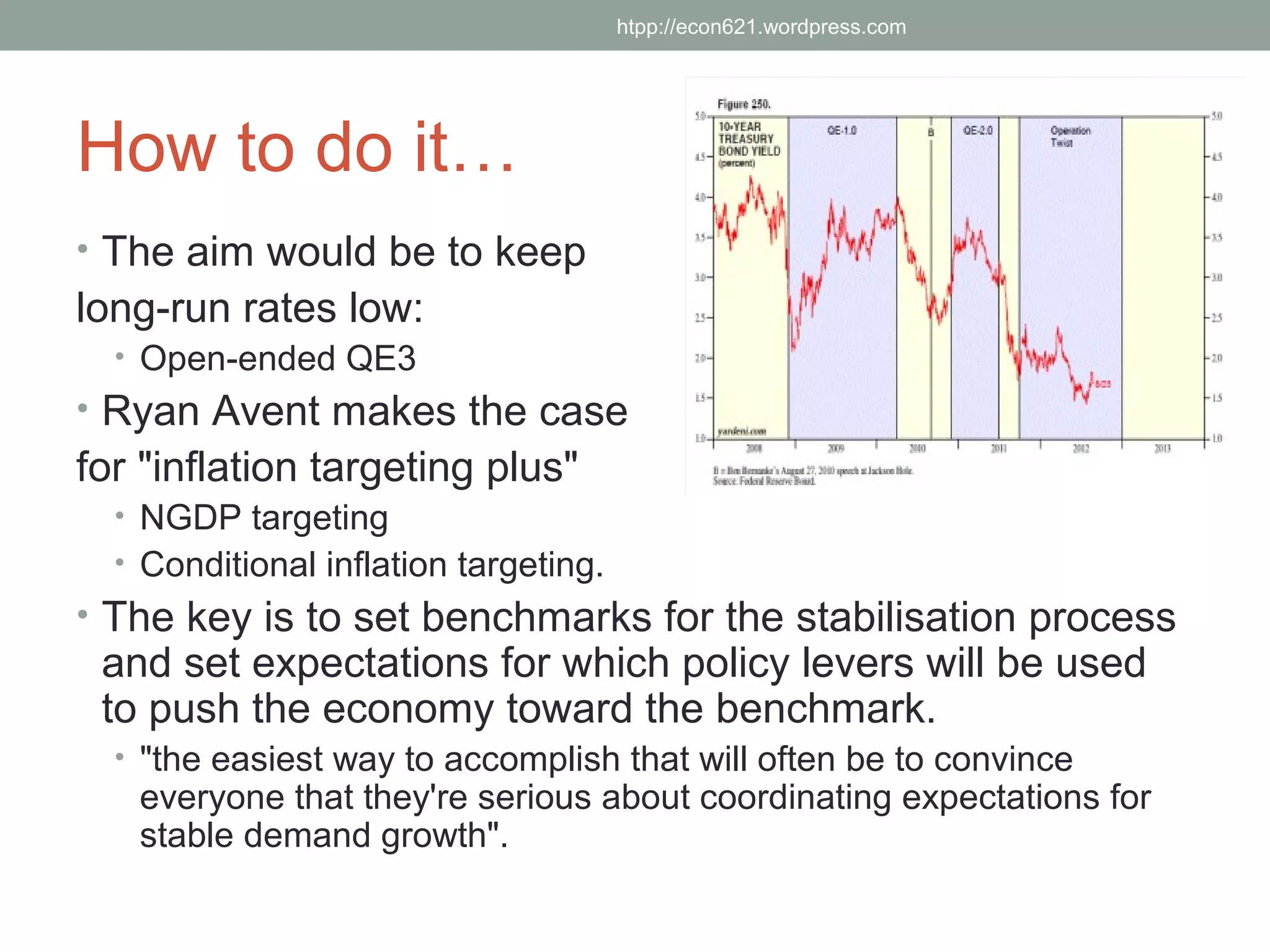

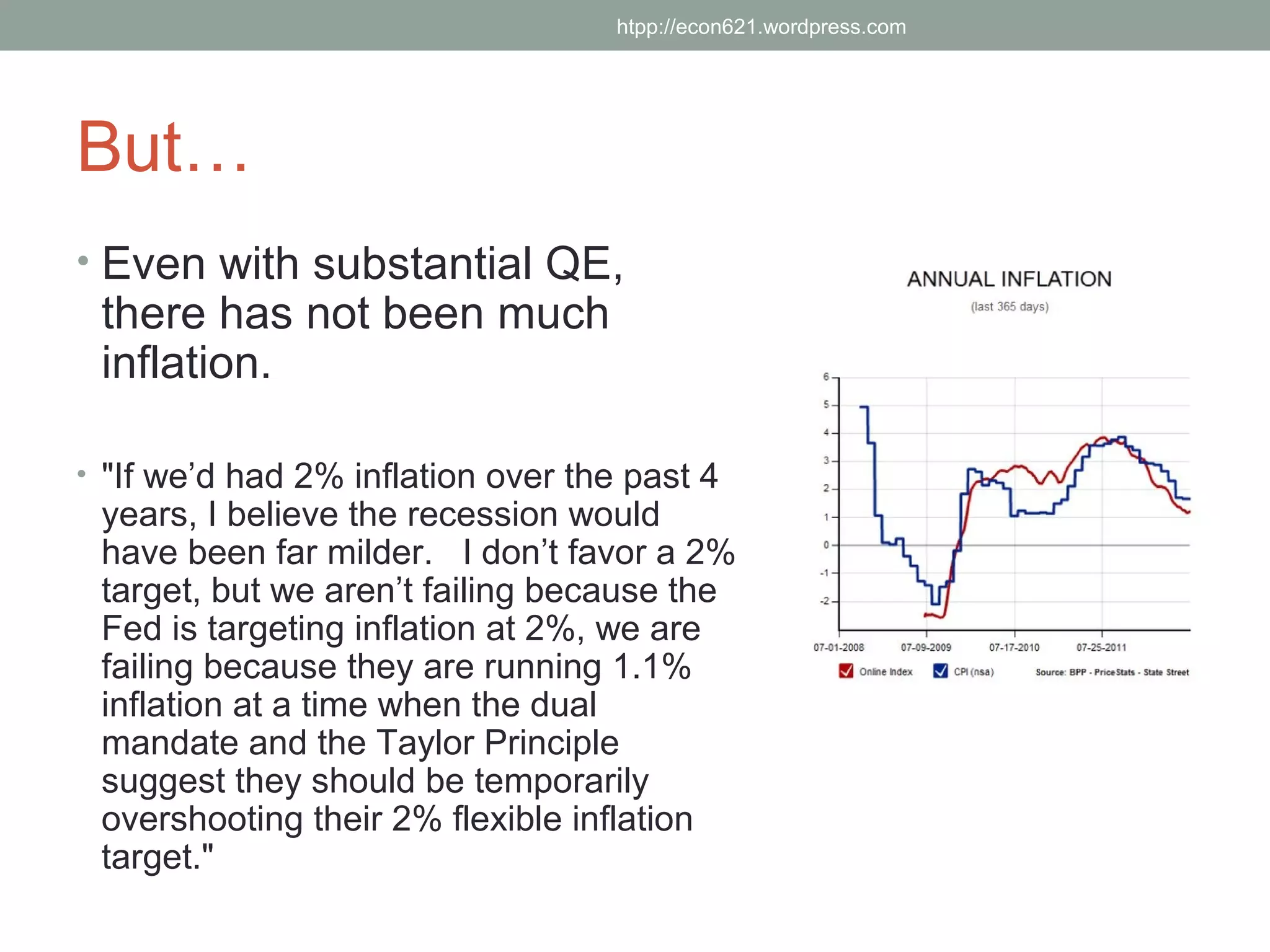

The document discusses the current state of the US economy, debates around additional actions the Federal Reserve could take, and differing views on these policies. It notes that while the US economy is slowly recovering, growth remains slow. It also outlines the "fiscal cliff" risks to the economy if tax cuts expire and spending cuts take effect. The document discusses calls for more monetary stimulus from the Fed and debates around whether this would effectively boost demand and inflation or fuel further problems. It concludes by looking ahead to the Jackson Hole symposium and an upcoming class debate on bank accountability.