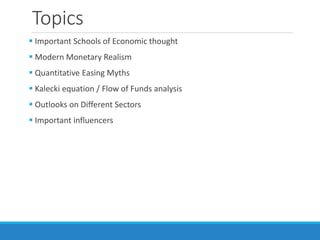

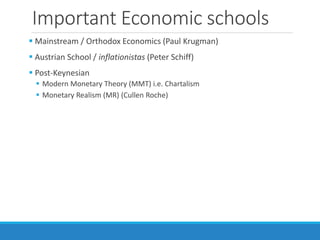

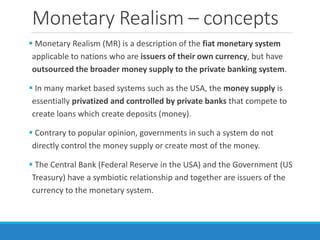

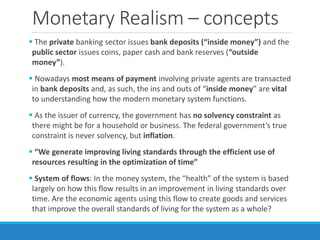

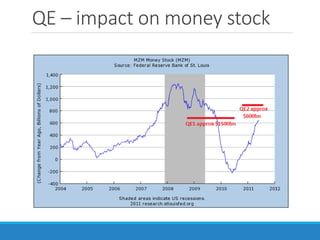

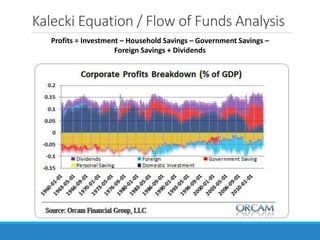

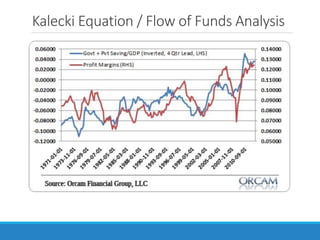

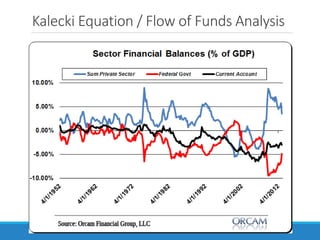

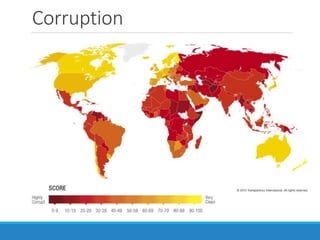

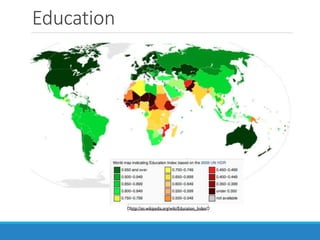

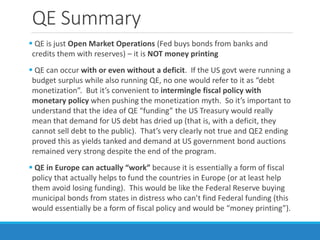

The document provides an in-depth analysis of global macroeconomics, focusing on modern monetary realism, the complexities of the fiat monetary system, and the roles of various economic schools of thought. It discusses the implications of quantitative easing, sector outlooks, and the economic conditions in the U.S., Europe, Japan, and China, alongside critiques of common myths surrounding economic constraints and policies. The author emphasizes the need for understanding monetary mechanisms over simplistic views of government solvency and inflation, while also addressing the potential for emerging markets like India.