The state of the us economy marco annunziata ge market sense 1 nov12

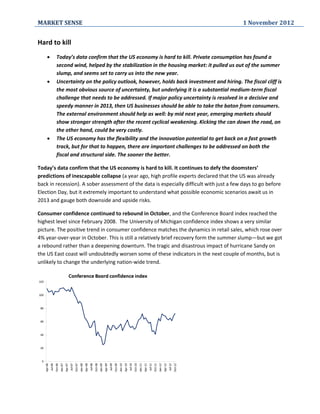

- 1. MARKET SENSE 1 November 2012 Hard to kill Today’s data confirm that the US economy is hard to kill. Private consumption has found a second wind, helped by the stabilization in the housing market: it pulled us out of the summer slump, and seems set to carry us into the new year. Uncertainty on the policy outlook, however, holds back investment and hiring. The fiscal cliff is the most obvious source of uncertainty, but underlying it is a substantial medium-term fiscal challenge that needs to be addressed. If major policy uncertainty is resolved in a decisive and speedy manner in 2013, then US businesses should be able to take the baton from consumers. The external environment should help as well: by mid next year, emerging markets should show stronger strength after the recent cyclical weakening. Kicking the can down the road, on the other hand, could be very costly. The US economy has the flexibility and the innovation potential to get back on a fast growth track, but for that to happen, there are important challenges to be addressed on both the fiscal and structural side. The sooner the better. Today’s data confirm that the US economy is hard to kill. It continues to defy the doomsters’ predictions of inescapable collapse (a year ago, high profile experts declared that the US was already back in recession). A sober assessment of the data is especially difficult with just a few days to go before Election Day, but it extremely important to understand what possible economic scenarios await us in 2013 and gauge both downside and upside risks. Consumer confidence continued to rebound in October, and the Conference Board index reached the highest level since February 2008. The University of Michigan confidence index shows a very similar picture. The positive trend in consumer confidence matches the dynamics in retail sales, which rose over 4% year-over-year in October. This is still a relatively brief recovery form the summer slump—but we got a rebound rather than a deepening downturn. The tragic and disastrous impact of hurricane Sandy on the US East coast will undoubtedly worsen some of these indicators in the next couple of months, but is unlikely to change the underlying nation-wide trend.

- 2. MARKET SENSE 1 November 2012 Housing and jobs are the main factors behind the stronger consumer confidence. Evidence that the housing market has bottomed out and started a gradual recovery gets more convincing every month. Only a slow and gradual improvement, but an improvement: housing is no longer a headwind to the recovery. Initial jobless claims declined this week, beating expectations, and confirming the picture of a slow firming up of the labor market. The pace of job creation is disappointing, and I remain of the view that the labor market weakness has a bigger structural component than the Fed seems to think. The improved trends in consumer confidence and consumption are consistent in principle with a troubling entrenched dichotomy between the haves and the have-nots in the labor market: on one side, people who have the right skills and are now less afraid of losing their jobs; on the other people who still find themselves shut out of the labor market. Data on voluntary separations (workers resigning to pursue other opportunities) and indications of increased labor mobility seem to point in the same direction—a reminder that skills and education will play a more and more important role in employment trends as we go forward. Narrowing this dichotomy is key to prevent a deterioration in the potential growth rate of the economy.

- 3. MARKET SENSE 1 November 2012 Business sentiment as measured by the manufacturing ISM also improved, rising for the second consecutive month in October. This is another testament to the resilience of domestic consumption, given that international trade has weakened in the past few months. Investment and hiring, however, are still held back by the uncertainty on the post-election outlook, and in particular on how the “fiscal cliff” will be addressed. According to the Washington Post, a study by the National Association of Manufacturers to be released tomorrow (Friday) estimates that the Damocles’ sword of the fiscal cliff will have cost us about one million jobs this year—quite a costly uncertainty ( http://www.washingtonpost.com/business/economy/fiscal-cliff-already-hampering-us- economy-report-says/2012/10/25/45730250-1ecf-11e2-ba31-3083ca97c314_story.html ). Given the precedent of last year’s debt ceiling fiasco, it would be prudent to assume that any agreement on the fiscal cliff will only be reached at the very last moment, and possibly after some of the cliff’s automatic tax hikes and spending cuts have already been triggered. But in the end common sense should prevail and almost everyone expects that the bulk of the fiscal cliff will be avoided. The real issue is that the US’s medium term fiscal picture looks precarious, and will eventually require some tough decisions. On current legislation, the Congressional Budget Office estimates that debt held by the public might rise to 200% of GDP by 2035. The bulk of the projected rise is driven by health care costs, but the current underlying state of public finances is far from healthy, with gross public debt in excess of 100% of GDP and a fiscal deficit of close to 9% of GDP even as interest payments on the debt are at exceptionally low levels (2012 IMF projections). There is a wide window of opportunity to act: US government bonds are still seen as a safe haven, and the projected rise in health care costs can be addressed without a short-term budget squeeze. Public finances can be brought back on a sustainable track without draconian growth-destroying measures. But uncertainty is costly, and this is a large uncertainty to face, especially when compounded by question marks on whether US potential growth has weakened, and by fears on the external environment. If major policy uncertainty is resolved in a sufficiently decisive and speedy manner in 2013, then US businesses should be able to take the baton from consumers. US corporates are healthy, lean and

- 4. MARKET SENSE 1 November 2012 profitable, with cash to invest and an existing workforce already squeezed to capacity—the conditions for an acceleration in investment and hiring are in place. External conditions should turn more supportive by mid-2013. While Europe will still be in the doldrums, emerging markets should start seeing the impact of the recent loosening in policies. We are seeing early signs in China, where the pick-up in the PMI index is consistent with a soft landing to a 7-8% GDP growth rate. Kicking the can down the road, on the other hand, might be very costly. US consumers are doing a commendable job at supporting economic growth through the year-end uncertainty, but their balance sheets are still too weak to fuel a further acceleration into next year. The corporate sector will need to take a greater role, and better visibility over the economic horizon is essential. Protracted uncertainty could hold back hiring, undermining the improvement in both consumer and business sentiment, prolonging the current state of sluggish and fragile economic performance. The US economy has the flexibility and the innovation potential to get back on a fast growth track, but for that to happen, there are important challenges to be addressed on both the fiscal and structural side. The sooner the better.