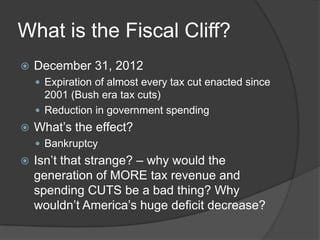

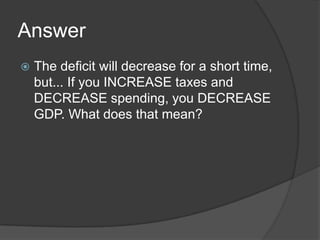

The document discusses the potential economic effects of going over the "fiscal cliff" at the end of 2012, which would result in large tax increases and spending cuts. [1] Going over the cliff could plunge the economy into a recession in 2013, reducing GDP growth by 0.5% and increasing unemployment to 9.1%. [2] While it would significantly reduce the budget deficit, the spending cuts and tax increases would also cut consumer spending, cause businesses to fail, and reduce mass employment. [3]

![Let’s start with increasing

taxes…

GDP is Gross Domestic Product– “the market

value of all officially recognized final goods

and services produced within a country in a

given period of time” [WFE]

Really, it’s just the standard of living

If you increase GDP, people will spend less,

right?

What happens when there is less spending?

Business begin to fail (not enough people buying

their stuff due to low spending confidence)

Mass unemployment](https://image.slidesharecdn.com/fiscalcliff-121128223219-phpapp02/85/Fiscal-cliff-5-320.jpg)