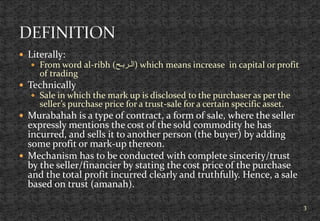

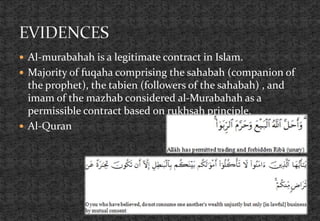

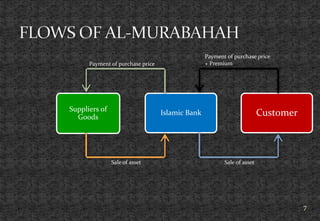

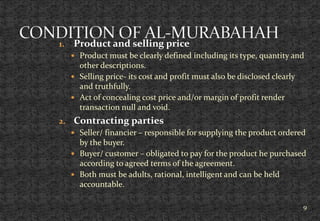

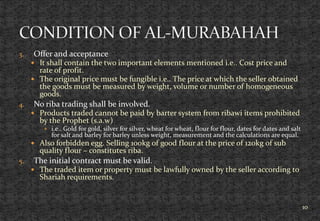

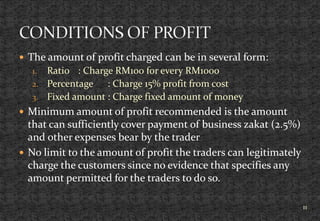

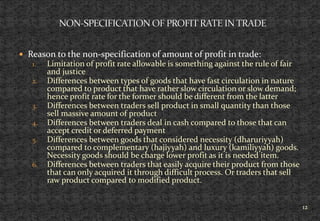

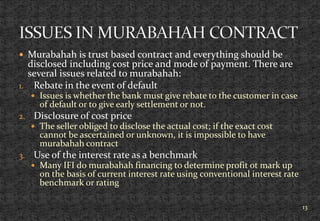

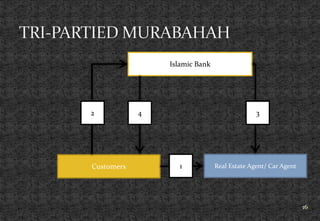

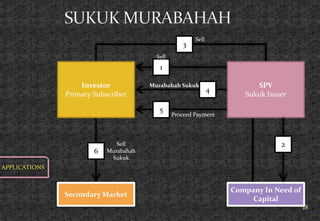

This document defines murabahah, provides evidence for its validity, and outlines its key pillars and conditions. Murabahah involves the sale of an asset where the seller discloses the purchase price and adds an agreed-upon profit. It must involve trust and transparency between buyer and seller. The document also discusses applications of murabahah, including murabahah financing, commodity trading, and sukuk murabahah (asset-backed securities).