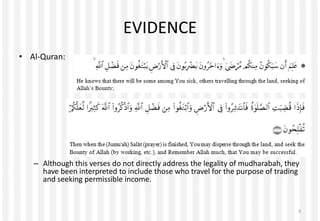

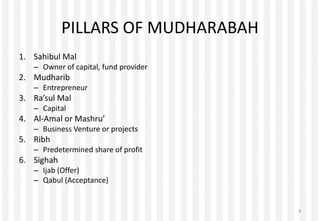

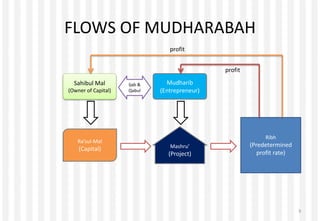

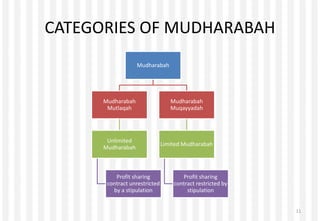

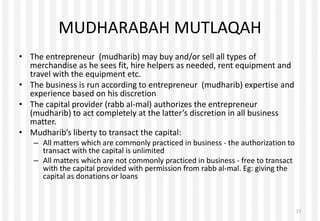

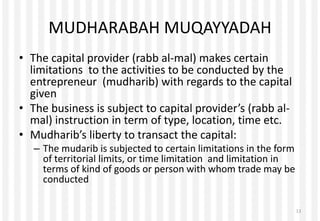

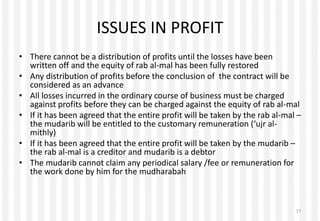

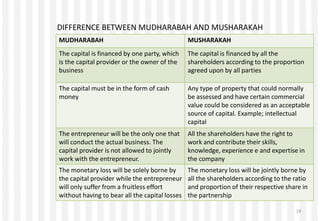

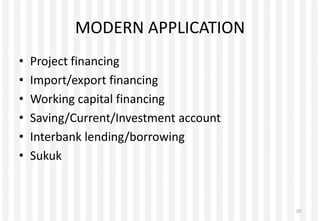

Mudharabah is a partnership contract between two parties where one provides capital to the other to invest in a business venture. Any profits generated are shared between the parties according to a predetermined ratio, while losses are borne solely by the capital provider. The document defines mudharabah, provides evidence for it from the Quran and hadith, and outlines the key pillars, categories, conditions, differences from musharakah, and modern applications of mudharabah contracts.