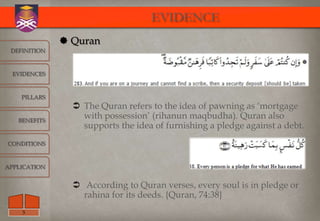

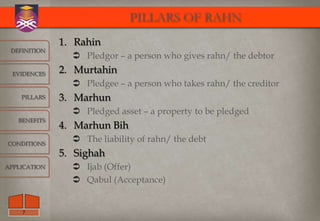

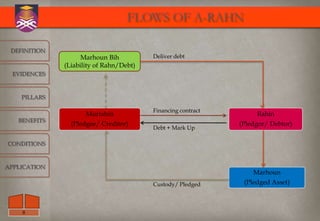

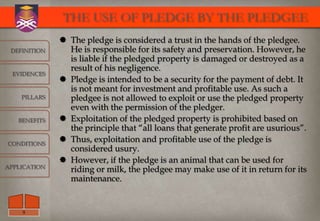

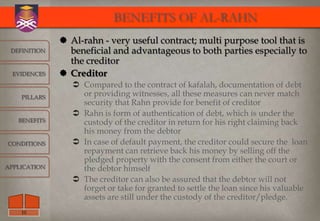

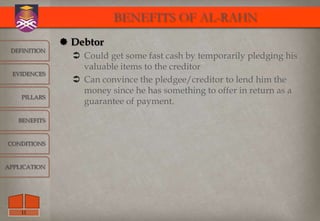

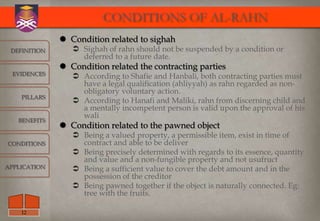

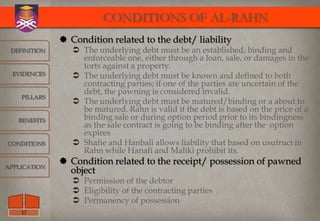

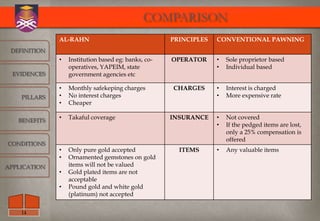

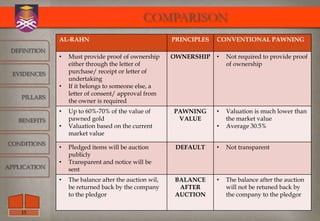

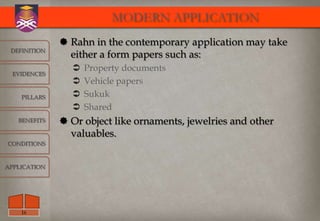

This document defines al-Rahn (pawning) and discusses its pillars, evidence from the Quran and Hadith, benefits, and conditions. Al-Rahn refers to taking a property as security against a debt such that the secured property can repay the debt if not paid. The key pillars are the pledgor (debtor), pledgee (creditor), and pledged asset. Al-Rahn benefits both parties by providing the creditor security and allowing the debtor access to funds. Conditions require the pledged asset be valuable, permissible, and sufficient to cover the debt.