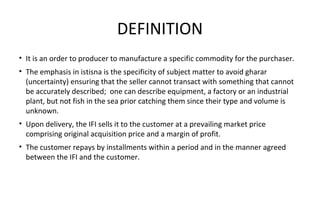

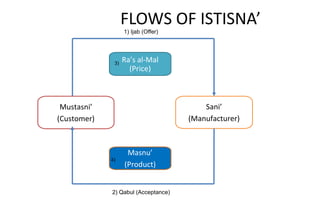

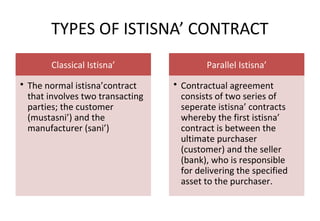

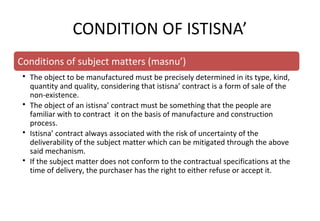

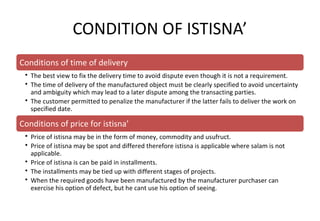

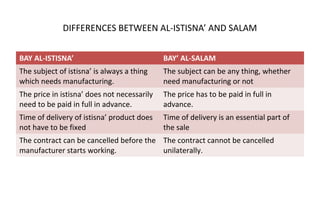

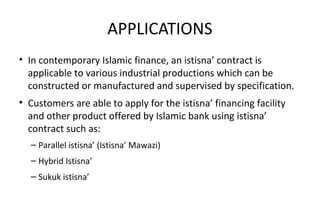

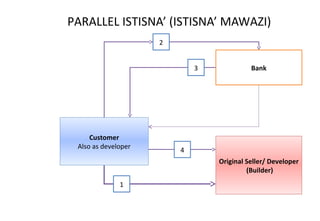

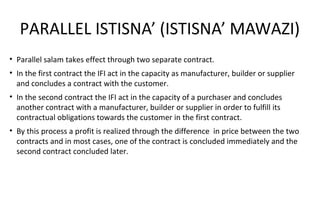

This document defines and discusses the Islamic financing contract of bay' al-istisna'. It begins by defining istisna' as a contractual agreement with a manufacturer to produce specified goods at an agreed upon price using their own materials and labor. The document then covers evidence for its legitimacy, the key pillars of an istisna' contract, different types including classical and parallel istisna', conditions, differences from salam contracts, and modern applications for istisna' financing such as for industrial production or real estate development.