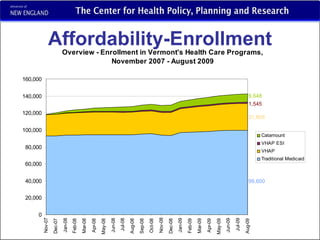

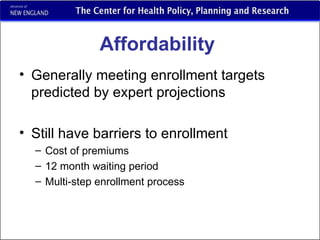

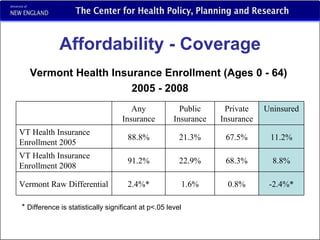

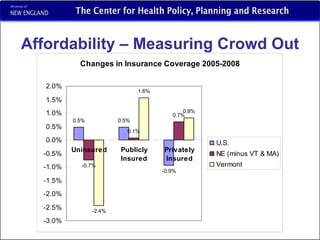

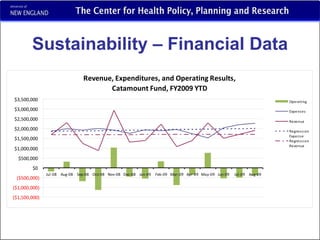

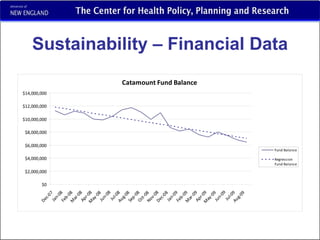

Vermont's 2006 health care reform law aimed to increase access to affordable health insurance. A key part was the Catamount Health public/private hybrid plan, which saw sharp enrollment growth initially. While take-up rates were higher among older groups, barriers to enrollment remain. Insurance coverage in Vermont increased significantly between 2005-2008, with growth in both public and private insurance. However, long-term sustainability faces challenges due to reliance on declining revenue sources and the economic downturn potentially impacting enrollment.