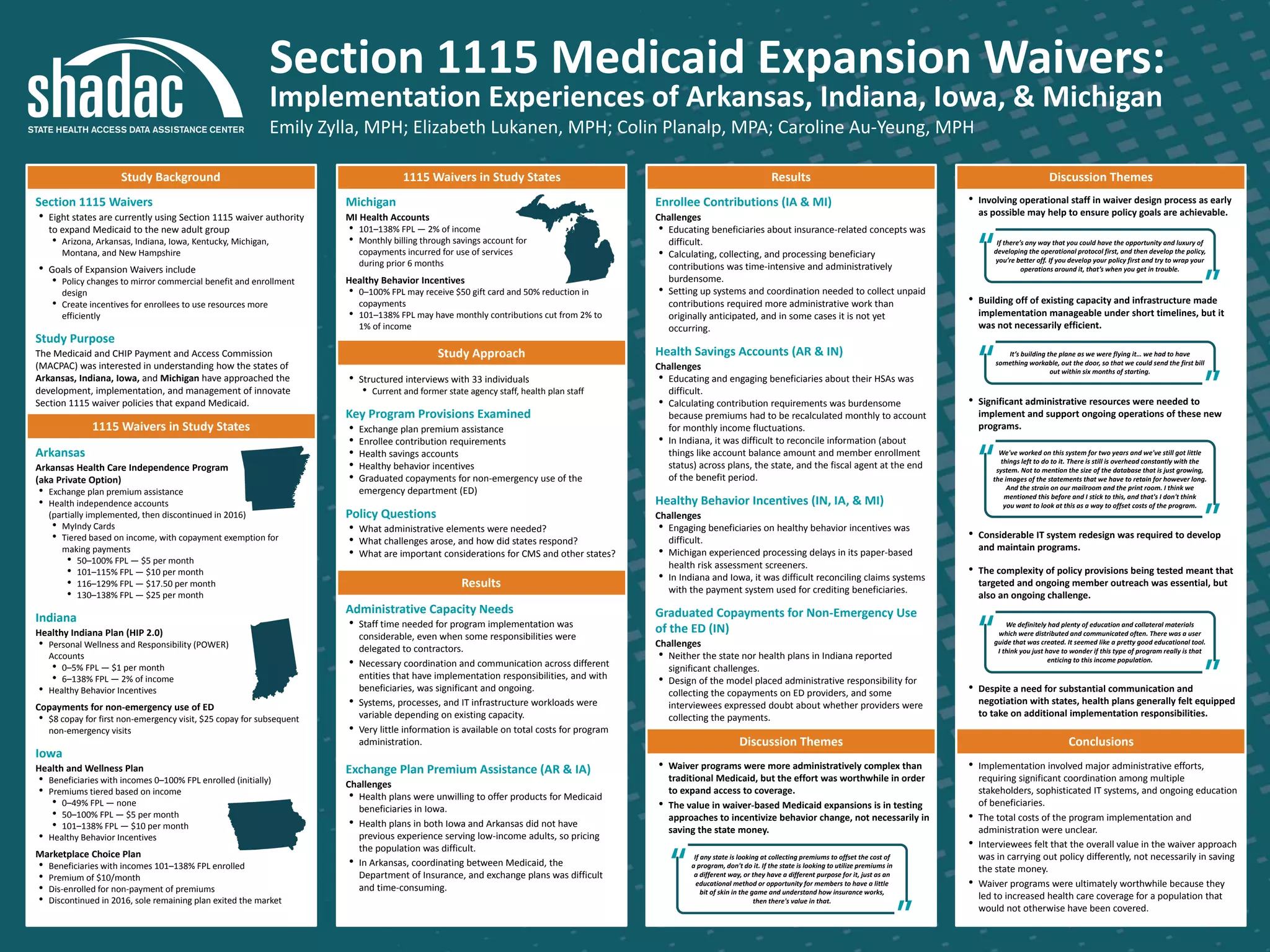

- Structured interviews were conducted with 33 current and former state agency and health plan staff across 4 states to understand challenges implementing Section 1115 Medicaid expansion waiver programs.

- Key challenges included the significant administrative resources and coordination required across entities, educating enrollees, and reconciling complex program rules across systems.

- While waiver programs allowed for innovative policy testing, the administrative complexity was substantial and ongoing. Implementation involved major efforts to develop new IT systems and operational protocols within tight timelines.