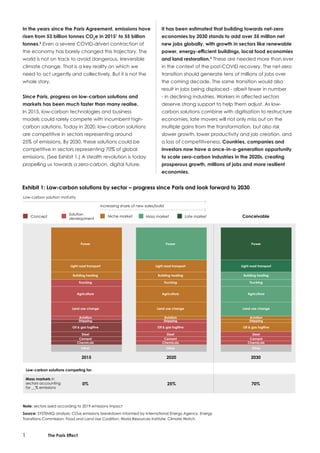

Zero-carbon solutions are growing faster than expected since the Paris Agreement. Low-carbon technologies are now competitive in sectors representing 25% of global emissions, and could be competitive in sectors representing 70% of emissions by 2030. Countries, cities, and companies representing over 50% of global GDP have adopted net-zero targets. Progress in sectors like electric vehicles, renewable power, and alternative proteins has been faster than anticipated, setting the stage for a global transition to a zero-carbon economy over the coming decade if conditions remain supportive of low-carbon investment and innovation.