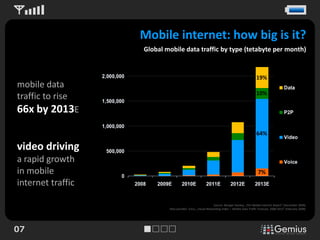

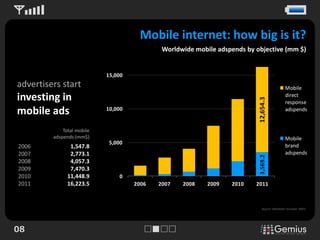

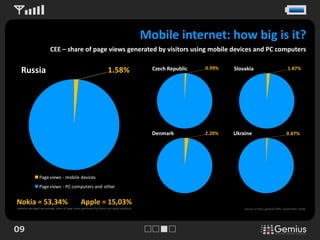

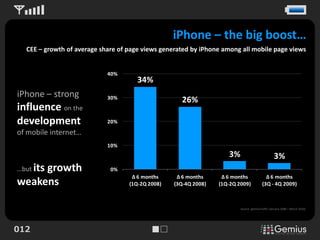

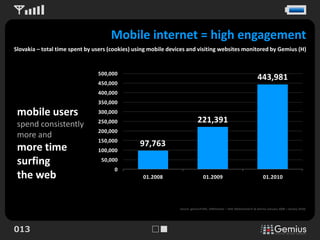

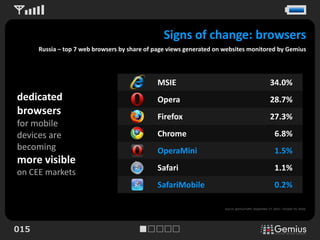

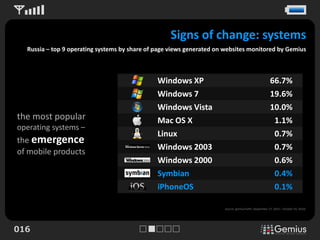

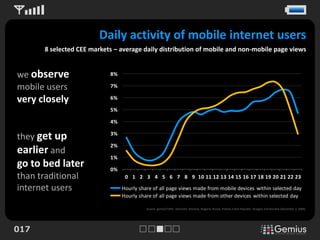

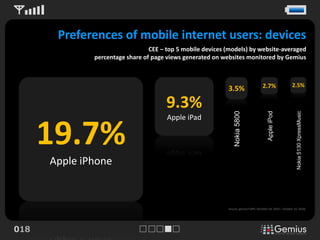

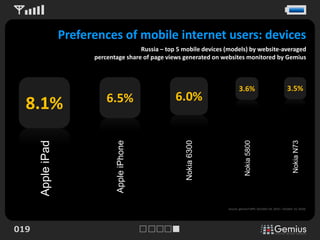

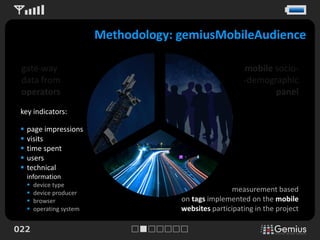

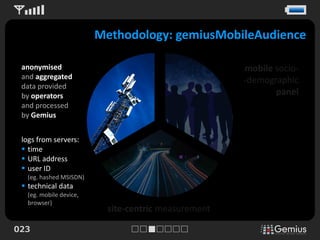

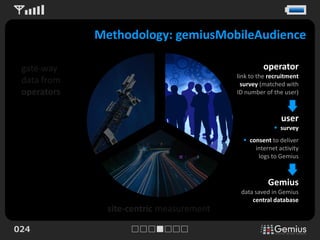

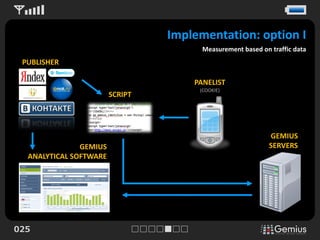

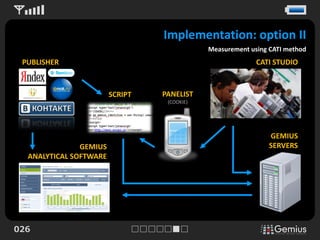

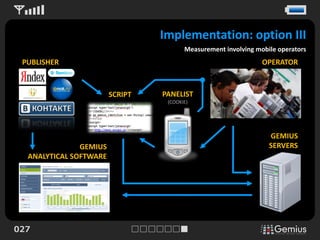

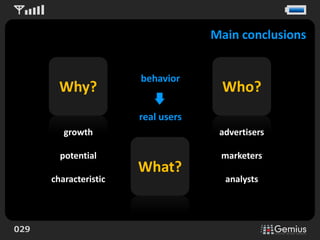

The document provides an analysis of the mobile internet landscape, highlighting metrics such as growth in mobile data traffic, advertising expenditures, and user behavior across various regions and devices. It emphasizes the increasing importance of mobile internet, the evolving communication patterns, and the engagement level of mobile users. Additionally, it discusses the methodologies for measuring mobile internet usage and draws conclusions regarding the opportunities for marketers in this growing sector.