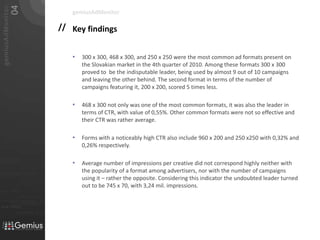

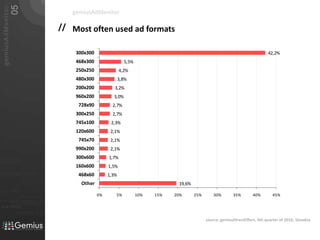

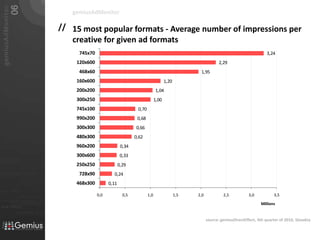

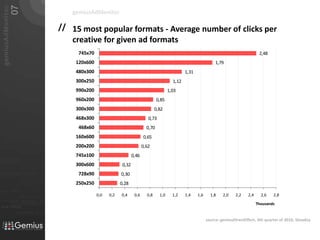

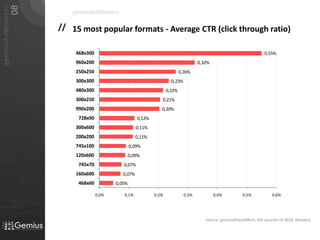

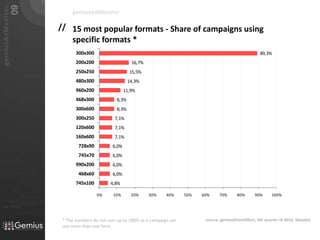

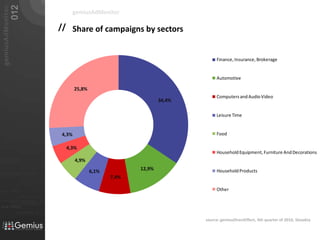

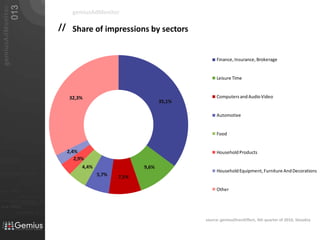

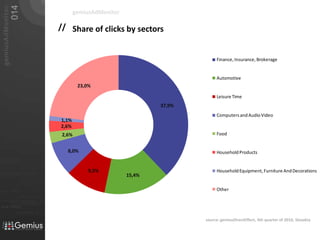

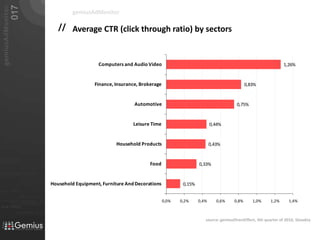

The document summarizes an analysis of online display advertising in Slovakia in the fourth quarter of 2010. It finds that the most common ad formats were 300 x 300, 468 x 300, and 250 x 250. The format with the highest click-through rate was 468 x 300 at 0.55%. Finance and automotive sectors accounted for the largest shares of campaigns at 34% and 13% respectively. The finance sector also generated the largest share of impressions at around one-third.