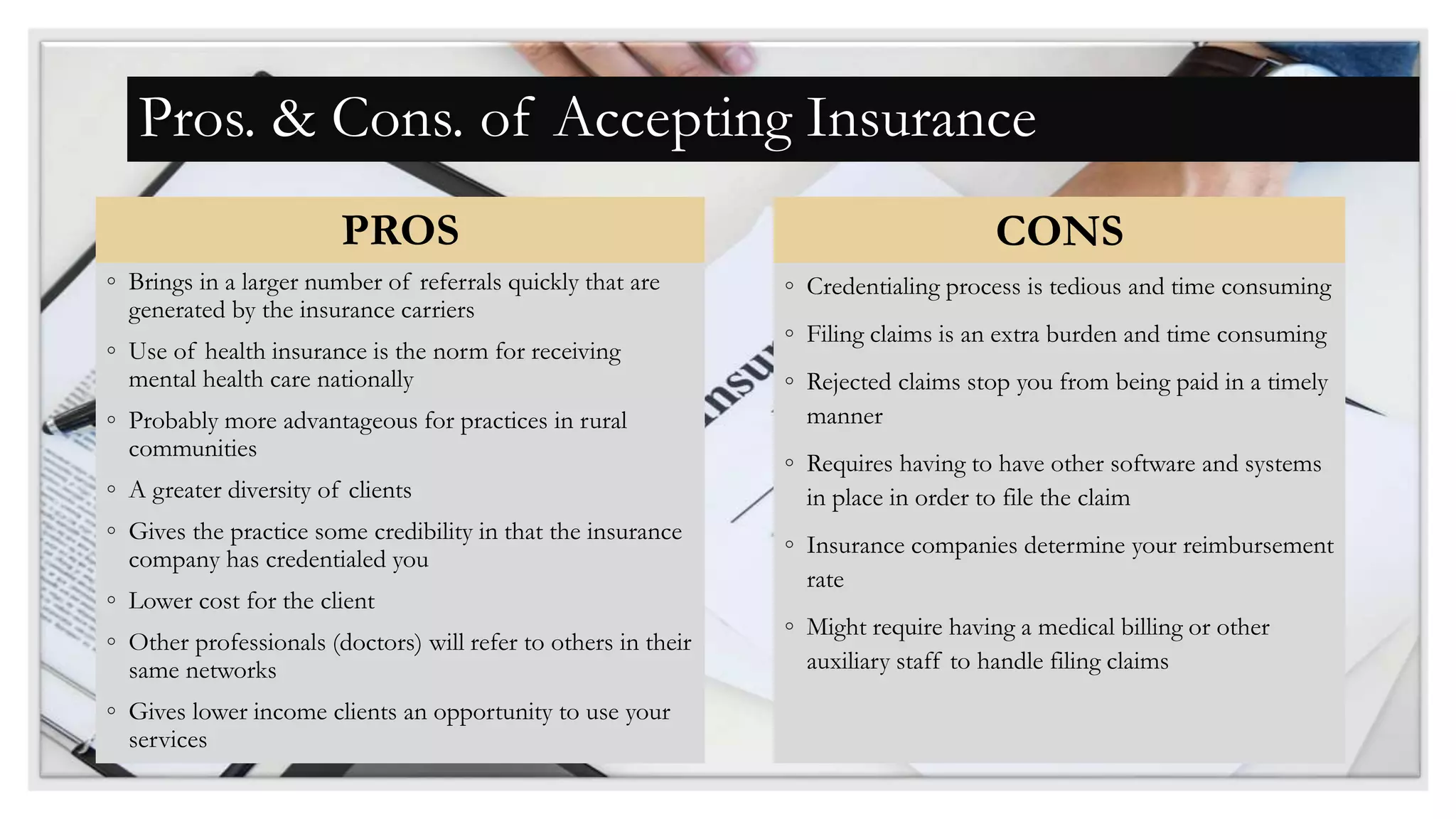

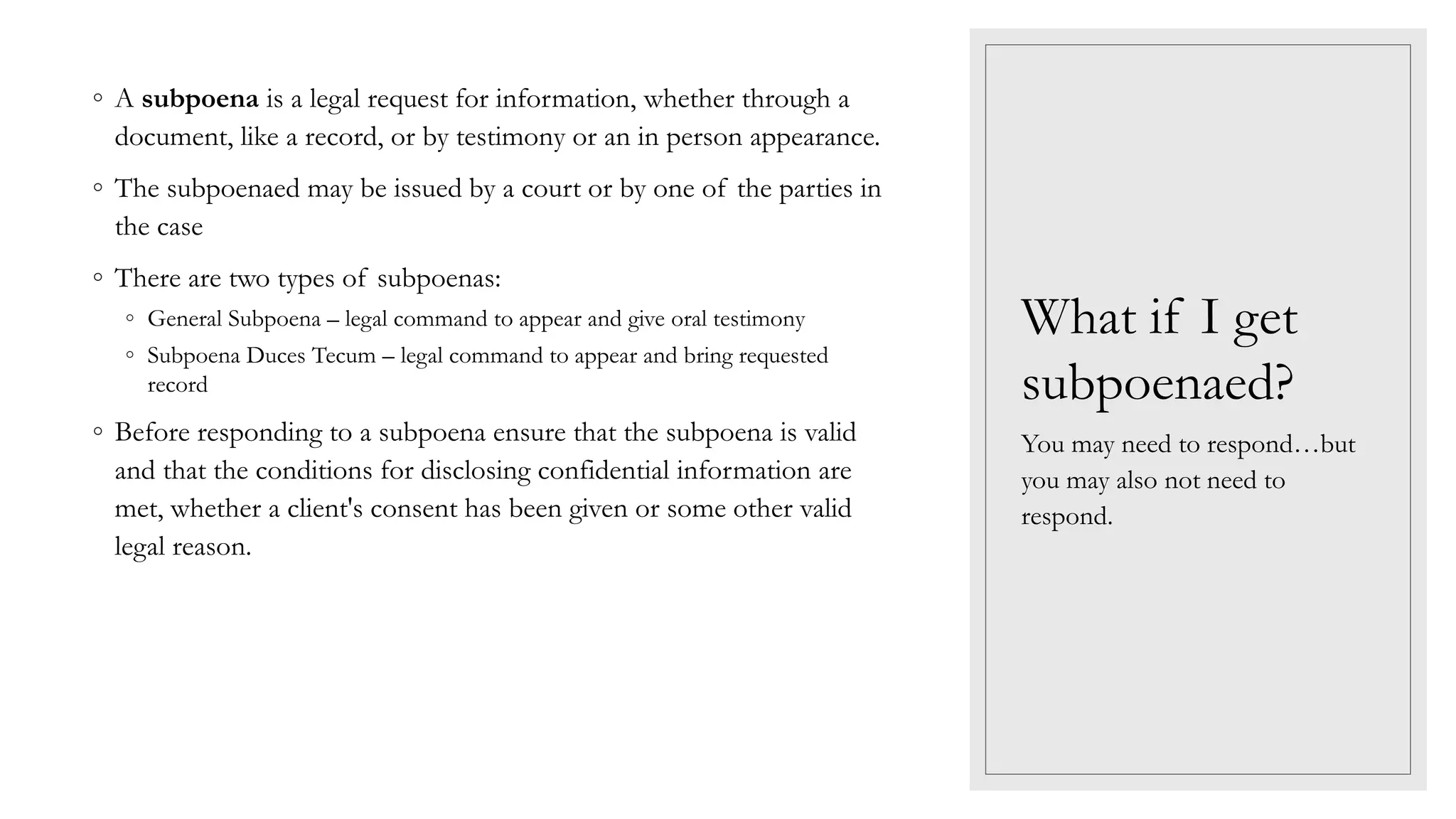

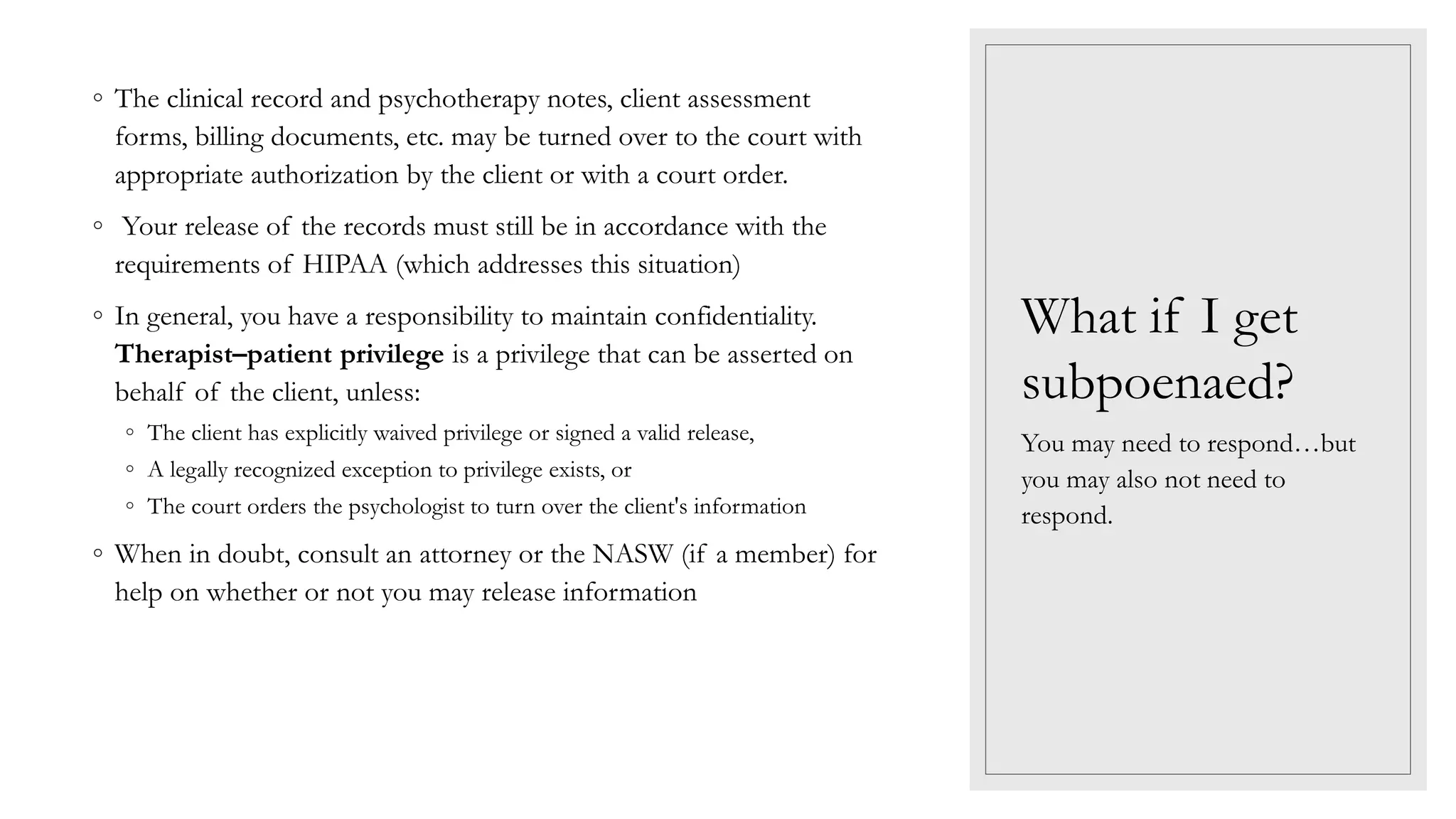

This document provides information and considerations for social workers starting a private practice. It discusses licensing requirements, costs, business structures, office locations, accepting insurance or operating as a cash-only practice, HIPAA compliance, potential legal issues like subpoenas, and the implications of telehealth. Key points covered include needing an LCSW license, obtaining 2 years of post-masters supervised experience, carrying malpractice insurance, deciding whether to open a solo or group practice, getting tax and NPI numbers, setting fees, and ensuring privacy for teletherapy clients. The document aims to outline major factors to evaluate when establishing a private counseling business.