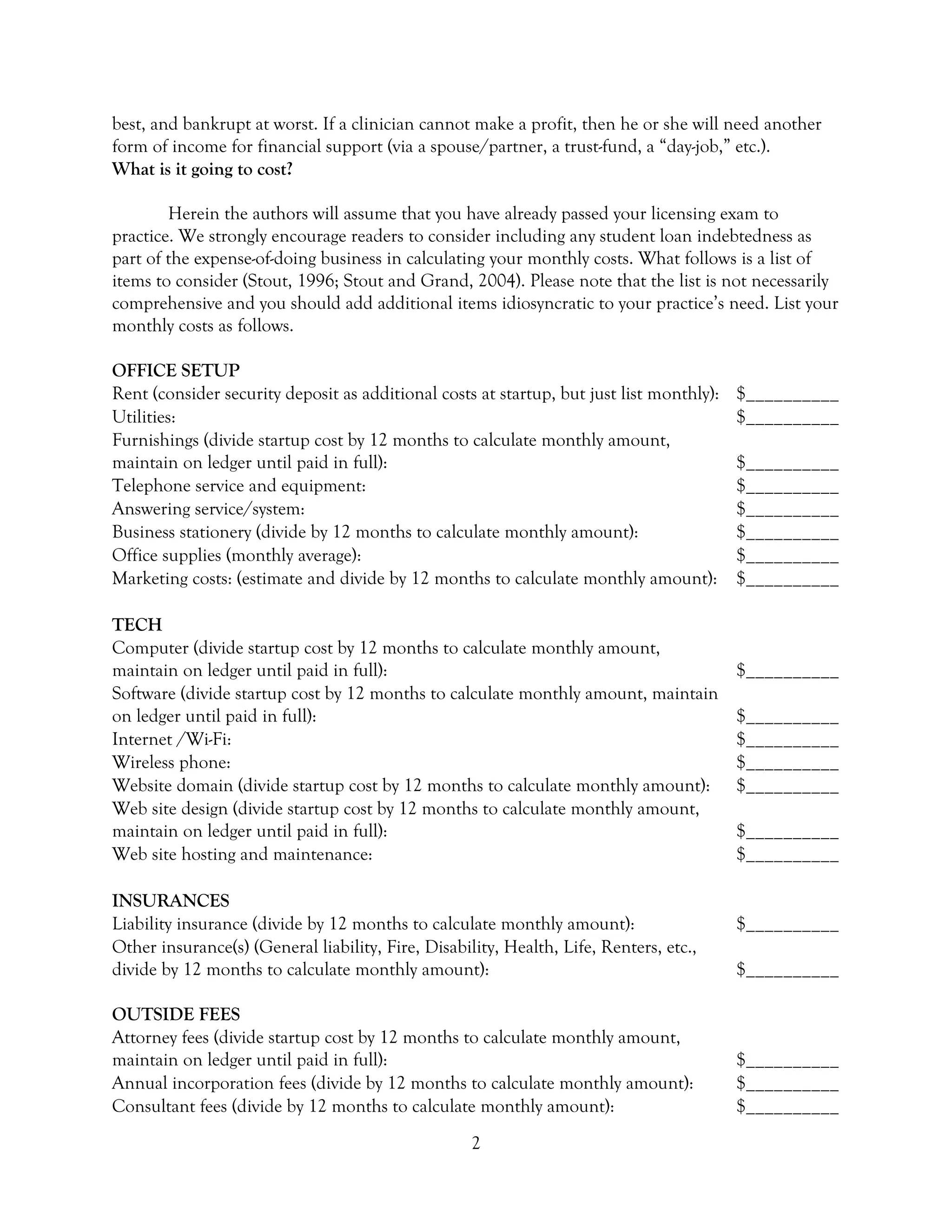

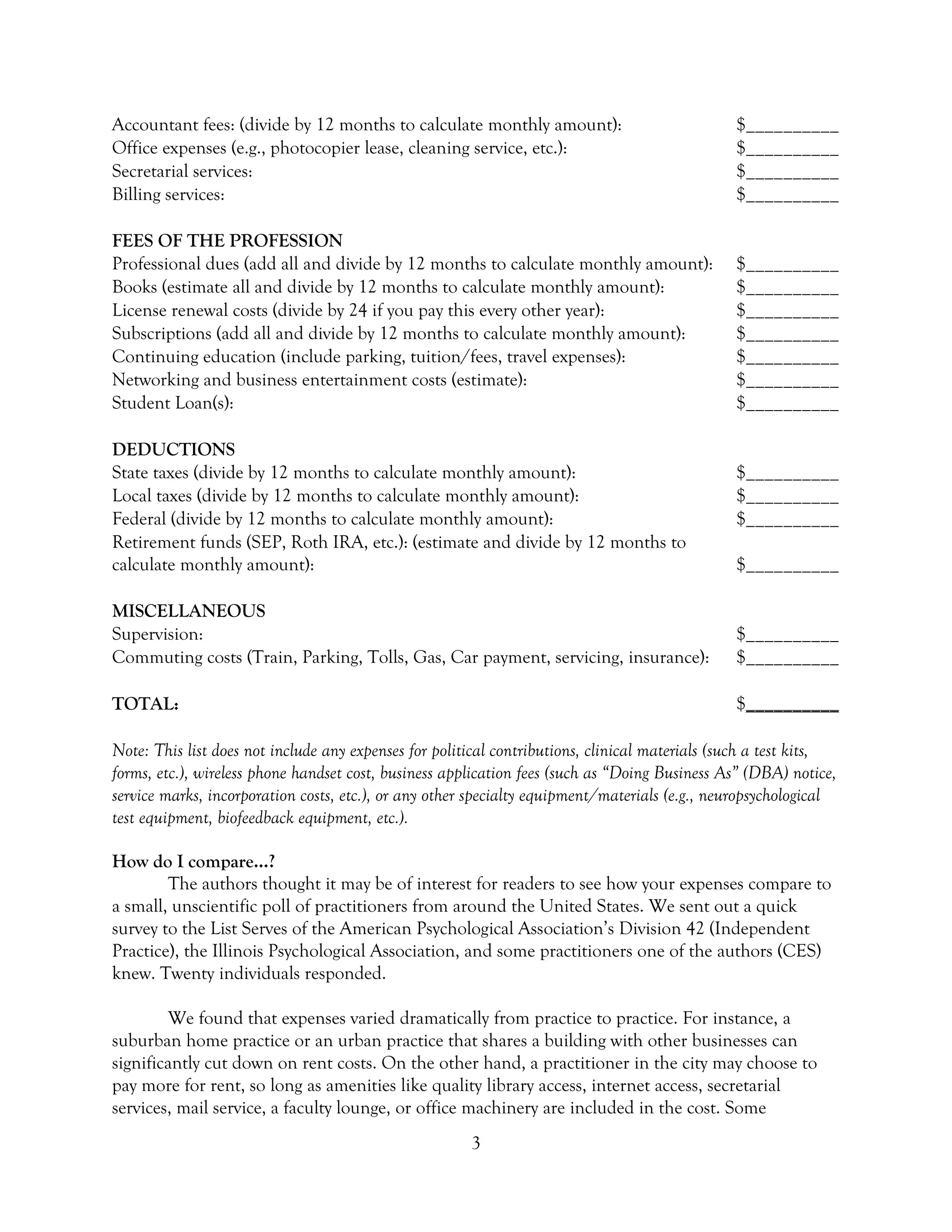

This chapter discusses the costs and financial considerations involved in starting and sustaining a private practice for healthcare providers. It emphasizes the importance of understanding business expenses, potential funding sources, and strategies for achieving profitability. The authors also highlight varied experiences from practitioners in managing costs and securing financing for their practices.

![4

practitioners strike up creative rent agreements – for instance, one respondent pays $15/hour for

rent, only pays for the sessions she has, and agrees to pay $50/month if no sessions are scheduled.

In addition, over half of the respondents said that utilities like heat, electric, and water are

included in rent.

Phone costs also varied considerably. Some practitioners use their personal cell phones and

attribute half of its cost to the business. Others use a free Google voice number and have calls

forwarded to their personal cell phone. More costly options include a combination of separate

phone lines, multiple landlines (up to four or five), private voicemail, and answering services.

While over half of respondents do not have employees or contractors to factor into their

budget, some practitioners choose to hire bookkeepers, technicians, secretaries, or additional

clinicians. The cost of these workers could be as low as $2400/year or as high as $30,000/year.

Other costs include software, office supplies, marketing, parking or transit, training, testing

materials, subscriptions, website maintenance, and donations.

Any surprises? Those responding were primarily from the Midwest and in suburban and/or

urban locations, so rents and the like will certainly co-vary as a function of that. The average

number of years in private practice was about 19, ranging from less than one year to 35 years. The

mean length of time in practice of this group was 15.5 years, ranging from one year to about 35

years. More on this group’s experiences below, but let’s return to your costs of practice.

Do the Math: Is Your Business Viable?

Next, calculate the sum of the above applicable items. This total will be your Practice Costs,

or PC. Use these formulas to calculate your Hourly Cost. Note, this is the COST of doing

business, not what your fee or cost to your patients is.

(X clinical service hours) x (Y number of weeks worked annually) = Total Annual Hours

Worked

For example, (30 hours worked per week) x (48 weeks) = 1440

Next, (Total Annual Hours Worked) x (80% [based on -20% for bad debt, missed sessions,

etc.]) = Total Billable Annual Hours

For example, 1440 x 80% = 1152

So, (Practice Costs)/(Total Billable Annual Hours) = Hourly Cost

Hypothetically, if PC = $95,000, then $95,000/1152 = $82.47/hour. Thus, in this case, it

costs $82.47/hour to deliver that hour of therapy. In other words, assuming you have annual

practice costs of $ 95,000 and you plan to work 30 clinical hours per week for 48 weeks per year

(figuring four total weeks of vacation). In this hypothetical that would be 1440 billable hours

worked, minus 20% for bad debt, missed sessions, etc., equals 1152 revenue generating hours

annually. This suggests that roughly to cover your annual costs, you need to generate at least

$82.47/hour. If you add a modest 5% profit margin it becomes $86.59/hour, or $90.74/hour for

a 10% profit margin.](https://image.slidesharecdn.com/howtoaffordyourprivatepracticewaystofundstartingupandhowtokeepitgoingstrong-150919191533-lva1-app6892/75/How-to-afford-your-private-practice-ways-to-fund-starting-up-and-how-to-keep-it-going-strong-4-2048.jpg)