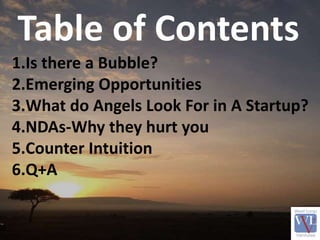

The document provides an overview of trends in startup investing and advice for entrepreneurs. It discusses how:

1) Society is rapidly changing due to increased connectivity and mobile technology which is disrupting hierarchies and transforming how we work and live.

2) Government is ill-equipped to keep up with technological and social changes happening quickly. This rise new business models like Uber and Airbnb.

3) Angels should invest in "gazelles", companies with the potential for 30x returns, rather than "unicorns" which have billion dollar valuations but lower odds of success. The document provides an example of angel investment math.

4) When angels say yes to an investment, it is because