This document provides an overview of the author's background and experience:

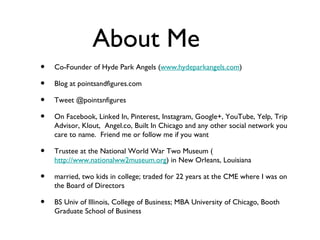

- The author is the co-founder of Hyde Park Angels and blogs at pointsandfigures.com. He is active on many social networks and is a trustee at the National WWII Museum in New Orleans.

- He has 22 years of trading experience at the CME and holds a BS from the University of Illinois and an MBA from the University of Chicago.

- The document discusses what an angel investment organization is, typical angel deals, what angels look for in investments, and advice for entrepreneurs.