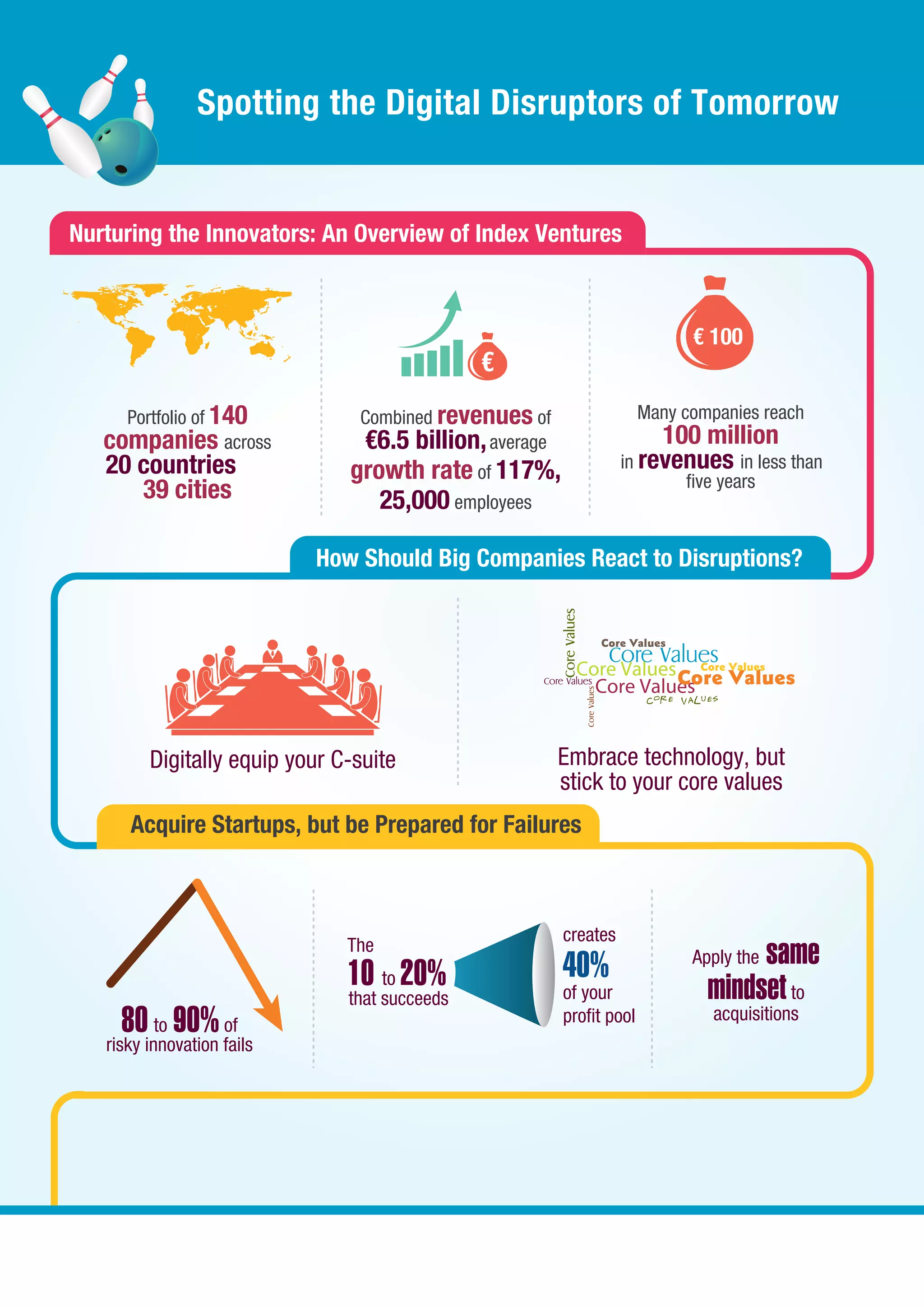

Saul Klein, a partner at Index Ventures, discusses the rise of digital disruptors and the challenges faced by established companies in adapting to these changes. He highlights that startups leverage lower costs and agile structures, making it difficult for incumbents, who often have higher legacy costs and less digital expertise, to compete. Klein emphasizes the growing entrepreneurial culture and the need for big corporations to engage more actively with startups and incorporate new technologies to maintain their relevance.