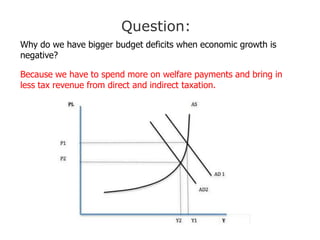

The document discusses budget deficits and national debt. It begins by outlining the objectives of understanding what a budget deficit is, knowing the size of the UK's deficit, why deficits rise in recessions, and why large deficits can be problematic. It then provides ways that governments can reduce budget deficits, such as by decreasing spending, increasing taxes, and pursuing economic growth. The document also discusses how countries fund deficits through bond sales and what can happen if a country is unable to sell enough bonds to cover its deficit.