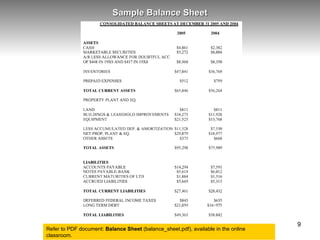

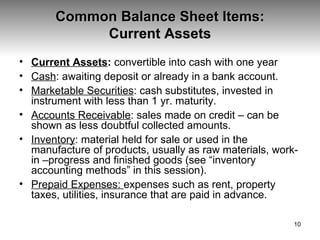

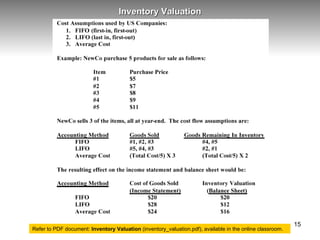

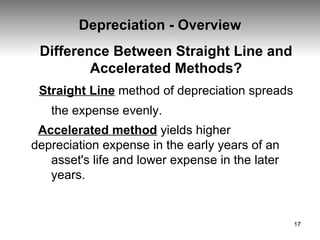

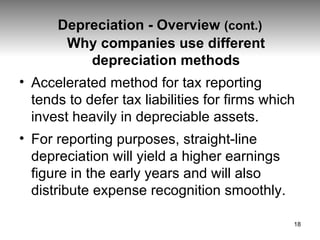

The document provides an overview of balance sheets, detailing their key components: assets, liabilities, and equity. It explains the classification of these components into current and non-current items and emphasizes the importance of a balanced equation where assets equal total liabilities plus equity. Additionally, the document touches on inventory valuation and depreciation methods, highlighting their implications for financial reporting and tax liabilities.