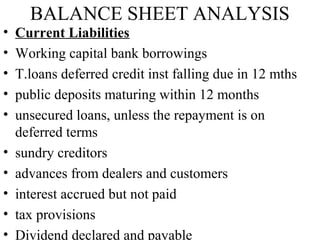

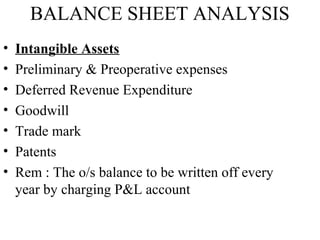

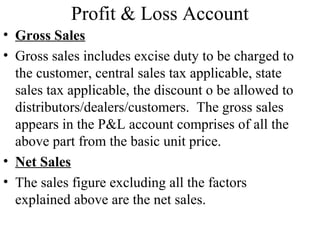

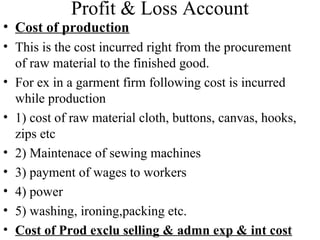

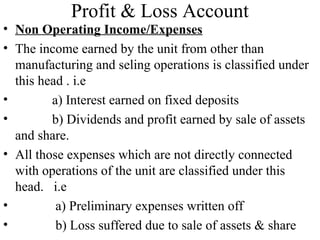

This document provides an overview of balance sheet analysis and profit and loss account concepts. It discusses the key components of the balance sheet including sources of funds like capital, reserves, and liabilities, and uses of funds like fixed assets, current assets, and intangible assets. It also covers the key line items in a profit and loss account, such as gross sales, cost of goods sold, operating profit, and net profit. Notes are provided on accounting conventions and qualitative factors to consider in analyzing financial statements.