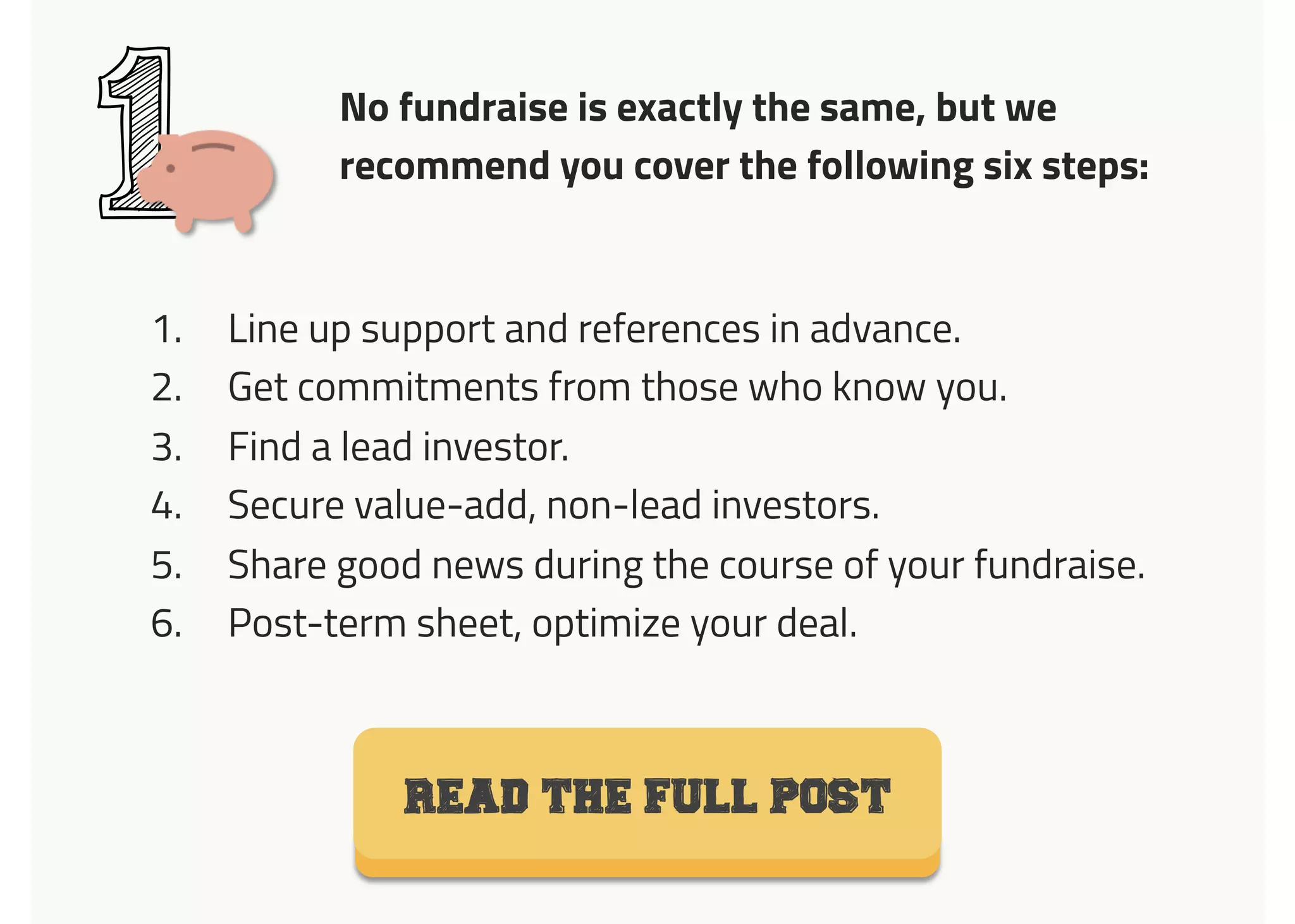

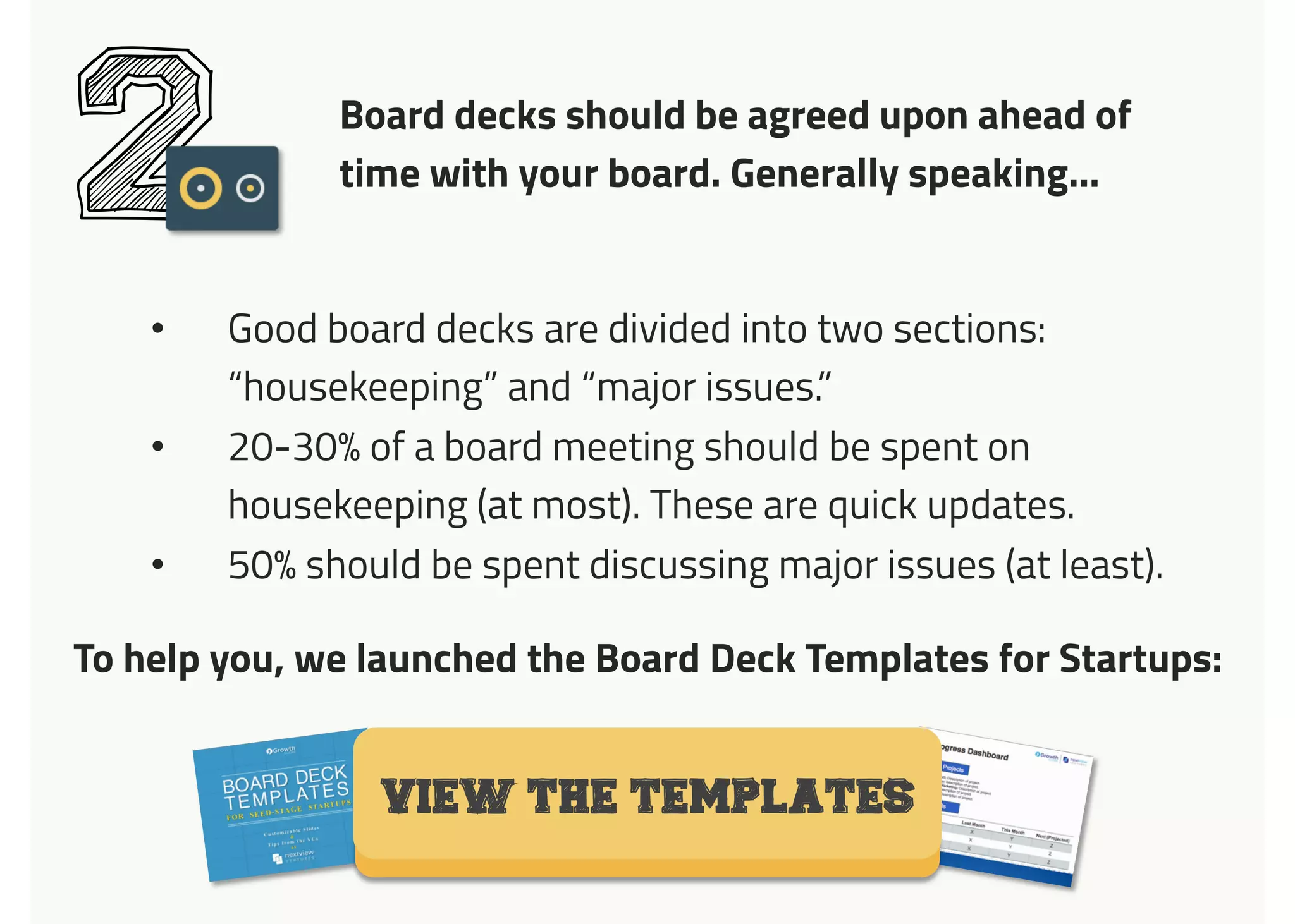

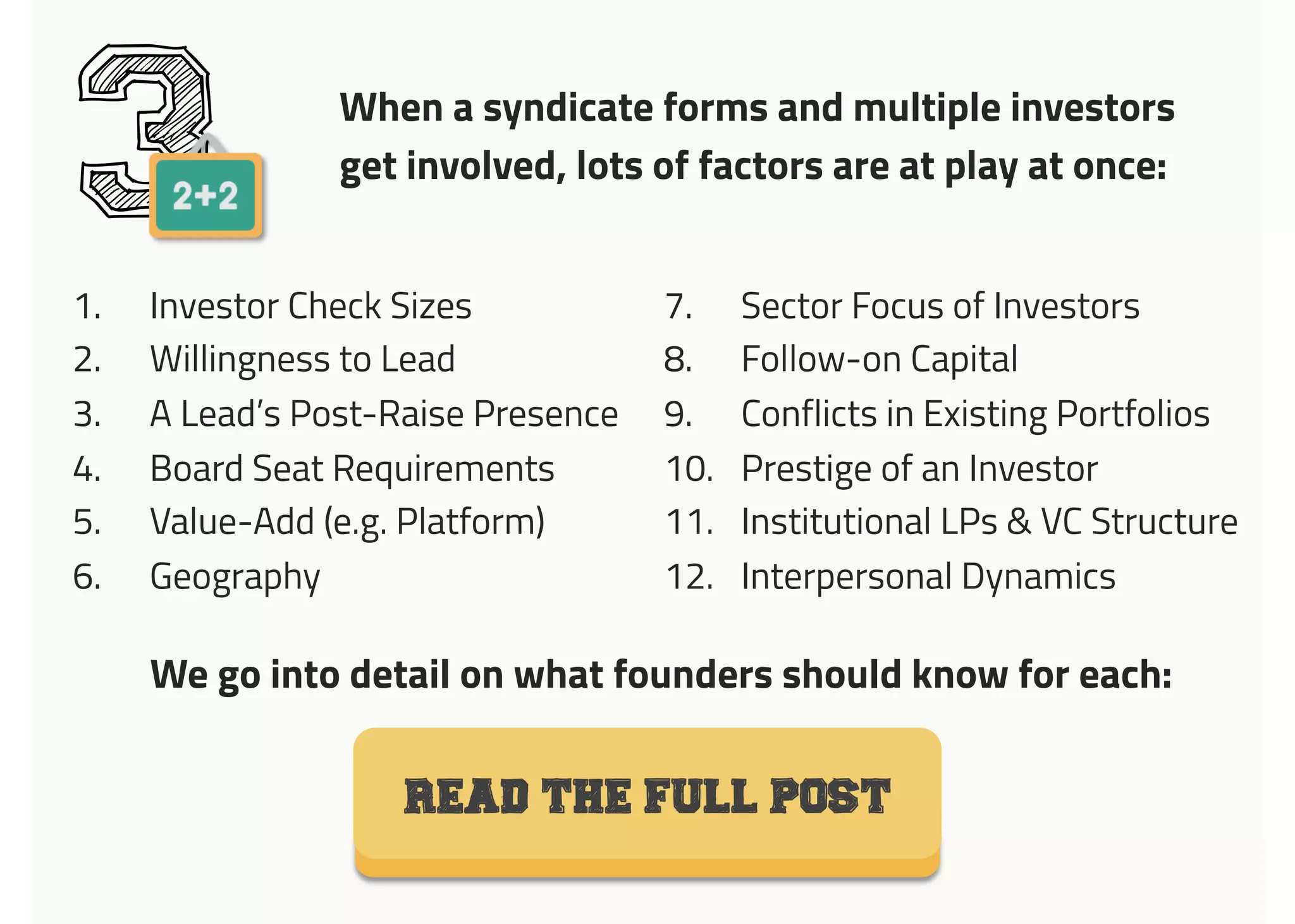

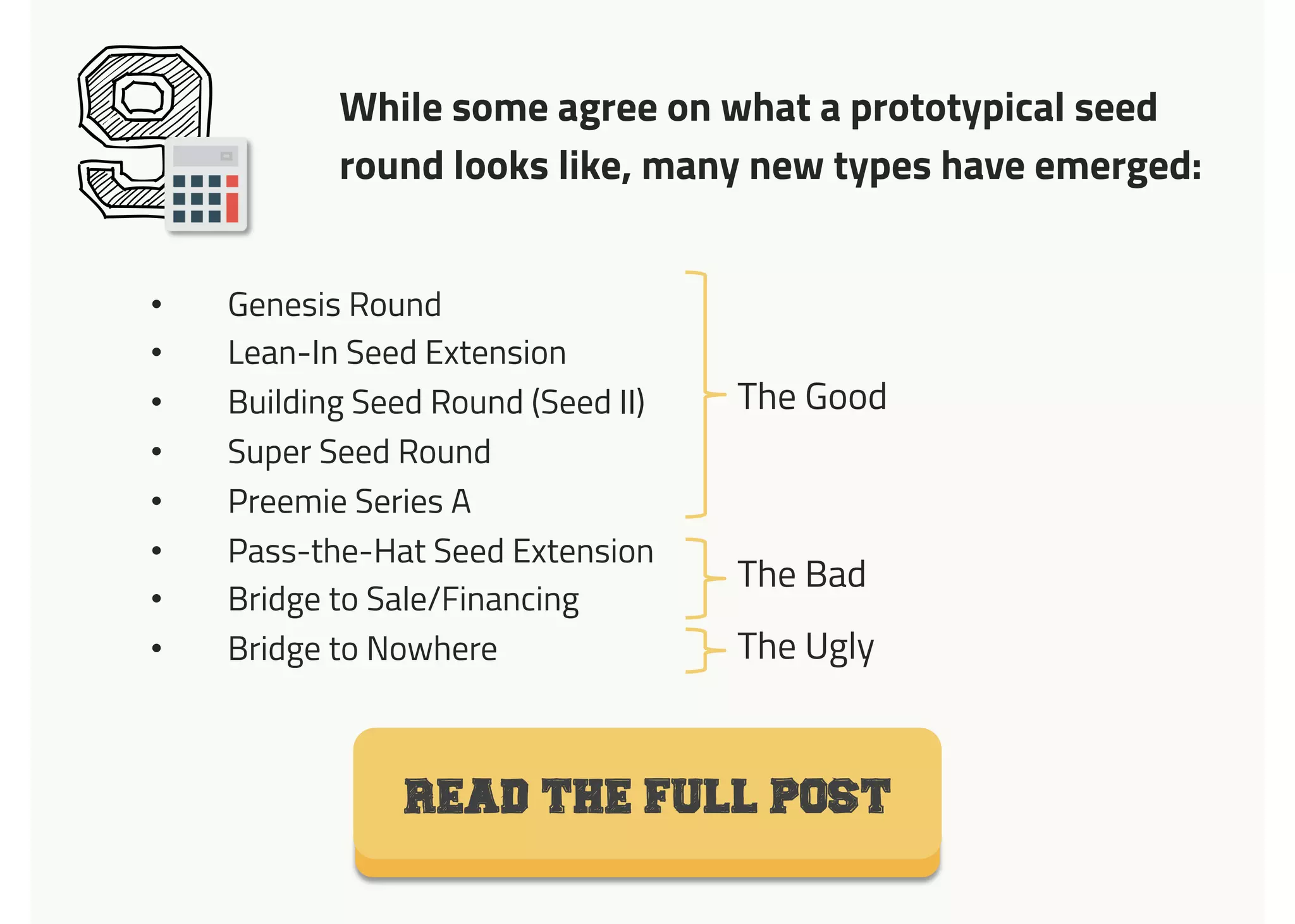

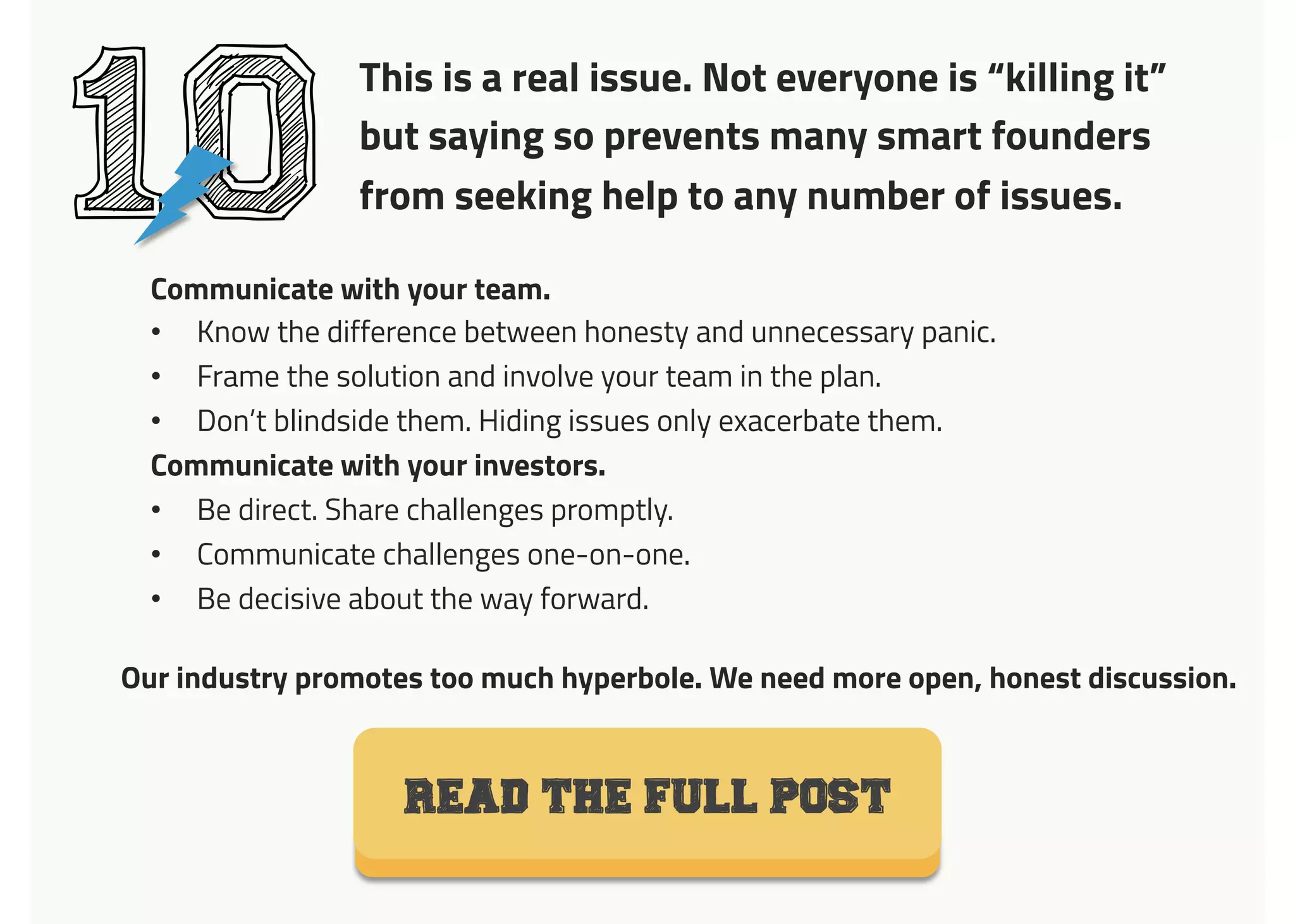

The document discusses key insights and questions received from seed-stage startup founders, focusing on topics like fundraising strategies, building effective board decks, and post-funding actions. It emphasizes the importance of honest communication, growth strategies, and content marketing for successful startup development. Additionally, it invites readers to engage by submitting their own questions for further discussion.