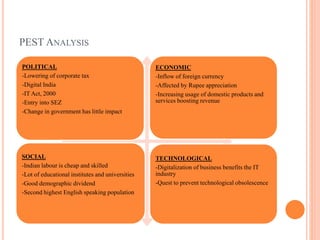

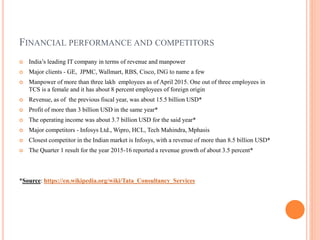

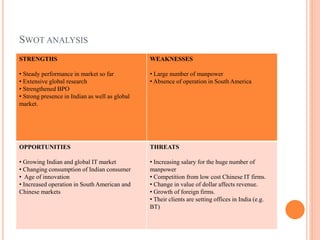

Tata Consulting Services (TCS) is India's largest IT services company, founded in 1968. It has over 300,000 employees globally and annual revenue of $15.5 billion. TCS provides a wide range of IT services and digital solutions. It has a presence in 44 countries and major clients include GE, JP Morgan Chase, and Walmart. While TCS has experienced steady growth, it faces threats from increasing salaries and competition from other Indian and global IT firms. The company aims to strengthen its position by expanding into new markets and through strategic acquisitions.