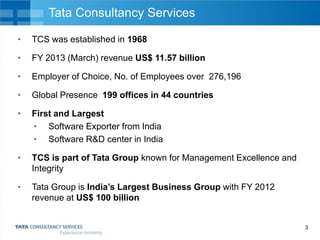

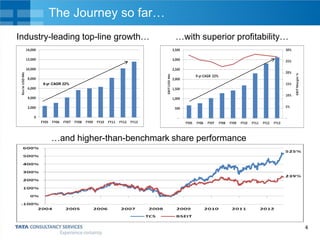

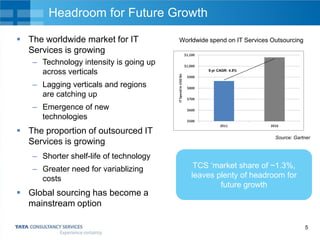

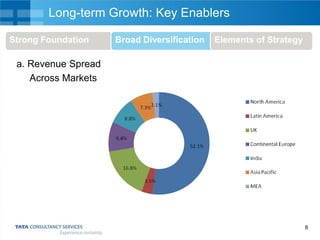

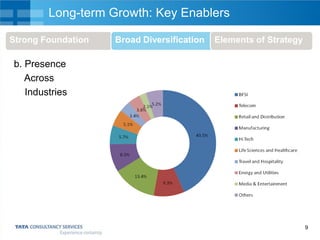

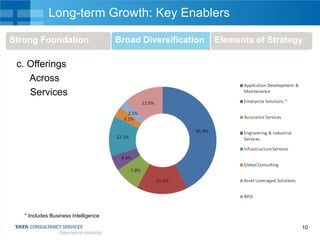

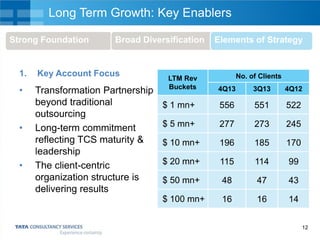

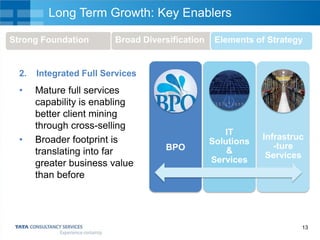

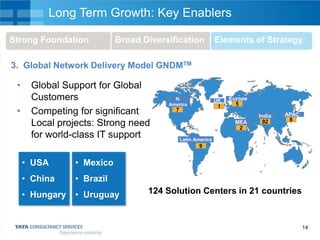

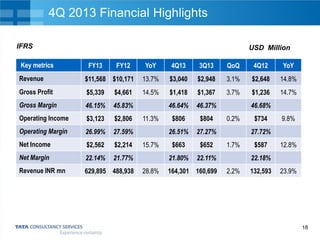

Tata Consultancy Services provides a forward-looking statement discussing potential risks and uncertainties that could impact their future prospects. These risks include wage increases, currency fluctuations, talent retention, and other economic and political factors. The document outlines Tata's strategy for long-term growth, including diversifying across markets, industries, and services. Their strategies include a focus on key accounts, integrated full services, global delivery networks, strategic acquisitions, and non-linear business models. Financial highlights show continued revenue growth and expanding margins, demonstrating their strategies are supporting sustainable long-term expansion.