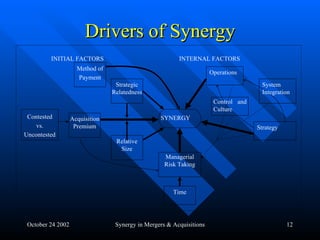

The document discusses mergers and acquisitions (M&As) theory and practice in Central Europe. It provides an overview of M&As as an economic phenomenon and reasons for M&As. It explores the concept of synergy as the goal of M&As to create value. Drivers of synergy include strategic relatedness between acquiring and target companies, operational integration challenges, and dealing with differences in company culture. The document also examines a case study of a successful horizontal acquisition between two construction companies in Slovakia and the Czech Republic where cultural similarities helped with integration.