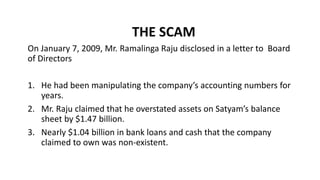

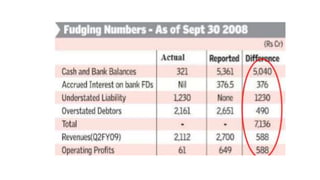

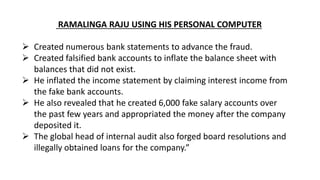

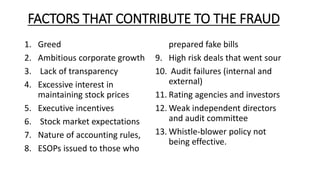

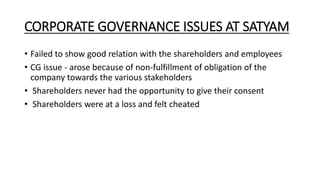

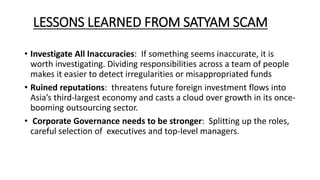

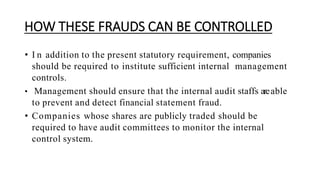

Ramalinga Raju, the former chairman of Satyam Computers, confessed in 2009 to manipulating the company's accounting for years and overstating assets by $1.47 billion. He had created fake bank accounts and salary accounts to inflate Satyam's financial reports. The fraud went undetected by PwC, who had audited Satyam for 9 years. The scandal severely damaged investor trust, India's IT sector, and the country's reputation. It highlighted the need for stronger corporate governance and internal controls to prevent such accounting frauds. Tech Mahindra later acquired Satyam to restore stability.