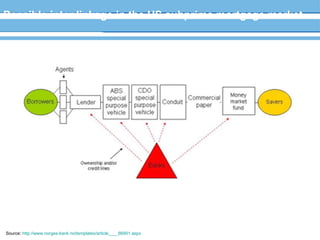

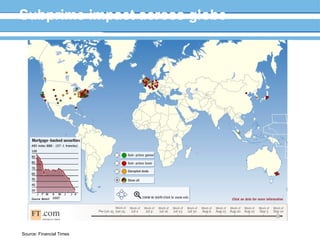

The document summarizes the evolution of the US home mortgage industry from the 1930s to the 2000s and how risky lending practices led to the global financial crisis. It discusses how government interventions created Fannie Mae and Freddie Mac to support the mortgage market after the Great Depression. It then explains how private securitization expanded risky subprime lending that was packaged and sold globally. When the subprime mortgage market collapsed in 2007 due to rising defaults, it spread contagion worldwide and caused a liquidity crisis and losses across the global financial system totaling over $586 billion.