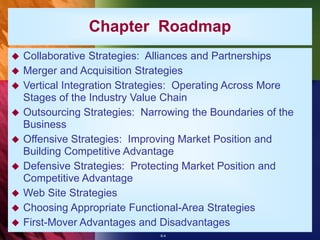

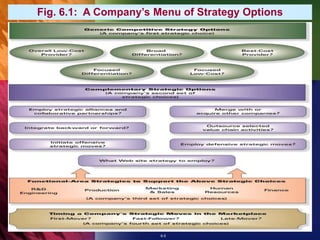

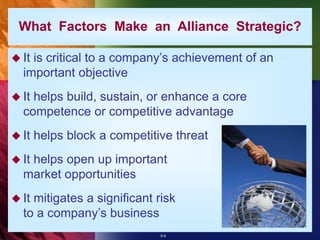

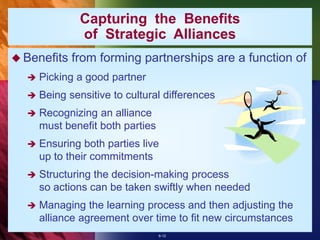

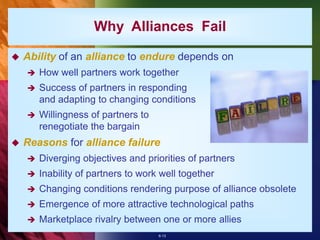

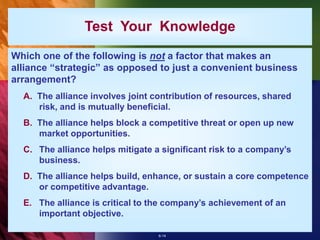

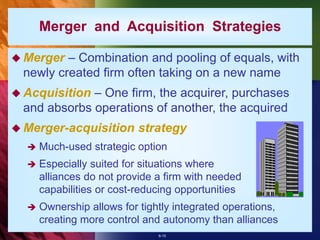

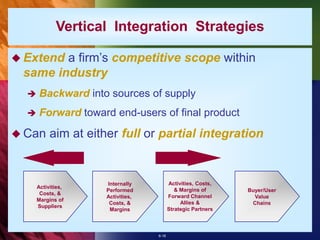

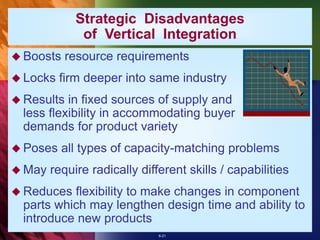

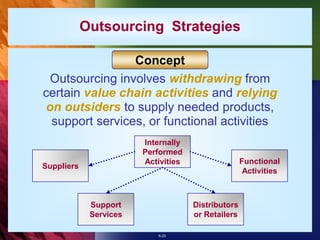

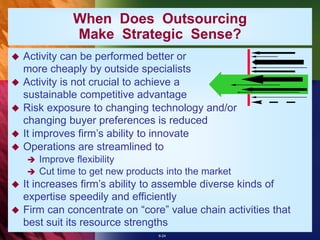

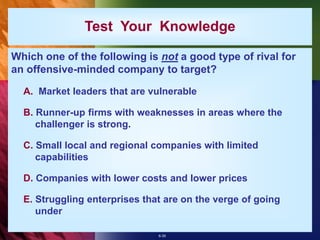

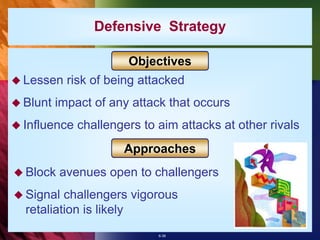

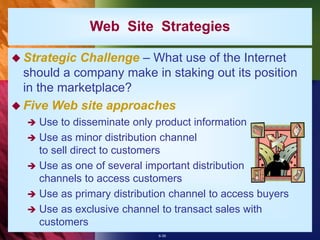

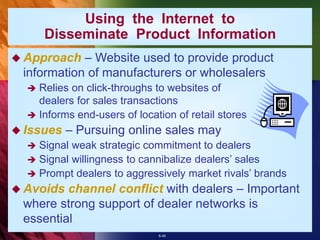

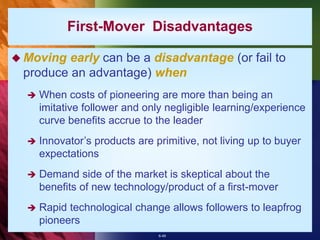

The document discusses various strategies that companies can use to supplement their chosen competitive strategy. It covers collaborative strategies like alliances and partnerships, merger and acquisition strategies, vertical integration strategies, outsourcing strategies, offensive and defensive strategies, web site strategies, and choosing appropriate functional area strategies. Some key points discussed include the objectives, advantages, and disadvantages of these different supplemental strategies.