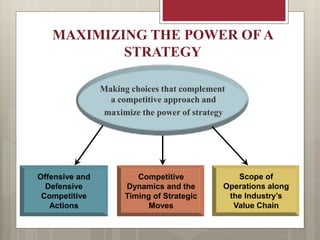

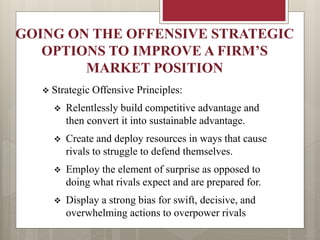

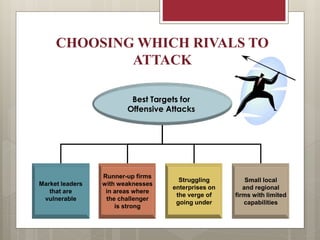

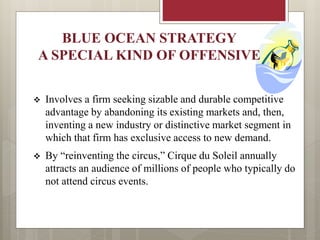

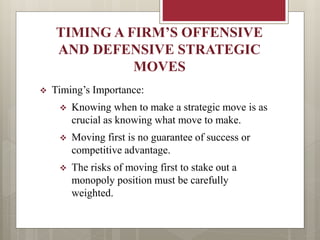

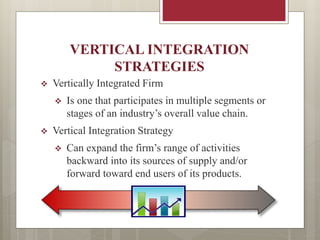

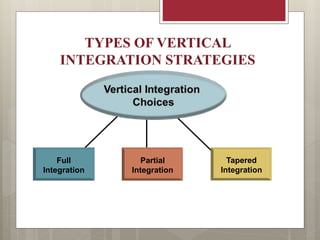

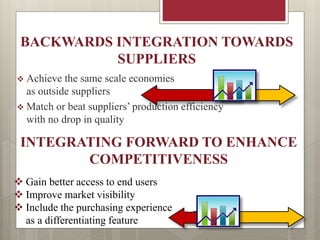

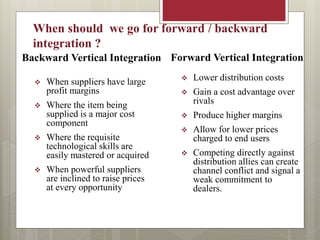

This document provides an overview of strategies for strengthening a company's competitive position, including offensive and defensive actions, scope of operations, integration, outsourcing, and strategic alliances. Offensive strategies are used to build new market position or advantage, while defensive strategies protect existing advantage. The scope of a company's operations relates to the range of internal activities, product/service breadth, geographic presence, and size of its competitive footprint. Integration strategies include mergers, acquisitions, and expanding vertically along the value chain. Strategic alliances allow partners to cooperate toward shared objectives while maintaining independence.