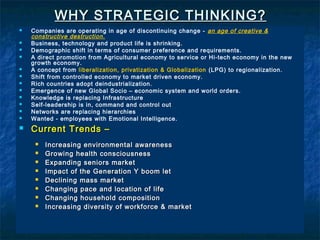

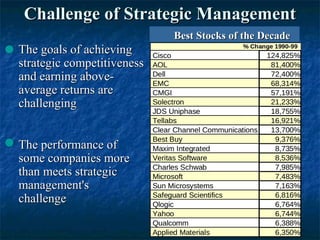

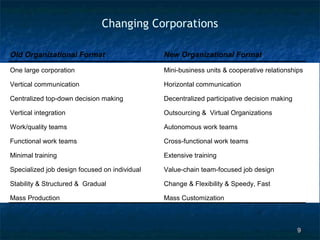

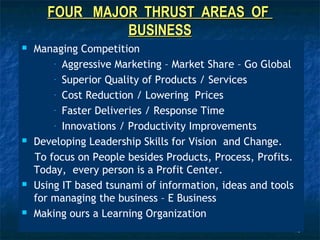

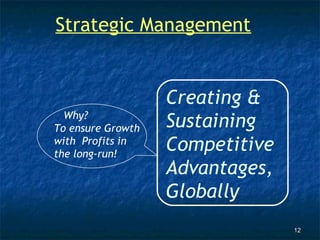

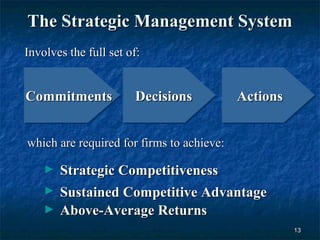

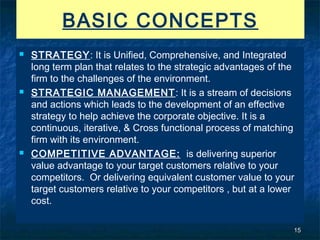

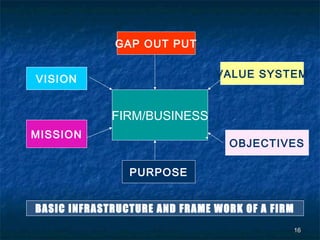

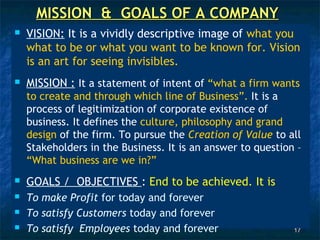

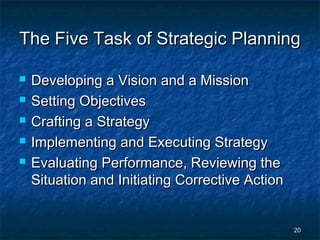

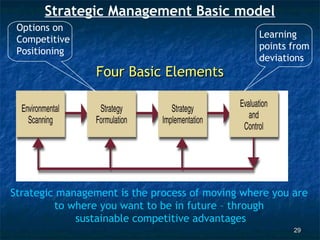

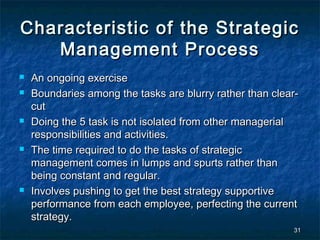

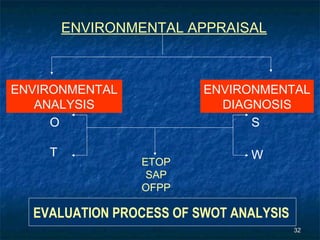

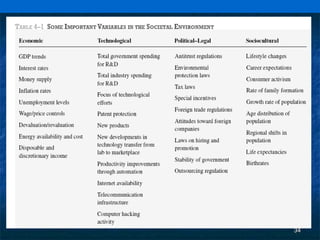

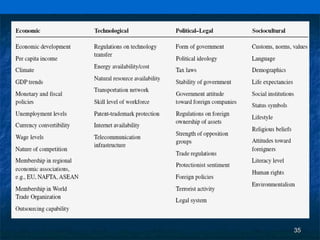

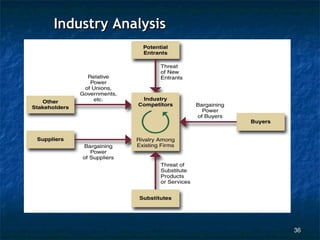

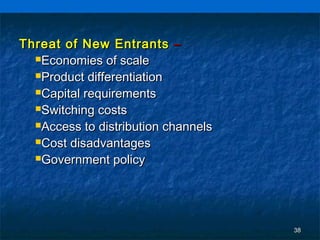

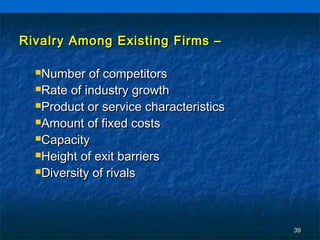

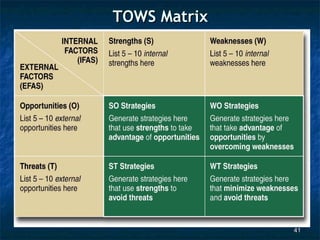

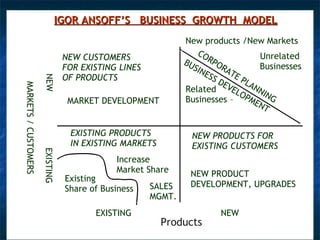

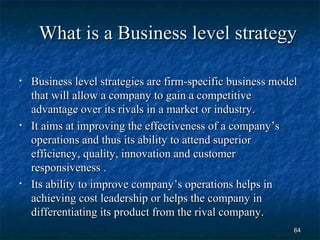

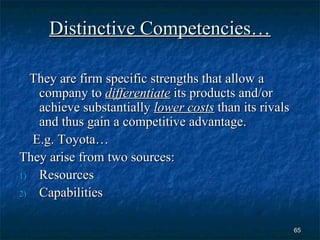

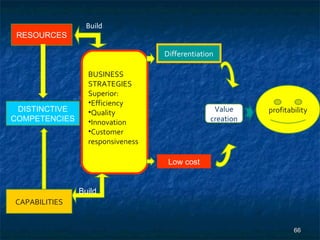

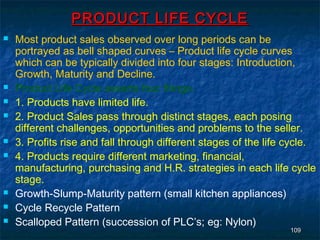

This document discusses strategic management and the need for strategic thinking in the 21st century. It notes that companies must operate with strategic competitiveness and sustained competitive advantages in order to survive amid discontinuing change, shrinking business and technology lifecycles, and shifting consumer preferences and demographics. It also discusses analyzing the external environment, including industries and competition, as well as developing strategic plans through vision, mission, objectives and crafting strategies. The strategic management process is characterized as ongoing, iterative and cross-functional.