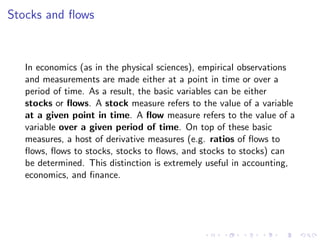

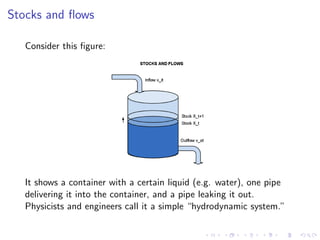

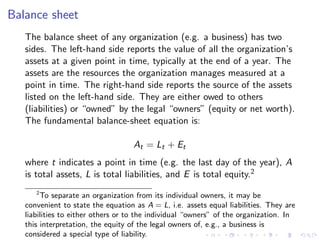

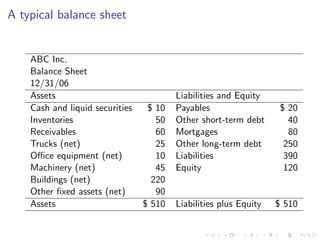

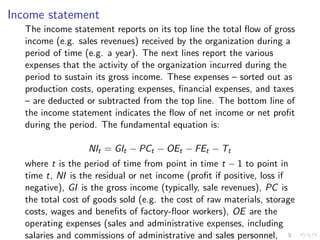

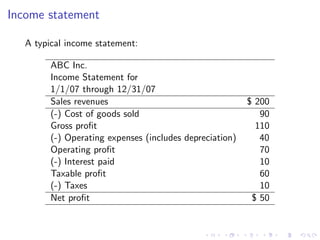

The document explains the concepts of stocks and flows in accounting, economics, and finance, emphasizing their importance for understanding financial statements. It details how stock measures represent values at a specific point in time, while flow measures represent values over a period, illustrating these concepts with equations and examples. Additionally, it describes the balance sheet and income statement as key financial statements, highlighting their roles in reporting a business's financial performance.