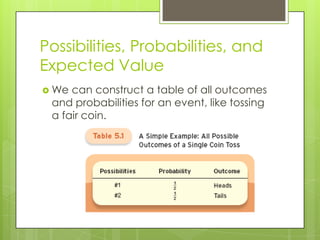

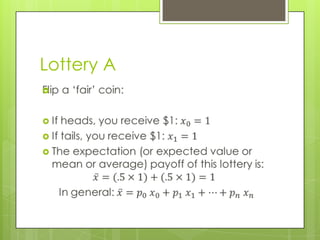

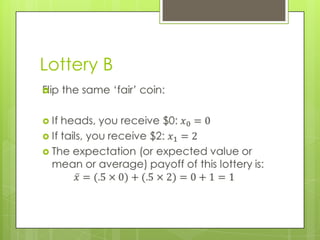

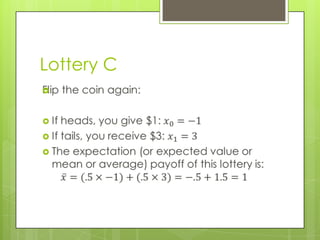

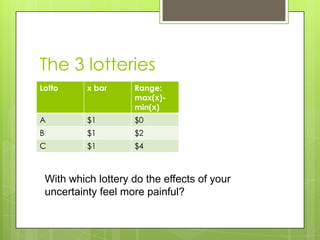

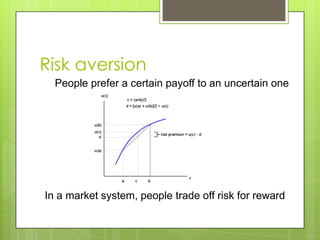

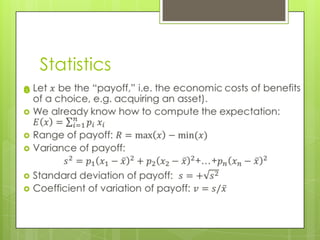

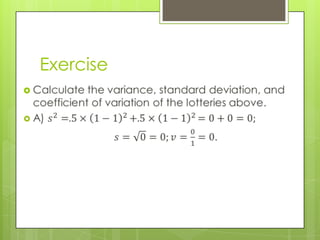

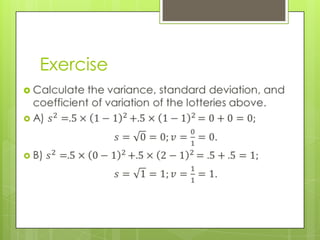

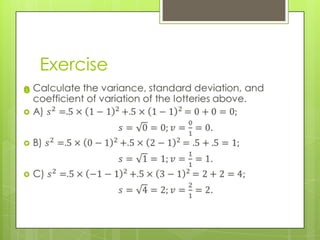

The document discusses risk and uncertainty in economic life. It defines risk as the economic effect of uncertainty, often quantified as the variability in potential payoffs. It describes how probability and statistics are used to analyze risk and uncertainty. It discusses different types of risks like idiosyncratic and systemic risks. Finally, it explains how risk can be managed through hedging, which reduces risk by combining offsetting investments, and diversification, which reduces risk by spreading investments across many uncorrelated sources of risk.