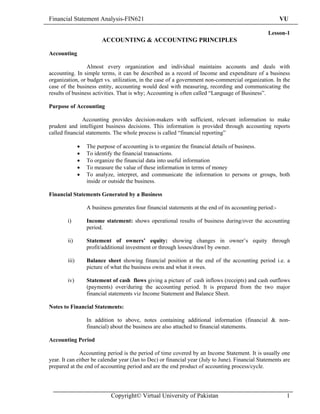

The document discusses accounting principles and financial statements. It provides definitions of accounting and discusses its purpose of providing relevant financial information to decision-makers through financial statements. It then lists the four main financial statements generated by businesses: [1] the income statement, [2] statement of owners' equity, [3] balance sheet, and [4] statement of cash flows. Additional notes may also be attached to provide further financial and non-financial information. Accounting periods are usually one year, covering either the calendar or financial year.

![Financial Statement Analysis-FIN621 VU

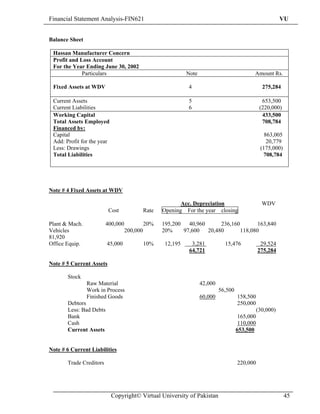

Cost of Asset = 100,000

Life of the Asset = 5 Years

Depreciation Method = Straight Line

Residual Value = Rs.10000

Sale Price after Five Years = Rs.15000

Depreciation per year = (100000-10000) / 5

= Rs.5000 per year

Total Depreciation in Five Years = 18,000 x 5

= 90,000

Book Value after Five Years = 100,000- 90,000

= 10,000

Profit on Disposal = 15,000 – 10,000

= Rs.5000

Recording of Disposal

Debit Fixed Asset Disposal A/c 100,000

Credit Fixed Asset Cost A/c 100,000

(With the cost of asset)

Debit Accumulated Dep. A/c 90,000

Credit Fixed Asset Disposal A/c 90,000

(With the depreciation accumulated to date)

Debit Cash / Bank / Receivable A/c 15,000

Credit Fixed Asset Disposal A/c 15,000

(With the price at which asset is sold)

[Note: one group to appear at a time]

Disposal of Asset Account

Fixed Asset Disposal Account

Debit Credit

Cost Account 100,000 Acc. Dep. Account 90,000

Cash / Bank 15,000

P & L Account 5000

( Balancing Figure)

Total 105000 Total 105000

Policy for Depreciation

Copyright© Virtual University of Pakistan 84](https://image.slidesharecdn.com/financialstatementanalysis-111029122049-phpapp02/85/Financial-statement-analysis-84-320.jpg)