Embed presentation

Download to read offline

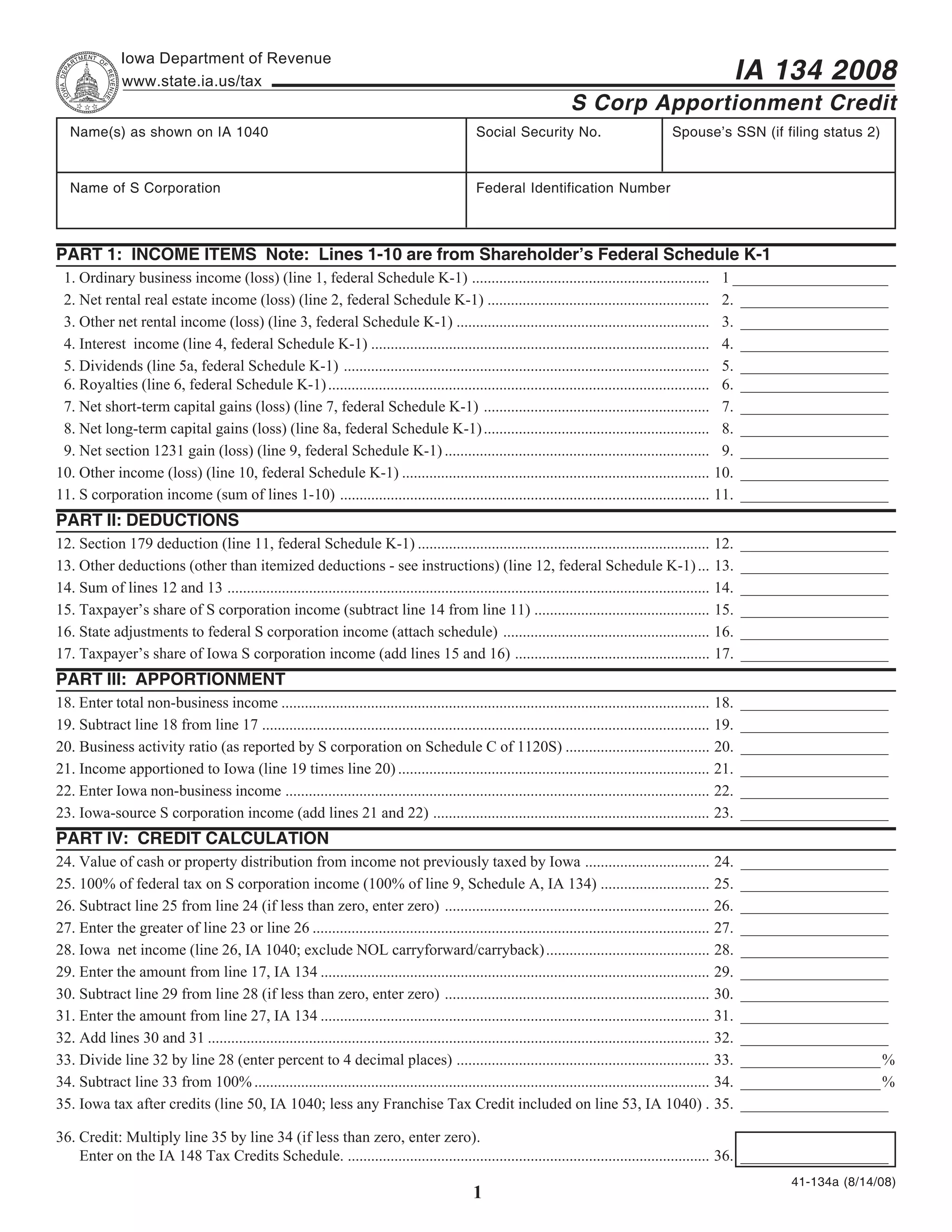

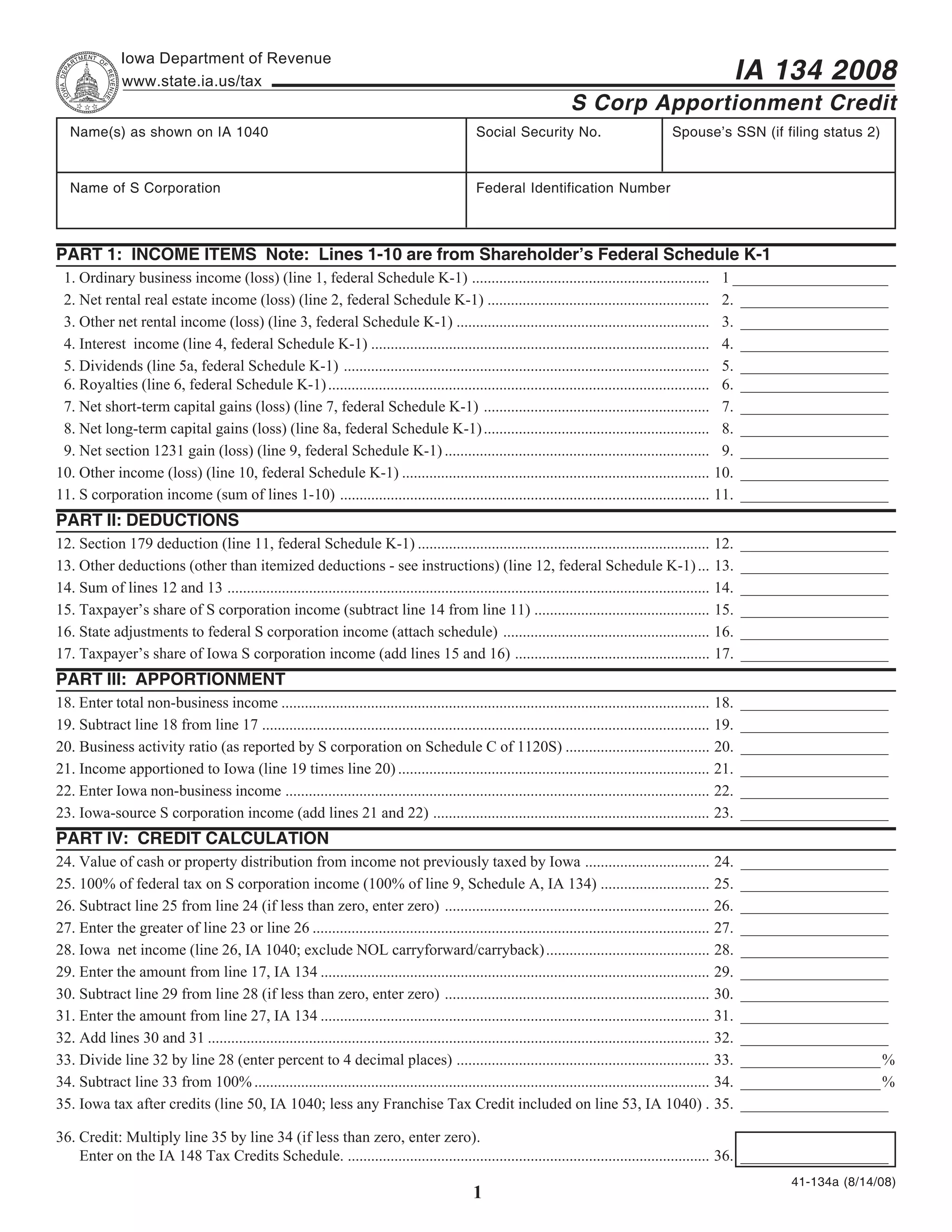

This document is an Iowa Department of Revenue form and instructions for calculating an S Corporation Apportionment Credit. It provides information for shareholders of S corporations operating in Iowa and other states to determine what portion of their S corporation income is taxable in Iowa. Key parts include: - Calculating the shareholder's Iowa-source S corporation income by applying the business activity ratio reported by the S corporation to the shareholder's net S corporation income. - Determining cash or property distributions from income not previously taxed by Iowa to calculate the credit amount. - Instructions specify not to include certain itemized deductions or distributions already taxed by Iowa in previous years.