Embed presentation

Download to read offline

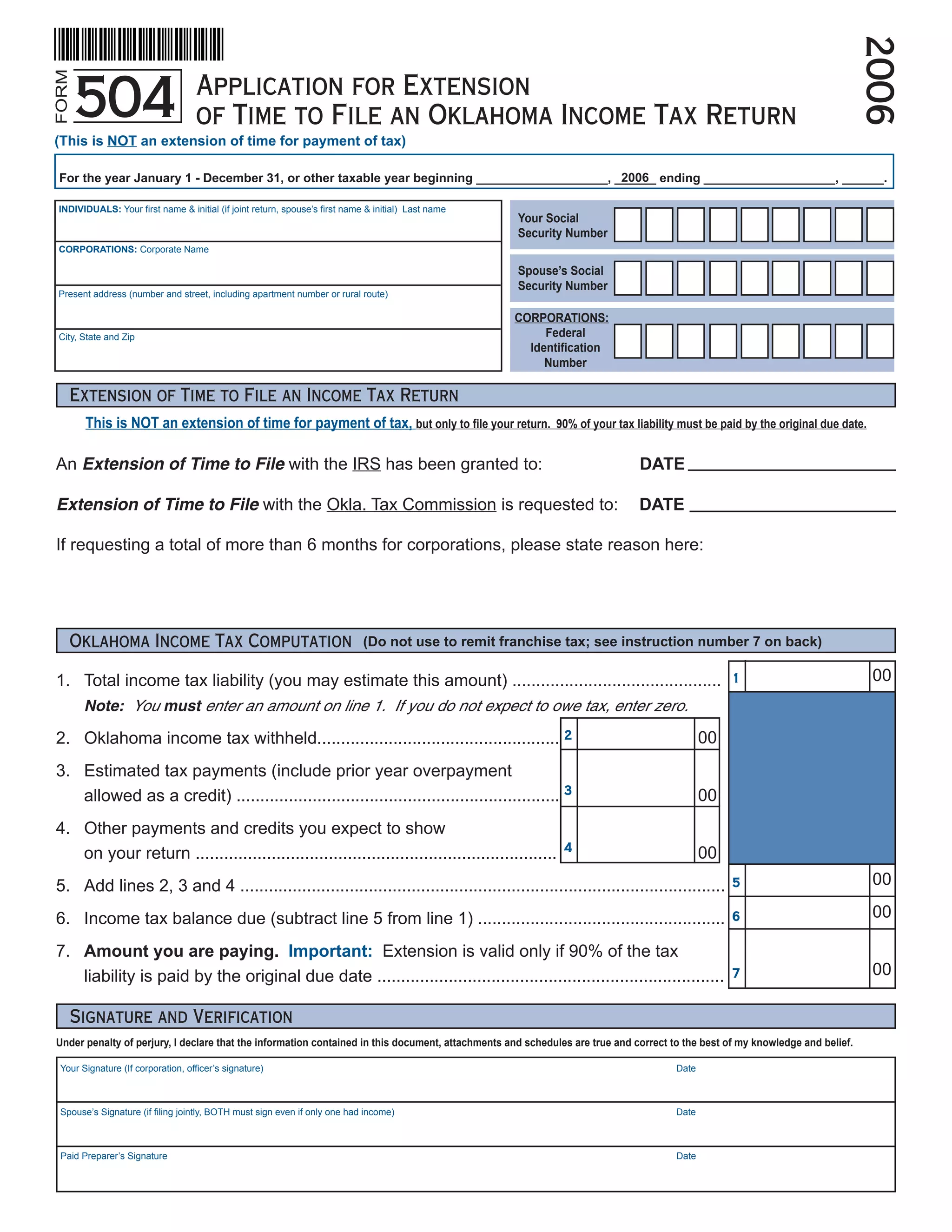

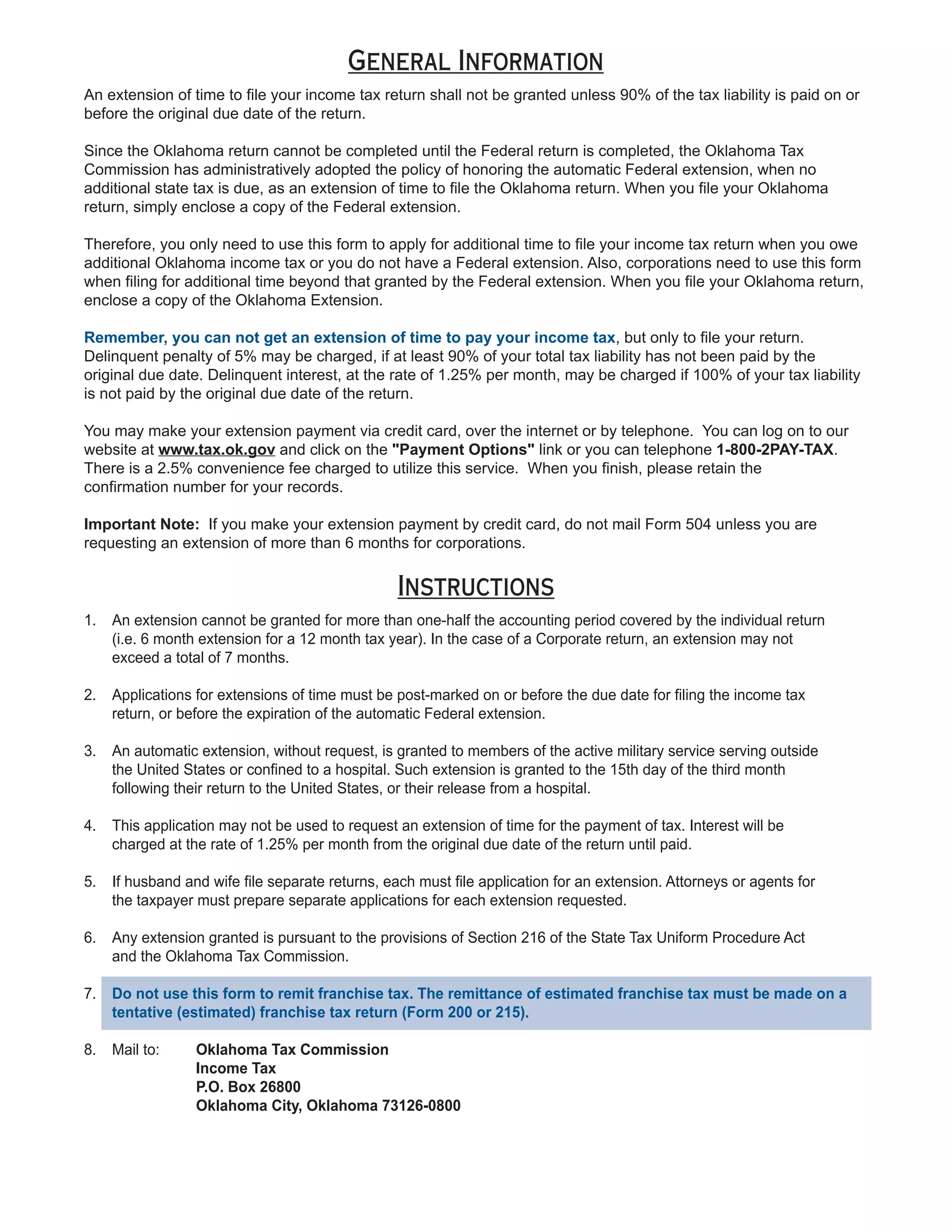

This document is an application for an extension of time to file an Oklahoma income tax return. It provides important instructions, including that the form is not for extending tax payments, only for filing the return. It must not be used to remit franchise tax. The applicant may request up to a 6 month extension for individuals or 7 months for corporations, but at least 90% of the estimated tax liability must be paid by the original filing deadline. The form requires estimating the total tax, payments made, balance due and payment amount.