Embed presentation

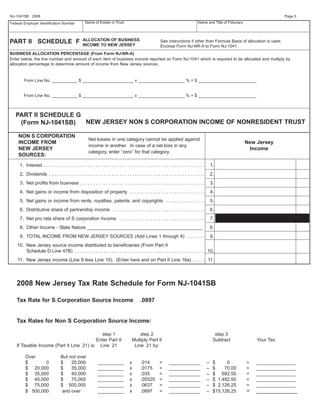

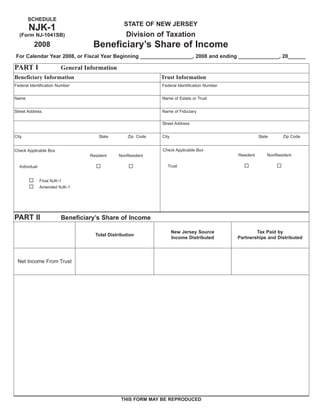

Download to read offline

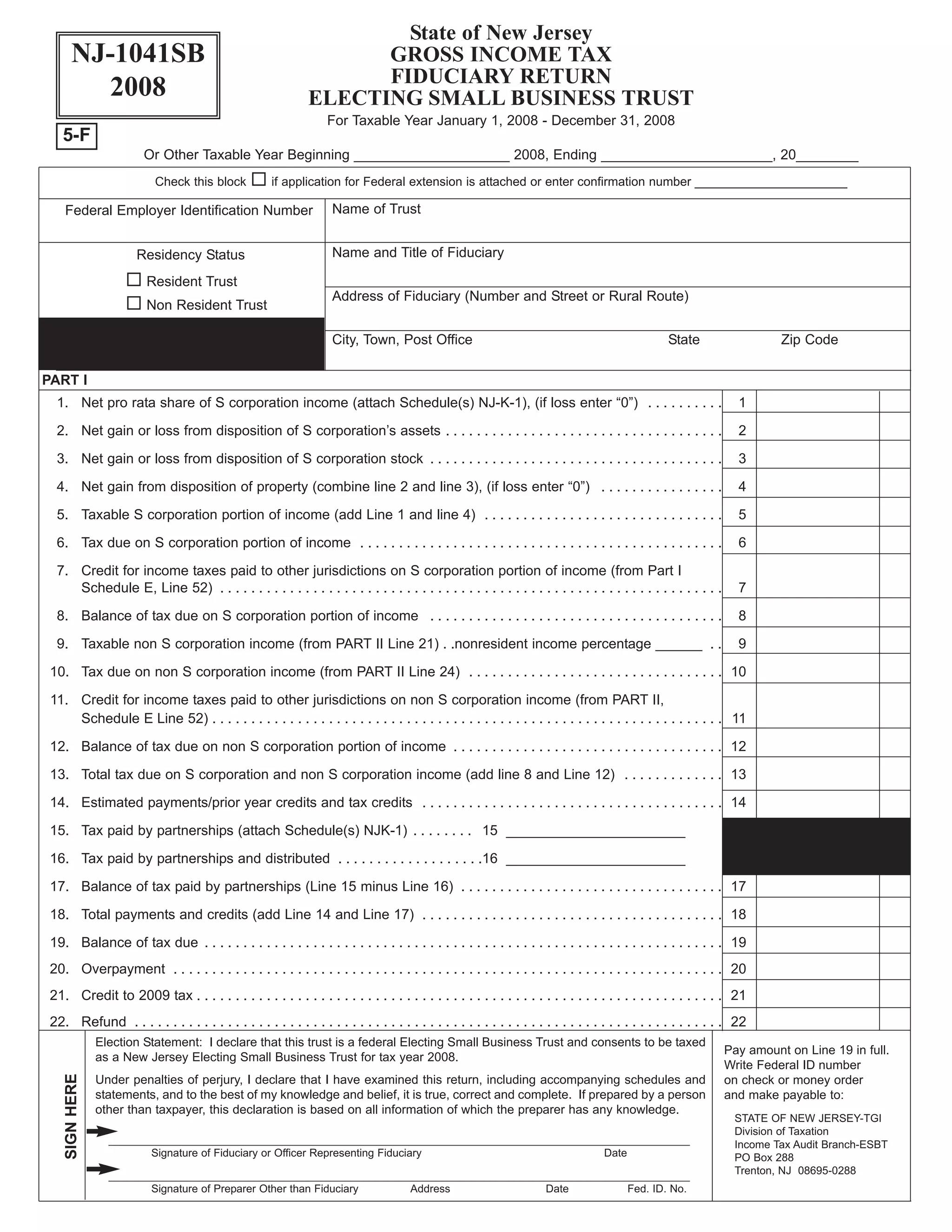

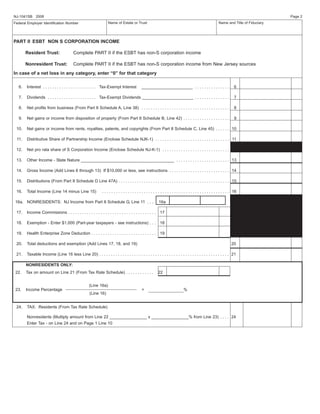

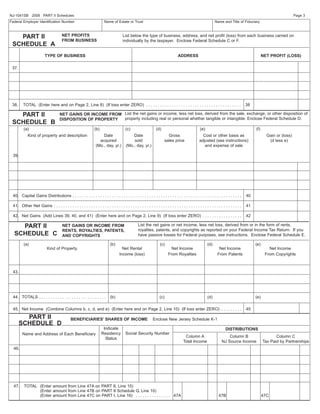

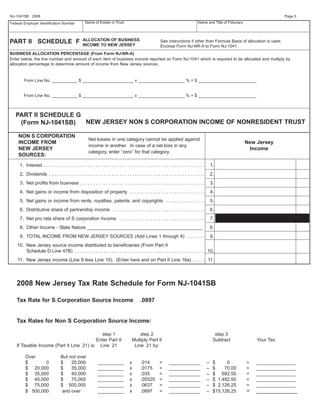

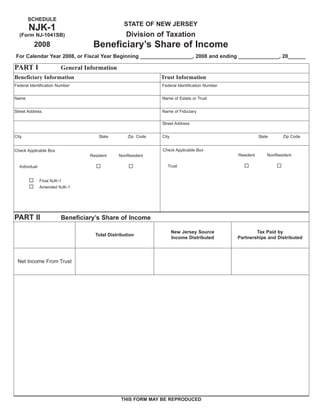

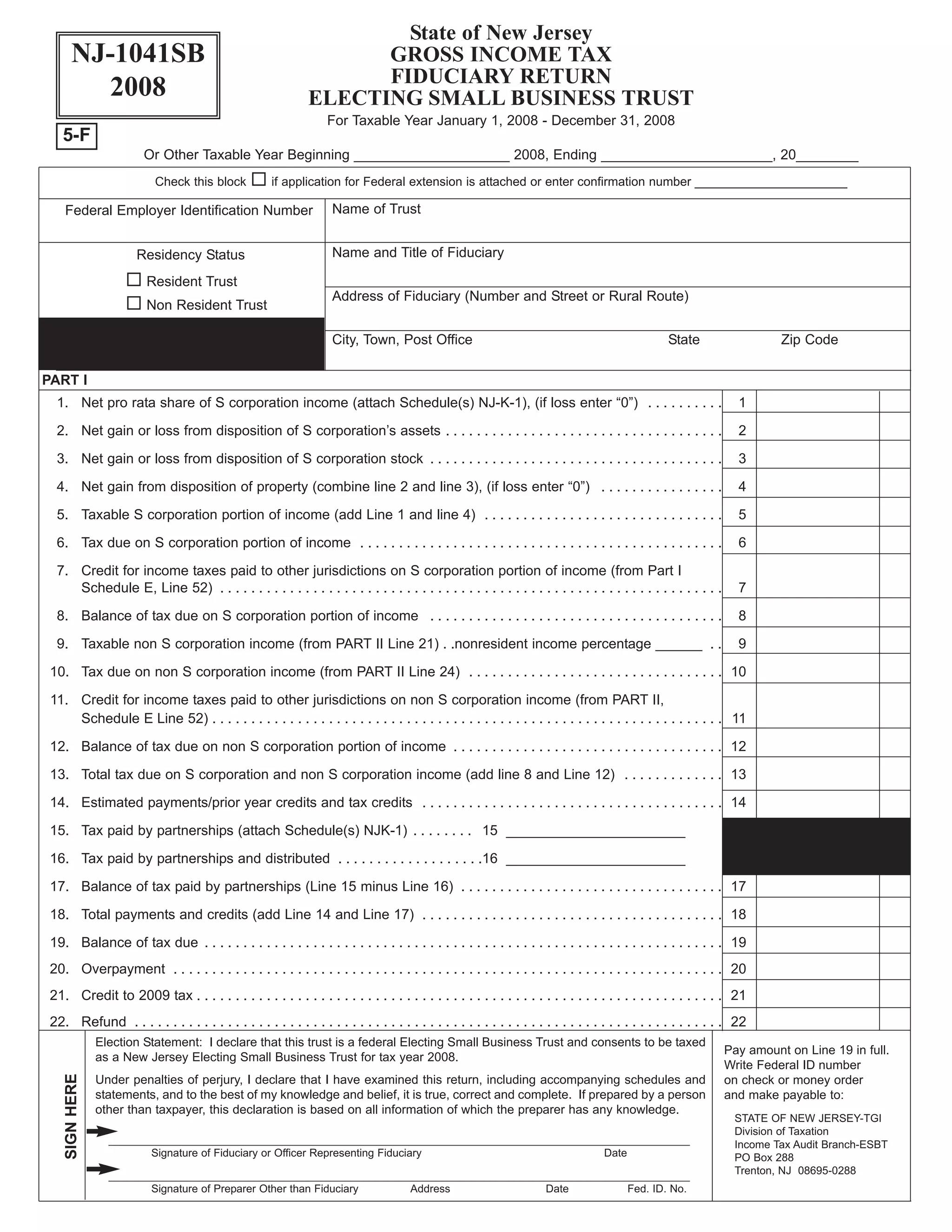

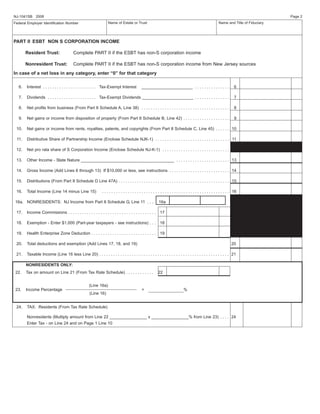

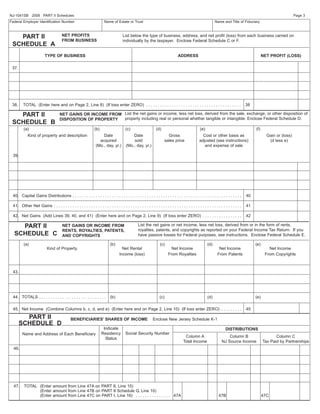

This document is a tax return form for the State of New Jersey for an Electing Small Business Trust (ESBT) for the tax year 2008. It contains sections to report the trust's income, deductions, taxes owed, and credits. Key details include: - It reports S corporation income and non-S corporation income separately - There are lines to calculate tax amounts owed for both types of income and claim credits for taxes paid to other jurisdictions - Schedules are included to provide additional details on business income, capital gains, rental income, and beneficiary distributions The form is used by ESBTs to file New Jersey gross income tax and report income from S corporations and non-S corporation sources,