Embed presentation

Download to read offline

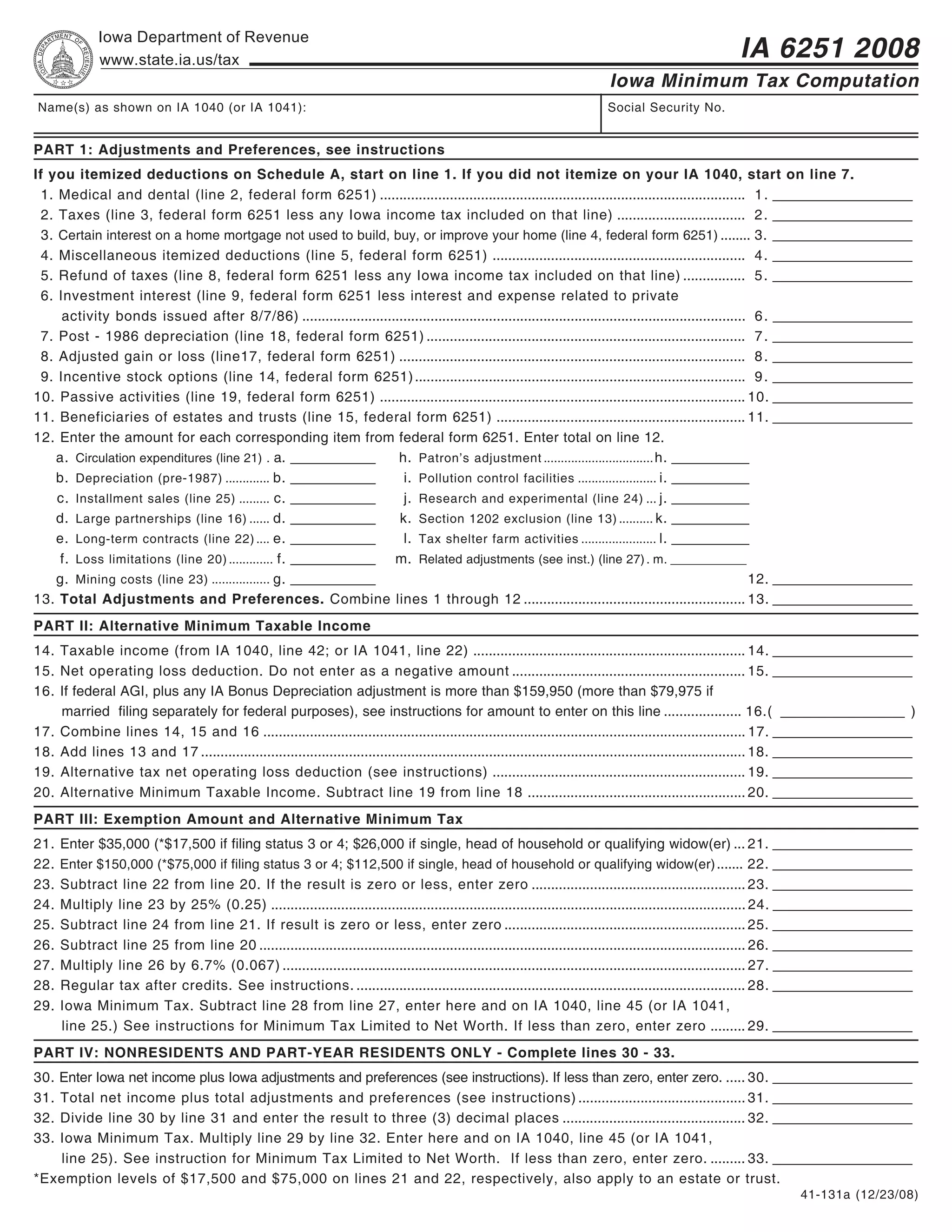

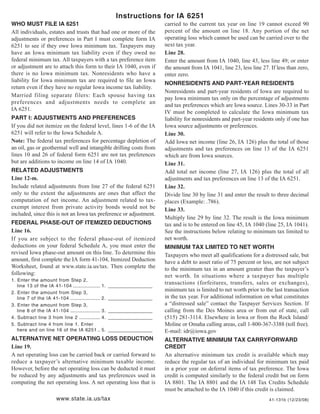

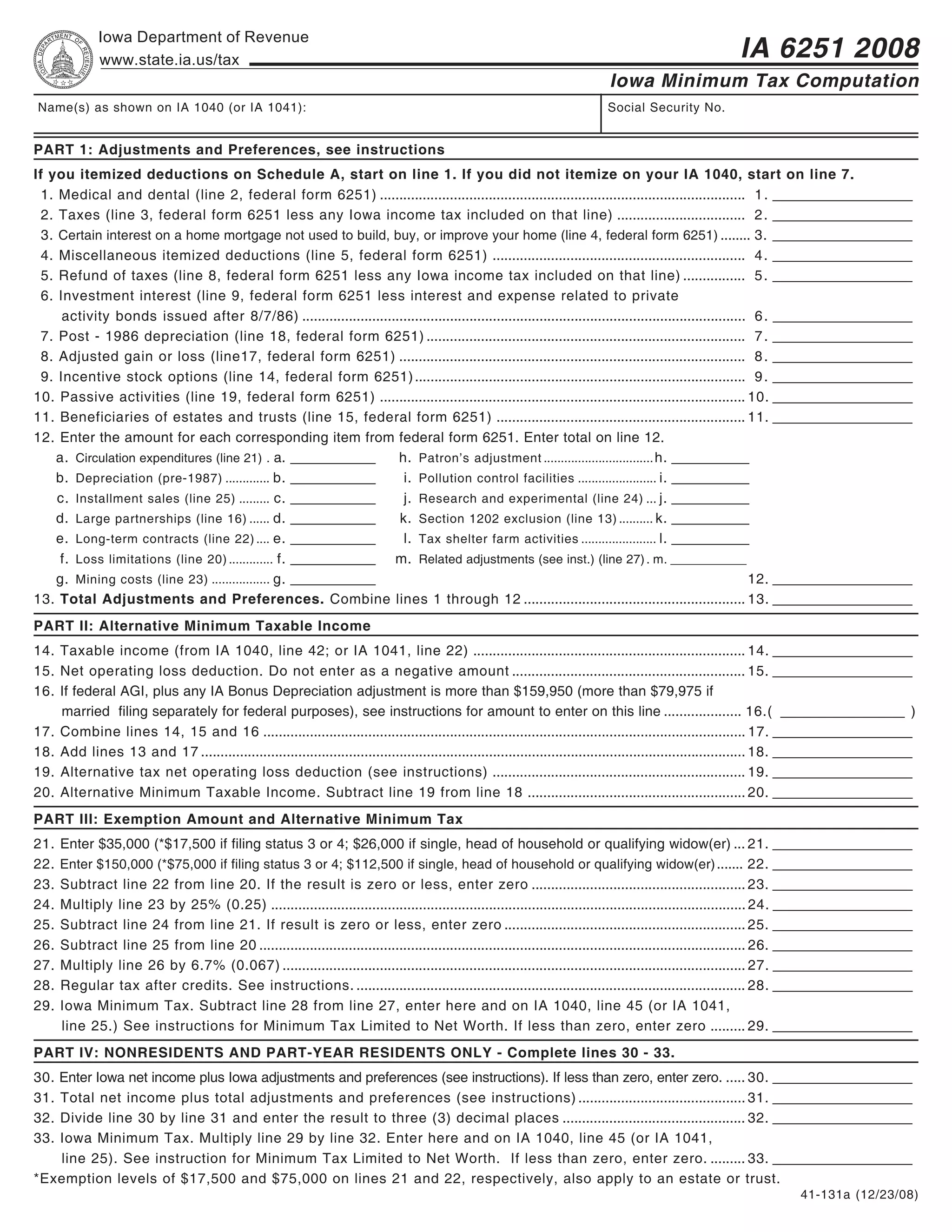

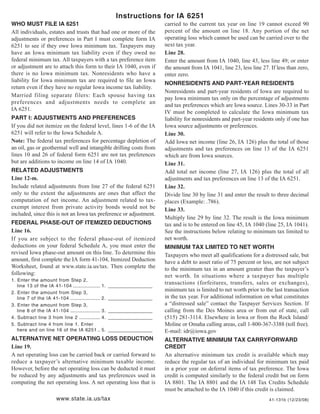

This document provides instructions for completing an Iowa Minimum Tax Computation form. It explains how to calculate adjustments and preferences from a federal tax form to determine alternative minimum taxable income. It also provides details for nonresidents and part-year residents on calculating their Iowa minimum tax liability. Exemption amounts and rates for calculating the alternative minimum tax are provided. The instructions also address limitations to the minimum tax based on a taxpayer's net worth and how to carry forward any alternative minimum tax credit.