state.ia.us tax forms 0841132

•

0 likes•110 views

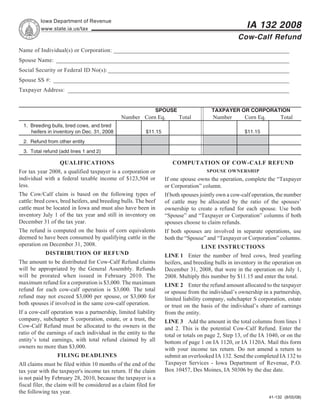

This document is an application form for an Iowa Cow-Calf tax refund. It provides instructions for taxpayers to claim a refund for breeding cattle. Key details include: - The refund is available to individuals or corporations with federal taxable income of $123,504 or less, based on the number and type of breeding cattle in inventory on December 31 that were also in inventory on July 1 of that year. - The refund amount is calculated based on the number of bred cows, bred heifers, and breeding bulls multiplied by $11.15 per head. - The maximum refund is $3,000 per taxpayer or cow-calf operation. For jointly owned operations, the refund is limited

Report

Share

Report

Share

Download to read offline

Recommended

20% top Federal Tax Rate

United Californians for Tax Reform (UCTR) proposes reducing the top tax rate from 35% to 20% by eliminating the deduction for state and local taxes and the personal exemption. This proposal would simplify taxes for over 90% of taxpayers, make the tax code more fair, and promote economic growth while remaining revenue neutral.

Whbm03

The document discusses the accounting cycle and key accounting concepts. It provides examples of journal entries for various business transactions for a lawn care service. This includes entries for investments by owners, purchases and sales of assets, expenses, revenues, and dividends paid. It explains the purpose of accounts, ledgers, journals, and the trial balance in tracking and reporting the financial activities and position of a business.

IN-111 - Income Tax Return

- The document is Vermont's 2006 income tax return and instructions.

- It provides information on filing options including electronic filing, important dates, and changes for the 2006 tax year.

- Key points include a new combined homestead/property tax form, an increased household income limit for property tax adjustments, and planning information for the 2007 tax year.

tax.utah.gov forms current tc tc-114s

(1) This document is an application form for a Utah state tax commission special fuel tax refund for government entities.

(2) It requests information such as the applicant name, address, federal identification number, filing period, number of gallons of CNG and undyed diesel purchased, invoice numbers, transaction dates, vendor names and addresses, and total tax paid.

(3) Utah law allows federal and state/local government refunds for special fuel taxes paid on CNG and undyed diesel purchased for exclusive government use in vehicles and equipment.

The Economic Importance of Deep Creek Lake (10.10.2013)

- Real property taxes make up over 70% of Garrett County's budgeted revenue for 2013, with District 18 accounting for over 43% of real property tax revenue.

- The number of building permits and their declared value have generally increased in both the Deep Creek Lake watershed and the entire county since the late 1990s.

- Residential real estate sales in both the Deep Creek Lake watershed and the entire county have fluctuated but remained relatively strong in recent years.

The bearded cpa

This document discusses taxation issues relevant to real estate professionals. It covers topics like the sale of a principal residence, federal tax liens on real estate, cancellation of debt, employing family members, home offices, automobiles, and accounting systems. It also provides advice on dealing with unfiled tax returns, audits, and paying back taxes owed. The overall message is that taxes can significantly impact profits for real estate agents and addressing tax issues promptly is key to avoiding penalties and problems with the IRS.

REV184 taxes.state.mn.us

This document is a Power of Attorney form for the Minnesota Department of Revenue. It allows a taxpayer to appoint an attorney-in-fact to represent them before the department for tax and nontax debt matters. The taxpayer provides their name and identification number. They then name the person or firm given power of attorney and specify the authority granted, such as full authority or limited authority for specific tax types and years. The taxpayer signs and dates the form, granting the power of attorney.

revenue.ne.gov tax current f_2210n

This document is Form 2210N for underpayment of estimated tax for the state of Nebraska. It provides instructions for calculating penalties for underpaying estimated quarterly income tax payments. The form has sections to calculate the required annual payment, quarterly installment amounts, amounts paid by each due date, and any underpayment amounts. It then provides sections to calculate penalties for underpayments based on the number of days the underpayment remained unpaid. There are also special instructions and calculations for farmers and ranchers with certain income sources.

Recommended

20% top Federal Tax Rate

United Californians for Tax Reform (UCTR) proposes reducing the top tax rate from 35% to 20% by eliminating the deduction for state and local taxes and the personal exemption. This proposal would simplify taxes for over 90% of taxpayers, make the tax code more fair, and promote economic growth while remaining revenue neutral.

Whbm03

The document discusses the accounting cycle and key accounting concepts. It provides examples of journal entries for various business transactions for a lawn care service. This includes entries for investments by owners, purchases and sales of assets, expenses, revenues, and dividends paid. It explains the purpose of accounts, ledgers, journals, and the trial balance in tracking and reporting the financial activities and position of a business.

IN-111 - Income Tax Return

- The document is Vermont's 2006 income tax return and instructions.

- It provides information on filing options including electronic filing, important dates, and changes for the 2006 tax year.

- Key points include a new combined homestead/property tax form, an increased household income limit for property tax adjustments, and planning information for the 2007 tax year.

tax.utah.gov forms current tc tc-114s

(1) This document is an application form for a Utah state tax commission special fuel tax refund for government entities.

(2) It requests information such as the applicant name, address, federal identification number, filing period, number of gallons of CNG and undyed diesel purchased, invoice numbers, transaction dates, vendor names and addresses, and total tax paid.

(3) Utah law allows federal and state/local government refunds for special fuel taxes paid on CNG and undyed diesel purchased for exclusive government use in vehicles and equipment.

The Economic Importance of Deep Creek Lake (10.10.2013)

- Real property taxes make up over 70% of Garrett County's budgeted revenue for 2013, with District 18 accounting for over 43% of real property tax revenue.

- The number of building permits and their declared value have generally increased in both the Deep Creek Lake watershed and the entire county since the late 1990s.

- Residential real estate sales in both the Deep Creek Lake watershed and the entire county have fluctuated but remained relatively strong in recent years.

The bearded cpa

This document discusses taxation issues relevant to real estate professionals. It covers topics like the sale of a principal residence, federal tax liens on real estate, cancellation of debt, employing family members, home offices, automobiles, and accounting systems. It also provides advice on dealing with unfiled tax returns, audits, and paying back taxes owed. The overall message is that taxes can significantly impact profits for real estate agents and addressing tax issues promptly is key to avoiding penalties and problems with the IRS.

REV184 taxes.state.mn.us

This document is a Power of Attorney form for the Minnesota Department of Revenue. It allows a taxpayer to appoint an attorney-in-fact to represent them before the department for tax and nontax debt matters. The taxpayer provides their name and identification number. They then name the person or firm given power of attorney and specify the authority granted, such as full authority or limited authority for specific tax types and years. The taxpayer signs and dates the form, granting the power of attorney.

revenue.ne.gov tax current f_2210n

This document is Form 2210N for underpayment of estimated tax for the state of Nebraska. It provides instructions for calculating penalties for underpaying estimated quarterly income tax payments. The form has sections to calculate the required annual payment, quarterly installment amounts, amounts paid by each due date, and any underpayment amounts. It then provides sections to calculate penalties for underpayments based on the number of days the underpayment remained unpaid. There are also special instructions and calculations for farmers and ranchers with certain income sources.

M23 taxes.state.mn.us

This document provides instructions for claiming a refund due to a deceased taxpayer in Minnesota. It addresses refunds for property taxes, income taxes, and military service credits. For property tax refunds, only a surviving spouse or dependent can claim the refund. For income tax refunds and military credits, the personal representative of the estate can claim the refund, or if no representative, eligible claimants are listed in order as the surviving spouse, children, grandchildren, parents, siblings, and nieces/nephews. If multiple eligible claimants, all must agree and sign to waive their claim so the refund goes to one person. The form and death certificate are required to claim the refund.

revenue.ne.gov tax current f_8453n

This document is the Nebraska Individual Income Tax Form 8453N for tax year 2008. It provides instructions for taxpayers who e-filed their Nebraska state tax return but need to submit additional forms or documentation not supported by electronic filing. The form lists common attachments that may be required such as various tax forms showing income, deductions, credits or withholding. It instructs filers to mail the completed form and required attachments to the Nebraska Department of Revenue once the e-filed return has been acknowledged.

Photo records for draft 2 ancillary

This document contains a list of photo records for a draft 2 of something ancillary. The list includes the names Chelsea, Rosie, Russ, and Marisha. The document provides a high-level list of names but no other context or details.

M60 taxes.state.mn.us

This document provides instructions for paying 2008 Minnesota individual income taxes. It explains that the payment is due by April 15, 2009 and if paid after that date penalties and interest must be included. It provides a worksheet to calculate the penalties and interest due based on the number of days late and unpaid tax amount. The total payment due is the unpaid taxes plus any calculated penalties and interest.

revenue.ne.gov tax current f_1041n_wkst

This document is a tax calculation worksheet for an Electing Small Business Trust (ESBT) filing a Nebraska state tax return. It provides instructions for calculating the ESBT's Nebraska taxable income and tax liability based on income received from an S corporation. Key steps include adjusting federal taxable income for items like U.S. government bond interest, then determining the portion of income from Nebraska sources to calculate the Nebraska tax amount.

Working Family Credit Table algorithms

The document outlines the Working Family Credit formulas for tax year 2008 based on the number of children and level of earned income. For taxpayers with no children, the credit is 1.9125% of the first $5,730 of earned income, reduced by the same percentage of income over $7,160 up to a maximum credit of $110. For one child the credit is 8.5% of income up to $8,580 plus 8.5% of income from $14,990 to $16,690, reduced by 5.73% of income over $18,710 up to $874. For two or more children the credit is 10% of income up to $12,060 plus 20% from

Schedule TC

This document is instructions for completing Schedule TC, the Wisconsin Technology Zone Credit form. It provides guidance on:

1) Who is eligible to claim the technology zone credit, including businesses located in certified technology zones.

2) How to calculate the credit amounts for property taxes paid, capital investments made, and jobs created on lines 1-3 of Schedule TC.

3) How to complete the remaining lines to determine the total credit and carryover amounts.

4) Special instructions for passing the credit through to shareholders, partners and beneficiaries for different entity types.

Schedule MT

This document is an alternative minimum tax schedule form for Wisconsin. It provides instructions for calculating Wisconsin alternative minimum tax. The form includes 20 lines for reporting various amounts used in the calculation, including federal alternative minimum taxable income, Wisconsin additions and subtractions, exemption amounts, tentative minimum tax, and Wisconsin alternative minimum tax. Key information includes determining Wisconsin alternative minimum taxable income, applying exemption amounts, calculating tentative minimum tax at 6.5% of taxable income exceeding exemptions, and determining the Wisconsin alternative minimum tax amount.

revenue.ne.gov tax current f_3800nsch04-05

This document is a form for computing Nebraska's enterprise zone tax credit. It provides instructions for calculating increases in employment and investment within an enterprise zone over the current and previous three years. The form is used to determine the available tax credit amount that can be used to offset tax liability or carried forward for future years.

revenue.ne.gov tax current f_7004n

This document is an application for an automatic extension of time to file a Nebraska corporation, fiduciary, or partnership tax return. It requests a 7-month extension until a specified future date. It requires the applicant to provide identifying information and calculates tentative tax liability, payments, and credits to determine the tax payment amount due, if any, by the original filing deadline. It must be signed by an authorized individual and submitted with any required payment to the Nebraska Department of Revenue.

Form 1-ES

This document is a voucher for estimated Wisconsin income tax payments. It provides instructions for accurately printing the voucher at 100% size without auto-rotation or centering. The voucher includes fields for the payer's name, address, social security number, payment amount, and payment due dates. It directs filers to mail the voucher with payment to the Wisconsin Department of Revenue.

revenue.ne.gov tax current f_4868n

This document is a Nebraska application form for an extension of time to file a Nebraska individual income tax return. It allows taxpayers to request a 7-month automatic extension from the original due date, or an extension in addition to a federal extension of up to 7 months total. The form requires the taxpayer's name, address, social security number, type of extension requested, tentative tax payment amount, and signature. Instructions explain who can file, how to file, where to file, and that interest is due from the original due date until taxes are paid.

revenue.ne.gov tax current f_1120sn

This document is a Nebraska S Corporation Income Tax Return form for the 2008 tax year. It provides lines for reporting ordinary income, Nebraska-specific adjustments that increase or decrease ordinary income, income apportioned to Nebraska, income subject to withholding for nonresident shareholders, withholding amounts, estimated tax payments, amounts due and refunds. Accompanying schedules are included for reporting income from both within and without Nebraska using apportionment factors. The form must be filed by S corporations operating in Nebraska and have the federal return and supporting schedules attached.

Fill-In Form

This document is a Power of Attorney form from the Wisconsin Department of Revenue. It allows a taxpayer to appoint an attorney-in-fact to represent them before the Department for certain tax matters. The form includes sections for the taxpayer and attorney contact information, the type of tax and years covered, any exclusions of authority for the attorney, how written communications should be sent, revocation of prior powers of attorney, and signatures to authorize the form. It provides a concise way for a taxpayer to grant tax representation powers to an attorney-in-fact for matters before the Wisconsin Department of Revenue.

Standard Deduction Table

This document provides a table listing the standard deduction amounts for tax year 2008 for different filing statuses based on federal income. It shows the standard deduction in increments of $500 for incomes between $0 and $83,500 for singles, married filing jointly or separately, heads of household, and qualifying widows(ers). For incomes above $83,500, the standard deduction is $0 for all filing statuses.

Fill-In Form

This document is a Wisconsin Department of Revenue form for calculating underpayment of estimated taxes by individuals and fiduciaries. It contains instructions for taxpayers to calculate their required annual payment, estimated tax payments made, and any underpayment amount owed including interest. The form provides options to use the short method, regular method, or annualized income installment method to figure the underpayment.

Fill-In Form

This document is a Wisconsin Schedule RT form for reporting related entity expenses. It requires the taxpayer to:

1. Summarize interest, rental, and royalty expenses paid to related entities in Part I, including the name, ID number, and amount for each related payee.

2. In Part II, check boxes to indicate if any reported interest or rental expenses meet criteria to qualify for a subtraction when computing Wisconsin income.

3. In Part II, enter the amounts of interest and rental expenses that qualify for subtraction according to the checked boxes, up to the "Total Subtraction Allowable" amount.

The document provides instructions for completing the form to report related entity expenses and determine if any qualify

state.ia.us tax forms 82053

This document is an annual report form from the Iowa Department of Revenue for retailers to report the gross gallons of various motor fuels sold at retail locations in Iowa for the calendar year 2008. Retailers are required to provide details on gasoline, ethanol blends, diesel, and biodiesel sales by fuel type. They must also indicate their license and permit numbers. The report is due by January 31, 2009 and is used to monitor the state's tax incentives for alternative fuels but does not collect any taxes.

state.ia.us tax forms 0841130

This document provides instructions for calculating an Iowa out-of-state tax credit for Iowa residents. It contains two sections, one for full-year Iowa residents and one for part-year Iowa residents. For full-year residents, it describes how to calculate the percentage of income taxed by both Iowa and another state, apply that percentage to the Iowa tax, and claim a credit for the lower of that amount or the actual tax paid to the other state. For part-year residents, it provides similar instructions but requires additional proration based on the portion of income earned while an Iowa resident.

revenue.ne.gov tax current f_3800wkst_2006

This document is a worksheet for calculating Nebraska tax credits for research and development activities and renewable energy generation. It provides instructions for determining the base amount for research and development credits for the current and prior tax years. It also provides a calculation to determine the renewable energy tax credit based on kilowatt-hours of electricity generated by a qualifying zero-emission facility. The worksheet is to be attached to Form 3800N when claiming these tax credits.

0841011 state.ia.us tax forms

This document is an Iowa Department of Revenue form for declaring electronically filed tax returns. It includes sections for taxpayer information, tax return details from the IA 1040 form, a declaration of consent for direct deposit of any refund, and a declaration signed by the electronic return originator and preparer. Key details include requirements to attach W-2 and 1099 forms, retain the form for 3 years, and procedures if the return requires changes after signing.

tax.utah.gov forms current tc tc-804b

This document is a request form for a monthly payment plan to pay back taxes owed to the Utah State Tax Commission. It provides instructions for taxpayers to request spreading payments of their tax debt over multiple months instead of paying the full amount at once. Key details include entering contact and account information, the tax period and amount owed, proposed monthly payment amounts, and requirements to have filed all prior tax returns to qualify for the payment plan. It explains the payment plan approval process and consequences for missing payments or future tax filing obligations.

More Related Content

Viewers also liked

M23 taxes.state.mn.us

This document provides instructions for claiming a refund due to a deceased taxpayer in Minnesota. It addresses refunds for property taxes, income taxes, and military service credits. For property tax refunds, only a surviving spouse or dependent can claim the refund. For income tax refunds and military credits, the personal representative of the estate can claim the refund, or if no representative, eligible claimants are listed in order as the surviving spouse, children, grandchildren, parents, siblings, and nieces/nephews. If multiple eligible claimants, all must agree and sign to waive their claim so the refund goes to one person. The form and death certificate are required to claim the refund.

revenue.ne.gov tax current f_8453n

This document is the Nebraska Individual Income Tax Form 8453N for tax year 2008. It provides instructions for taxpayers who e-filed their Nebraska state tax return but need to submit additional forms or documentation not supported by electronic filing. The form lists common attachments that may be required such as various tax forms showing income, deductions, credits or withholding. It instructs filers to mail the completed form and required attachments to the Nebraska Department of Revenue once the e-filed return has been acknowledged.

Photo records for draft 2 ancillary

This document contains a list of photo records for a draft 2 of something ancillary. The list includes the names Chelsea, Rosie, Russ, and Marisha. The document provides a high-level list of names but no other context or details.

M60 taxes.state.mn.us

This document provides instructions for paying 2008 Minnesota individual income taxes. It explains that the payment is due by April 15, 2009 and if paid after that date penalties and interest must be included. It provides a worksheet to calculate the penalties and interest due based on the number of days late and unpaid tax amount. The total payment due is the unpaid taxes plus any calculated penalties and interest.

revenue.ne.gov tax current f_1041n_wkst

This document is a tax calculation worksheet for an Electing Small Business Trust (ESBT) filing a Nebraska state tax return. It provides instructions for calculating the ESBT's Nebraska taxable income and tax liability based on income received from an S corporation. Key steps include adjusting federal taxable income for items like U.S. government bond interest, then determining the portion of income from Nebraska sources to calculate the Nebraska tax amount.

Working Family Credit Table algorithms

The document outlines the Working Family Credit formulas for tax year 2008 based on the number of children and level of earned income. For taxpayers with no children, the credit is 1.9125% of the first $5,730 of earned income, reduced by the same percentage of income over $7,160 up to a maximum credit of $110. For one child the credit is 8.5% of income up to $8,580 plus 8.5% of income from $14,990 to $16,690, reduced by 5.73% of income over $18,710 up to $874. For two or more children the credit is 10% of income up to $12,060 plus 20% from

Schedule TC

This document is instructions for completing Schedule TC, the Wisconsin Technology Zone Credit form. It provides guidance on:

1) Who is eligible to claim the technology zone credit, including businesses located in certified technology zones.

2) How to calculate the credit amounts for property taxes paid, capital investments made, and jobs created on lines 1-3 of Schedule TC.

3) How to complete the remaining lines to determine the total credit and carryover amounts.

4) Special instructions for passing the credit through to shareholders, partners and beneficiaries for different entity types.

Schedule MT

This document is an alternative minimum tax schedule form for Wisconsin. It provides instructions for calculating Wisconsin alternative minimum tax. The form includes 20 lines for reporting various amounts used in the calculation, including federal alternative minimum taxable income, Wisconsin additions and subtractions, exemption amounts, tentative minimum tax, and Wisconsin alternative minimum tax. Key information includes determining Wisconsin alternative minimum taxable income, applying exemption amounts, calculating tentative minimum tax at 6.5% of taxable income exceeding exemptions, and determining the Wisconsin alternative minimum tax amount.

revenue.ne.gov tax current f_3800nsch04-05

This document is a form for computing Nebraska's enterprise zone tax credit. It provides instructions for calculating increases in employment and investment within an enterprise zone over the current and previous three years. The form is used to determine the available tax credit amount that can be used to offset tax liability or carried forward for future years.

revenue.ne.gov tax current f_7004n

This document is an application for an automatic extension of time to file a Nebraska corporation, fiduciary, or partnership tax return. It requests a 7-month extension until a specified future date. It requires the applicant to provide identifying information and calculates tentative tax liability, payments, and credits to determine the tax payment amount due, if any, by the original filing deadline. It must be signed by an authorized individual and submitted with any required payment to the Nebraska Department of Revenue.

Form 1-ES

This document is a voucher for estimated Wisconsin income tax payments. It provides instructions for accurately printing the voucher at 100% size without auto-rotation or centering. The voucher includes fields for the payer's name, address, social security number, payment amount, and payment due dates. It directs filers to mail the voucher with payment to the Wisconsin Department of Revenue.

revenue.ne.gov tax current f_4868n

This document is a Nebraska application form for an extension of time to file a Nebraska individual income tax return. It allows taxpayers to request a 7-month automatic extension from the original due date, or an extension in addition to a federal extension of up to 7 months total. The form requires the taxpayer's name, address, social security number, type of extension requested, tentative tax payment amount, and signature. Instructions explain who can file, how to file, where to file, and that interest is due from the original due date until taxes are paid.

revenue.ne.gov tax current f_1120sn

This document is a Nebraska S Corporation Income Tax Return form for the 2008 tax year. It provides lines for reporting ordinary income, Nebraska-specific adjustments that increase or decrease ordinary income, income apportioned to Nebraska, income subject to withholding for nonresident shareholders, withholding amounts, estimated tax payments, amounts due and refunds. Accompanying schedules are included for reporting income from both within and without Nebraska using apportionment factors. The form must be filed by S corporations operating in Nebraska and have the federal return and supporting schedules attached.

Fill-In Form

This document is a Power of Attorney form from the Wisconsin Department of Revenue. It allows a taxpayer to appoint an attorney-in-fact to represent them before the Department for certain tax matters. The form includes sections for the taxpayer and attorney contact information, the type of tax and years covered, any exclusions of authority for the attorney, how written communications should be sent, revocation of prior powers of attorney, and signatures to authorize the form. It provides a concise way for a taxpayer to grant tax representation powers to an attorney-in-fact for matters before the Wisconsin Department of Revenue.

Standard Deduction Table

This document provides a table listing the standard deduction amounts for tax year 2008 for different filing statuses based on federal income. It shows the standard deduction in increments of $500 for incomes between $0 and $83,500 for singles, married filing jointly or separately, heads of household, and qualifying widows(ers). For incomes above $83,500, the standard deduction is $0 for all filing statuses.

Fill-In Form

This document is a Wisconsin Department of Revenue form for calculating underpayment of estimated taxes by individuals and fiduciaries. It contains instructions for taxpayers to calculate their required annual payment, estimated tax payments made, and any underpayment amount owed including interest. The form provides options to use the short method, regular method, or annualized income installment method to figure the underpayment.

Fill-In Form

This document is a Wisconsin Schedule RT form for reporting related entity expenses. It requires the taxpayer to:

1. Summarize interest, rental, and royalty expenses paid to related entities in Part I, including the name, ID number, and amount for each related payee.

2. In Part II, check boxes to indicate if any reported interest or rental expenses meet criteria to qualify for a subtraction when computing Wisconsin income.

3. In Part II, enter the amounts of interest and rental expenses that qualify for subtraction according to the checked boxes, up to the "Total Subtraction Allowable" amount.

The document provides instructions for completing the form to report related entity expenses and determine if any qualify

state.ia.us tax forms 82053

This document is an annual report form from the Iowa Department of Revenue for retailers to report the gross gallons of various motor fuels sold at retail locations in Iowa for the calendar year 2008. Retailers are required to provide details on gasoline, ethanol blends, diesel, and biodiesel sales by fuel type. They must also indicate their license and permit numbers. The report is due by January 31, 2009 and is used to monitor the state's tax incentives for alternative fuels but does not collect any taxes.

state.ia.us tax forms 0841130

This document provides instructions for calculating an Iowa out-of-state tax credit for Iowa residents. It contains two sections, one for full-year Iowa residents and one for part-year Iowa residents. For full-year residents, it describes how to calculate the percentage of income taxed by both Iowa and another state, apply that percentage to the Iowa tax, and claim a credit for the lower of that amount or the actual tax paid to the other state. For part-year residents, it provides similar instructions but requires additional proration based on the portion of income earned while an Iowa resident.

revenue.ne.gov tax current f_3800wkst_2006

This document is a worksheet for calculating Nebraska tax credits for research and development activities and renewable energy generation. It provides instructions for determining the base amount for research and development credits for the current and prior tax years. It also provides a calculation to determine the renewable energy tax credit based on kilowatt-hours of electricity generated by a qualifying zero-emission facility. The worksheet is to be attached to Form 3800N when claiming these tax credits.

Viewers also liked (20)

Similar to state.ia.us tax forms 0841132

0841011 state.ia.us tax forms

This document is an Iowa Department of Revenue form for declaring electronically filed tax returns. It includes sections for taxpayer information, tax return details from the IA 1040 form, a declaration of consent for direct deposit of any refund, and a declaration signed by the electronic return originator and preparer. Key details include requirements to attach W-2 and 1099 forms, retain the form for 3 years, and procedures if the return requires changes after signing.

tax.utah.gov forms current tc tc-804b

This document is a request form for a monthly payment plan to pay back taxes owed to the Utah State Tax Commission. It provides instructions for taxpayers to request spreading payments of their tax debt over multiple months instead of paying the full amount at once. Key details include entering contact and account information, the tax period and amount owed, proposed monthly payment amounts, and requirements to have filed all prior tax returns to qualify for the payment plan. It explains the payment plan approval process and consequences for missing payments or future tax filing obligations.

Char500 10

This document is an annual filing form for charitable organizations in New York State. It collects general information about the organization such as its name, address, employer identification number, the fiscal year covered in the filing, and certification by two officers. It also determines whether the organization qualifies for an exemption from submitting additional schedules based on its financial activity. If not exempt, it requires additional schedules be submitted providing details on professional fundraisers used and government contributions received.

Char500 10

This document is an annual filing form for charitable organizations in New York State. It collects general information about the organization such as its name, address, employer identification number, the fiscal year covered in the filing, and certification by two officers. It also determines whether the organization qualifies for an annual report exemption or must complete additional schedules providing details about government grants, professional fundraisers, and financial information.

Char500 10

This document is an annual filing form for charitable organizations in New York State. It requires general information about the organization, a certification signed by two officers, information about annual report exemptions, additional schedules if required, fee payment instructions, and a checklist of required document attachments. The form collects information needed by the New York State Department of Law (Office of the Attorney General) Charities Bureau to register and oversee charitable organizations.

IN-152 - Underpayment of 2007 Estimated Individual Income Tax

This document contains instructions and payment vouchers for making estimated income tax payments to Vermont for tax year 2008. Taxpayers who expect to owe more than $500 after withholding and credits are required to make estimated payments. Payments are due on April 15, June 15, September 15 of 2008 and January 15, 2009. The document provides worksheets to help estimate tax liability and record payments made. It also includes the 2008 preliminary Vermont income tax rates schedules.

tax.utah.gov forms current tc tc-804

This document is a payment agreement request form for the Utah State Tax Commission. It allows taxpayers to request a monthly payment plan if they cannot pay the full amount owed on their individual income tax return. Taxpayers provide personal information and details of the requested payment plan such as the monthly payment amount and due date. The form instructions explain how to complete the form and the requirements of the payment agreement if approved.

state.ia.us tax forms 0841134

This document is an Iowa Department of Revenue form and instructions for calculating an S Corporation Apportionment Credit. It provides information for shareholders of S corporations operating in Iowa and other states to determine what portion of their S corporation income is taxable in Iowa. Key parts include:

- Calculating the shareholder's Iowa-source S corporation income by applying the business activity ratio reported by the S corporation to the shareholder's net S corporation income.

- Determining cash or property distributions from income not previously taxed by Iowa to calculate the credit amount.

- Instructions specify not to include certain itemized deductions or distributions already taxed by Iowa in previous years.

tax.utah.gov forms current tc tc-544

This document provides instructions for paying Utah partnership tax balances. It explains that partnerships should use the payment coupon to pay balances due when filing a paper return or to pay an existing balance after filing. It includes a payment worksheet to calculate the minimum payment due, which is 90% of the current year's liability or 100% of the previous year's liability. Penalties may be assessed for underpayment or late payment. Interest accrues until the full balance is paid.

gov revenue formsandresources forms FRM_fill-in

This document provides instructions for Montana's 2008 Farm and Ranch Risk Management Account annual reporting form. It explains that eligible agricultural businesses can establish an account to exclude deposits of up to $20,000 from adjusted gross income. Deposits must be made in the tax year or within 3.5 months after, and must be distributed within 5 years or will be considered taxable income. The form requires information on the account grantor and trustee, deposits made in the tax year, and any distributions from the account.

1040 Long Booklet 08

The Iowa legislature has not yet coupled Iowa's tax code with the 2008 federal tax code extensions. As a result, Iowa returns must be filed according to current Iowa law, which does not include the federal deductions for educator expenses, tuition and fees, and state sales tax. Taxpayers who have already filed claiming these deductions need to amend their Iowa returns to exclude them. The Iowa department incorrectly assumed in the 2008 tax booklet that Iowa would adopt the federal extensions, so the booklet information is now contrary to current law.

0841002 state.ia.us tax forms

Iowa has not yet coupled with or adopted the federal "extenders" provisions for tax year 2008. This means that Iowa taxpayers cannot claim educator expenses, tuition and fees, or the itemized deduction for state sales tax paid on their Iowa returns, even if they claimed these items on their federal returns. Taxpayers who have already filed Iowa returns claiming these extenders need to file amended Iowa returns excluding the items. The Iowa tax booklet incorrectly stated that Iowa would follow the federal treatment of these extenders.

Declaration for Electronic Filing VA-8453

This document is an IRS Declaration Control Number form for an individual's Virginia state income tax return that was filed electronically. It contains information about the taxpayer's income and tax amounts according to their filed tax return. The taxpayer and paid preparer, if any, must sign the form to authorize electronic filing and direct deposit of any refund amount. The paid preparer also verifies the accuracy of the return. The form must be retained by the electronic return originator or transmitter for three years.

Request for Extension of Time to File South Carolina Tax Return (File on-line...

This document provides instructions for filing a South Carolina Individual Income Tax Return extension (Form SC4868). It explains that the extension allows an additional six months to file the tax return. Taxpayers have until April 15th (or the original due date of a fiscal year return) to file for the extension. While the extension provides more time to file, it does not extend the deadline for paying any taxes owed. The form and instructions provide guidance on calculating balances due and ensuring payment is submitted on time.

tax.utah.gov forms current tc tc-548

This document provides information about making prepayment of Utah fiduciary income taxes. It explains that taxpayers can make prepayments to cover their expected tax liability before the return due date to avoid penalties. It includes a worksheet to calculate the minimum required prepayment, which is either 90% of the estimated current year tax liability or 100% of the prior year's tax liability. The form also provides contact information for the Utah State Tax Commission for questions.

tax.utah.gov forms current tc tc-20inst

This document provides instructions for filing Utah state corporate tax returns. It outlines general filing requirements and instructions, including what forms to file based on the type of federal return filed. It also provides details on electronic filing options, payment requirements, due dates, and what supporting federal and state documentation must be included. Key points covered include filing requirements for C corporations, S corporations, and those filing under the corporate income tax.

tax.utah.gov forms current tc tc-546-2009

1. The document provides instructions for making prepayment of individual income taxes in Utah prior to the tax return due date.

2. It notes that prepayments may not be necessary if sufficient taxes were withheld, and provides a worksheet to calculate if prepayment is required.

3. The summary also states that taxpayers have an automatic 6-month extension to file their return but not to pay taxes owed, and that penalties will be assessed if the minimum tax payment is not made by the original due date.

Nonresident and Part-year resident Computation of Illinois Tax

This document provides instructions for completing Schedule M, which is used to report additions and subtractions for Illinois individual income tax. Some key points:

- Schedule M allows taxpayers to calculate additions to income reported on Line 3 of Form IL-1040 and subtractions that can be claimed on Line 7.

- Common additions include income from medical savings accounts, college savings plan earnings, and depreciation adjustments. Common subtractions include contributions to college savings plans and military pay.

- Taxpayers must attach Schedule M and any required documentation to their Form IL-1040 if they report an amount on either Line 3 or Line 7.

- The instructions provide line-by-line guidance for

Instructions

This document provides instructions for Form 1-ES, which is used to pay estimated income tax for individuals, estates, and trusts in Wisconsin. It discusses who must pay estimated tax, when payments are due, and how to calculate the amount due. The key points are:

- You must pay estimated tax if you expect to owe at least $200 in tax and your withholding will be less than 90% of the current year's tax or 100% of the prior year's tax.

- Estimated tax payments are generally due on April 15, June 16, September 15, and January 16 of the following year. Special rules apply to farmers, fishers, and fiscal year filers.

- To calculate your

tax.utah.gov forms current tc tc-65pa

This document provides instructions for filing the Utah Composite Return (TC-65PA) for nonresident professional team members. It outlines who can file the composite return, when it is due, and what to attach. It includes instructions for completing specific lines on the return form as well as details about penalties, interest, and payment options. Schedules for reporting team member compensation and allocating compensation to Utah must also be filed.

Similar to state.ia.us tax forms 0841132 (20)

IN-152 - Underpayment of 2007 Estimated Individual Income Tax

IN-152 - Underpayment of 2007 Estimated Individual Income Tax

Request for Extension of Time to File South Carolina Tax Return (File on-line...

Request for Extension of Time to File South Carolina Tax Return (File on-line...

Nonresident and Part-year resident Computation of Illinois Tax

Nonresident and Part-year resident Computation of Illinois Tax

More from taxman taxman

ftb.ca.gov forms 09_3528a

This document is an application for a California homebuyer's tax credit. It contains sections for the seller to certify that the home has never been occupied, as well as sections for the escrow company to provide closing details. Finally, there are sections for up to three qualified buyers to provide their contact and ownership information and certify that they intend to use the home as their primary residence for at least two years. The buyers will receive a tax credit of up to 5% of the home's purchase price or $10,000, whichever is less.

ftb.ca.gov forms 09_593bk

This document contains Forms 593-C and 593-E and instructions for real estate withholding in California for 2009. It explains that real estate withholding is a prepayment of estimated income tax due from gains on real estate sales in California. The Real Estate Escrow Person is responsible for providing the forms to sellers and withholding the appropriate amount based on the forms submitted.

ftb.ca.gov forms 09_593v

This document provides instructions for completing Form 593-V Payment Voucher for Real Estate Withholding Electronic Submission. Key details include:

1) Form 593-V is used to remit real estate withholding payment to the Franchise Tax Board if Form 593 was filed electronically. It must include the withholding agent's identifying information and payment amount.

2) Payments can be made by check or money order payable to the Franchise Tax Board, or through electronic funds transfer for large payments. The payment must match the electronically filed Form 593.

3) Payments are due within 20 days of the end of the month in which the real estate transaction occurred. Interest and penalties

ftb.ca.gov forms 09_593i

This document provides instructions for California real estate withholding on installment sales. It explains that for tax years beginning on or after January 1, 2009, the buyer is required to withhold taxes on the principal portion of each installment payment for properties sold via an installment sale. The form guides the buyer through providing their contact information, the seller's information, acknowledging the withholding requirement, and signing to indicate they understand their obligation to withhold taxes and send payments to the state. Escrow agents are instructed to send the initial withholding amount to the state and provide copies of documents to help facilitate ongoing withholding as future installment payments are made.

ftb.ca.gov forms 09_593c

This document is a California Form 593-C, which is a Real Estate Withholding Certificate. It allows a seller of California real estate to certify exemptions from real estate withholding requirements. The form has four parts: seller information, certifications that fully exempt from withholding, certifications that may partially or fully exempt, and the seller's signature. Checking boxes in Part II or III can allow full or partial exemption from the default 3 1/3% withholding on the sales price of California real estate.

ftb.ca.gov forms 09_593

This document is a California Form 593 for real estate withholding tax. It contains information about the withholding agent, seller or transferor, escrow or exchange details, and transaction details. The form requires the seller to sign a perjury statement if electing an optional gain on sale calculation method rather than the default 3 1/3% of total sales price withholding amount.

ftb.ca.gov forms 09_592v

This document provides instructions for completing Form 592-V, the payment voucher for electronically filed Form 592 (Quarterly Resident and Nonresident Withholding Statement) and Form 592-F (Foreign Partner or Member Annual Return). Key details include verifying complete information is provided on the voucher, rounding cents to dollars, mailing the payment and voucher to the Franchise Tax Board by the payment due date, and interest and penalties for late payments.

ftb.ca.gov forms 09_592b

This document is a California Form 592-B for the tax year 2009. It provides instructions for withholding agents and recipients regarding nonresident and resident withholding. Key details include:

- Form 592-B is used to report income subject to withholding and the amount of California tax withheld.

- It must be provided to recipients by January 31 and to foreign partners by the 15th day of the 4th month following the close of the taxable year.

- The recipient should attach Copy B to their California tax return to claim the withholding amount.

ftb.ca.gov forms 09_592a

This document is a Foreign Partner or Member Quarterly Withholding Remittance Statement form for tax year 2009 from the California Franchise Tax Board. It contains instructions for three installment payments due by the 15th day of the 4th, 6th, and 9th months of the tax year. The form collects identifying information about the Withholding Agent such as name, address, ID number, and payment amounts to be remitted to the Franchise Tax Board.

ftb.ca.gov forms 09_592

This document is a Quarterly Resident and Nonresident Withholding Statement form for tax year 2009. It is used to report tax amounts withheld from payments made to independent contractors, recipients of rents/royalties, distributions to shareholders/partners/beneficiaries, and other types of income. The form includes sections to enter information about the withholding agent, types of income, amounts of tax withheld and due, and a schedule of payees listing details of payments made and tax withheld for each recipient. Instructions are provided on filing deadlines, common errors to avoid, electronic filing requirements, interest and penalties.

ftb.ca.gov forms 09_590p

This document is a Nonresident Withholding Exemption Certificate form used to certify an exemption from withholding on distributions of previously reported income from an S corporation, partnership, or LLC. It allows a nonresident shareholder, partner, or member to claim exemption if the income represented by the distribution was already reported on their California tax return. The form requires information about the entity and individual, and certification that the income has been reported. It is to be kept by the entity and presented to claim exemption from withholding requirements on distributions of prior year income.

ftb.ca.gov forms 09_590

This document is a Withholding Exemption Certificate form from the California Franchise Tax Board. It allows individuals and entities to certify an exemption from California nonresident income tax withholding. The form contains checkboxes for different types of taxpayers, including individuals, corporations, partnerships, LLCs, tax-exempt entities, and trusts, to claim an exemption based on their status. It requires the taxpayer's name, address, and signature to certify that the information provided is true and correct.

ftb.ca.gov forms 09_588

This document is a request form for a waiver of nonresident withholding in California. It requests information about the requester, withholding agent, and payees. The requester provides their name and address and selects the type of income payment for which a waiver is requested. The withholding agent's name and address are also provided. In the vendor/payee section, names, addresses, and tax identification numbers are listed along with the reason for waiver request. Reasons include having current tax returns on file, making estimated payments, being a member of a combined reporting entity, or other special circumstances. The form is signed under penalty of perjury.

ftb.ca.gov forms 09_587

This document is a Nonresident Withholding Allocation Worksheet (Form 587) used to determine if withholding of income tax is required for payments made by a withholding agent to a nonresident vendor/payee. The vendor/payee provides information about the types of payments received and allocation of income between California and other states. The withholding agent uses this information to determine if withholding of 7% is required based on the amount of California-source income payments exceeding $1,500.

ftb.ca.gov forms 09_570

This document is a tax return form for California's nonadmitted insurance tax. It provides instructions for calculating taxes owed on insurance premiums paid to insurers not authorized to conduct business in California. The form includes sections to enter the taxpayer's information, identify the tax period and insurance contracts, compute the tax amount, and make payments or claim refunds. It also provides directions on filing amended returns, payment due dates, and authorizing a third party to discuss the filing with the tax agency.

ftb.ca.gov forms 09_541es

The document provides instructions for Form 541-ES, which is used to calculate and pay estimated tax for estates and trusts. Key details include:

- Estimated tax payments for 2009 are now required to be 30% of the estimated tax liability for the 1st and 2nd installments and 20% for the 3rd and 4th installments.

- Estates and trusts with a 2009 adjusted gross income of $1,000,000 or more must base estimated tax payments on their 2009 tax liability rather than the prior year's tax.

- The form and instructions provide guidance on calculating estimated tax, payment due dates, and how to complete and submit Form 541-ES.

ftb.ca.gov forms 09_540esins

This document provides instructions for California taxpayers to estimate their tax liability and make estimated tax payments for tax year 2009. Key details include:

- Taxpayers must make estimated payments if they expect to owe $500 or more in tax for 2009 after subtracting withholding and credits.

- Payments are due April 15, June 15, September 15 of 2009, and January 15 of 2010.

- A worksheet is provided to help calculate estimated tax liability based on 2008 tax return or expected 2009 income.

- Failure to make required estimated payments may result in penalties. Electronic payment is required for payments over $20,000.

ftb.ca.gov forms 09_540es

This document provides instructions for making estimated tax payments for individuals in California. It includes:

1) Directions for making online payments through the Franchise Tax Board website for ease and to schedule payments up to a year in advance.

2) A form for making estimated tax payments by mail on April 15, June 15, September 15, and January 15 that includes fields for name, address, amounts owed, and payment instructions.

3) Reminders not to combine estimated tax payments with tax payments from the previous year and to write your name and identification number on the check.

ftb.ca.gov forms 1240

This document contains contact information for the California Franchise Tax Board. It lists phone numbers and addresses for various tax-related services, including automated phone services, taxpayer assistance, tax practitioner services, and departments within the FTB that handle issues like collections, bankruptcy, and deductions. The board members and executive officer are also named.

ftb.ca.gov forms 1015B

This document provides answers to frequently asked questions about tax audits conducted by the Franchise Tax Board of California. It explains that the purpose of an audit is to fairly verify the correct amount of taxes owed. It addresses questions about obtaining representation, responding to information requests, payment plans if additional taxes are owed, and appeal rights. The document directs taxpayers to contact their auditor or the Franchise Tax Board directly for additional assistance.

More from taxman taxman (20)

Recently uploaded

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto RicoCorey Perlman, Social Media Speaker and Consultant

Social media for business Income Tax exemption for Start up : Section 80 IAC

A presentation on the concept of Exemption of Profits of Start ups from Income Tax

Structural Design Process: Step-by-Step Guide for Buildings

The structural design process is explained: Follow our step-by-step guide to understand building design intricacies and ensure structural integrity. Learn how to build wonderful buildings with the help of our detailed information. Learn how to create structures with durability and reliability and also gain insights on ways of managing structures.

3 Simple Steps To Buy Verified Payoneer Account In 2024

Buy Verified Payoneer Account: Quick and Secure Way to Receive Payments

Buy Verified Payoneer Account With 100% secure documents, [ USA, UK, CA ]. Are you looking for a reliable and safe way to receive payments online? Then you need buy verified Payoneer account ! Payoneer is a global payment platform that allows businesses and individuals to send and receive money in over 200 countries.

If You Want To More Information just Contact Now:

Skype: SEOSMMEARTH

Telegram: @seosmmearth

Gmail: seosmmearth@gmail.com

2024-6-01-IMPACTSilver-Corp-Presentation.pdf

IMPACT Silver is a pure silver zinc producer with over $260 million in revenue since 2008 and a large 100% owned 210km Mexico land package - 2024 catalysts includes new 14% grade zinc Plomosas mine and 20,000m of fully funded exploration drilling.

How are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

“After being the most listed dog breed in the United States for 31

years in a row, the Labrador Retriever has dropped to second place

in the American Kennel Club's annual survey of the country's most

popular canines. The French Bulldog is the new top dog in the

United States as of 2022. The stylish puppy has ascended the

rankings in rapid time despite having health concerns and limited

color choices.”

Easily Verify Compliance and Security with Binance KYC

Use our simple KYC verification guide to make sure your Binance account is safe and compliant. Discover the fundamentals, appreciate the significance of KYC, and trade on one of the biggest cryptocurrency exchanges with confidence.

Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

This letter, written by Kellen Harkins, Course Director at Full Sail University, commends Anny Love's exemplary performance in the Video Sharing Platforms class. It highlights her dedication, willingness to challenge herself, and exceptional skills in production, editing, and marketing across various video platforms like YouTube, TikTok, and Instagram.

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

SATTA MATKA SATTA FAST RESULT KALYAN TOP MATKA RESULT KALYAN SATTA MATKA FAST RESULT MILAN RATAN RAJDHANI MAIN BAZAR MATKA FAST TIPS RESULT MATKA CHART JODI CHART PANEL CHART FREE FIX GAME SATTAMATKA ! MATKA MOBI SATTA 143 spboss.in TOP NO1 RESULT FULL RATE MATKA ONLINE GAME PLAY BY APP SPBOSSDigital Transformation Frameworks: Driving Digital Excellence

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This presentation is a curated compilation of PowerPoint diagrams and templates designed to illustrate 20 different digital transformation frameworks and models. These frameworks are based on recent industry trends and best practices, ensuring that the content remains relevant and up-to-date.

Key highlights include Microsoft's Digital Transformation Framework, which focuses on driving innovation and efficiency, and McKinsey's Ten Guiding Principles, which provide strategic insights for successful digital transformation. Additionally, Forrester's framework emphasizes enhancing customer experiences and modernizing IT infrastructure, while IDC's MaturityScape helps assess and develop organizational digital maturity. MIT's framework explores cutting-edge strategies for achieving digital success.

These materials are perfect for enhancing your business or classroom presentations, offering visual aids to supplement your insights. Please note that while comprehensive, these slides are intended as supplementary resources and may not be complete for standalone instructional purposes.

Frameworks/Models included:

Microsoft’s Digital Transformation Framework

McKinsey’s Ten Guiding Principles of Digital Transformation

Forrester’s Digital Transformation Framework

IDC’s Digital Transformation MaturityScape

MIT’s Digital Transformation Framework

Gartner’s Digital Transformation Framework

Accenture’s Digital Strategy & Enterprise Frameworks

Deloitte’s Digital Industrial Transformation Framework

Capgemini’s Digital Transformation Framework

PwC’s Digital Transformation Framework

Cisco’s Digital Transformation Framework

Cognizant’s Digital Transformation Framework

DXC Technology’s Digital Transformation Framework

The BCG Strategy Palette

McKinsey’s Digital Transformation Framework

Digital Transformation Compass

Four Levels of Digital Maturity

Design Thinking Framework

Business Model Canvas

Customer Journey Map

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

Leaders who possess self-awareness deeply understand their emotions, strengths, and weaknesses.

Creative Web Design Company in Singapore

At Techbox Square, in Singapore, we're not just creative web designers and developers, we're the driving force behind your brand identity. Contact us today.

Mastering B2B Payments Webinar from BlueSnap

B2B payments are rapidly changing. Find out the 5 key questions you need to be asking yourself to be sure you are mastering B2B payments today. Learn more at www.BlueSnap.com.

一比一原版新西兰奥塔哥大学毕业证(otago毕业证)如何办理

一模一样【微信:A575476】【新西兰奥塔哥大学毕业证(otago毕业证)成绩单Offer】【微信:A575476】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:A575476】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:A575476】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

Building Your Employer Brand with Social Media

Presented at The Global HR Summit, 6th June 2024

In this keynote, Luan Wise will provide invaluable insights to elevate your employer brand on social media platforms including LinkedIn, Facebook, Instagram, X (formerly Twitter) and TikTok. You'll learn how compelling content can authentically showcase your company culture, values, and employee experiences to support your talent acquisition and retention objectives. Additionally, you'll understand the power of employee advocacy to amplify reach and engagement – helping to position your organization as an employer of choice in today's competitive talent landscape.

HOW TO START UP A COMPANY A STEP-BY-STEP GUIDE.pdf

How to Start Up a Company: A Step-by-Step Guide Starting a company is an exciting adventure that combines creativity, strategy, and hard work. It can seem overwhelming at first, but with the right guidance, anyone can transform a great idea into a successful business. Let's dive into how to start up a company, from the initial spark of an idea to securing funding and launching your startup.

Introduction

Have you ever dreamed of turning your innovative idea into a thriving business? Starting a company involves numerous steps and decisions, but don't worry—we're here to help. Whether you're exploring how to start a startup company or wondering how to start up a small business, this guide will walk you through the process, step by step.

Best practices for project execution and delivery

A select set of project management best practices to keep your project on-track, on-cost and aligned to scope. Many firms have don't have the necessary skills, diligence, methods and oversight of their projects; this leads to slippage, higher costs and longer timeframes. Often firms have a history of projects that simply failed to move the needle. These best practices will help your firm avoid these pitfalls but they require fortitude to apply.

Recently uploaded (20)

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto Rico

Income Tax exemption for Start up : Section 80 IAC

Income Tax exemption for Start up : Section 80 IAC

Structural Design Process: Step-by-Step Guide for Buildings

Structural Design Process: Step-by-Step Guide for Buildings

3 Simple Steps To Buy Verified Payoneer Account In 2024

3 Simple Steps To Buy Verified Payoneer Account In 2024

How are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

How are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

Easily Verify Compliance and Security with Binance KYC

Easily Verify Compliance and Security with Binance KYC

Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Digital Transformation Frameworks: Driving Digital Excellence

Digital Transformation Frameworks: Driving Digital Excellence

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

The Heart of Leadership_ How Emotional Intelligence Drives Business Success B...

HOW TO START UP A COMPANY A STEP-BY-STEP GUIDE.pdf

HOW TO START UP A COMPANY A STEP-BY-STEP GUIDE.pdf

state.ia.us tax forms 0841132

- 1. Reset Form Print Form Iowa Department of Revenue IA 132 2008 www.state.ia.us/tax Cow-Calf Refund Name of Individual(s) or Corporation: _____________________________________________________________ Spouse Name: _________________________________________________________________________________ Social Security or Federal ID No(s): _______________________________________________________________ Spouse SS #: __________________________________________________________________________________ Taxpayer Address: _____________________________________________________________________________ SPOUSE TAXPAYER OR CORPORATION Number Corn Eq. Total Number Corn Eq. Total 1. Breeding bulls, bred cows, and bred heifers in inventory on Dec. 31, 2008 $11.15 $11.15 2. Refund from other entity 3. Total refund (add lines 1 and 2) QUALIFICATIONS COMPUTATION OF COW-CALF REFUND For tax year 2008, a qualified taxpayer is a corporation or SPOUSE OWNERSHIP individual with a federal taxable income of $123,504 or If one spouse owns the operation, complete the “Taxpayer less. or Corporation” column. The Cow/Calf claim is based on the following types of If both spouses jointly own a cow-calf operation, the number cattle: bred cows, bred heifers, and breeding bulls. The beef of cattle may be allocated by the ratio of the spouses’ cattle must be located in Iowa and must also have been in ownership to create a refund for each spouse. Use both inventory July 1 of the tax year and still in inventory on “Spouse” and “Taxpayer or Corporation” columns if both December 31 of the tax year. spouses choose to claim refunds. The refund is computed on the basis of corn equivalents If both spouses are involved in separate operations, use deemed to have been consumed by qualifying cattle in the both the “Spouse” and “Taxpayer or Corporation” columns. operation on December 31, 2008. LINE INSTRUCTIONS DISTRIBUTION OF REFUND LINE 1 Enter the number of bred cows, bred yearling The amount to be distributed for Cow-Calf Refund claims heifers, and breeding bulls in inventory in the operation on will be appropriated by the General Assembly. Refunds December 31, 2008, that were in the operation on July 1, will be prorated when issued in February 2010. The 2008. Multiply this number by $11.15 and enter the total. maximum refund for a corporation is $3,000. The maximum LINE 2 Enter the refund amount allocated to the taxpayer refund for each cow-calf operation is $3,000. The total or spouse from the individual’s ownership in a partnership, refund may not exceed $3,000 per spouse, or $3,000 for limited liability company, subchapter S corporation, estate both spouses if involved in the same cow-calf operation. or trust on the basis of the individual’s share of earnings If a cow-calf operation was a partnership, limited liability from the entity. company, subchapter S corporation, estate, or a trust, the LINE 3 Add the amount in the total columns from lines 1 Cow-Calf Refund must be allocated to the owners in the and 2. This is the potential Cow-Calf Refund. Enter the ratio of the earnings of each individual in the entity to the total or totals on page 2, Step 13, of the IA 1040, or on the entity’s total earnings, with total refund claimed by all bottom of page 1 on IA 1120, or IA 1120A. Mail this form owners no more than $3,000. with your income tax return. Do not amend a return to FILING DEADLINES submit an overlooked IA 132. Send the completed IA 132 to Taxpayer Services - Iowa Department of Revenue, P.O. All claims must be filed within 10 months of the end of the Box 10457, Des Moines, IA 50306 by the due date. tax year with the taxpayer's income tax return. If the claim is not paid by February 28, 2010, because the taxpayer is a fiscal filer, the claim will be considered as a claim filed for the following tax year. 41-132 (8/05/08)