Embed presentation

Download to read offline

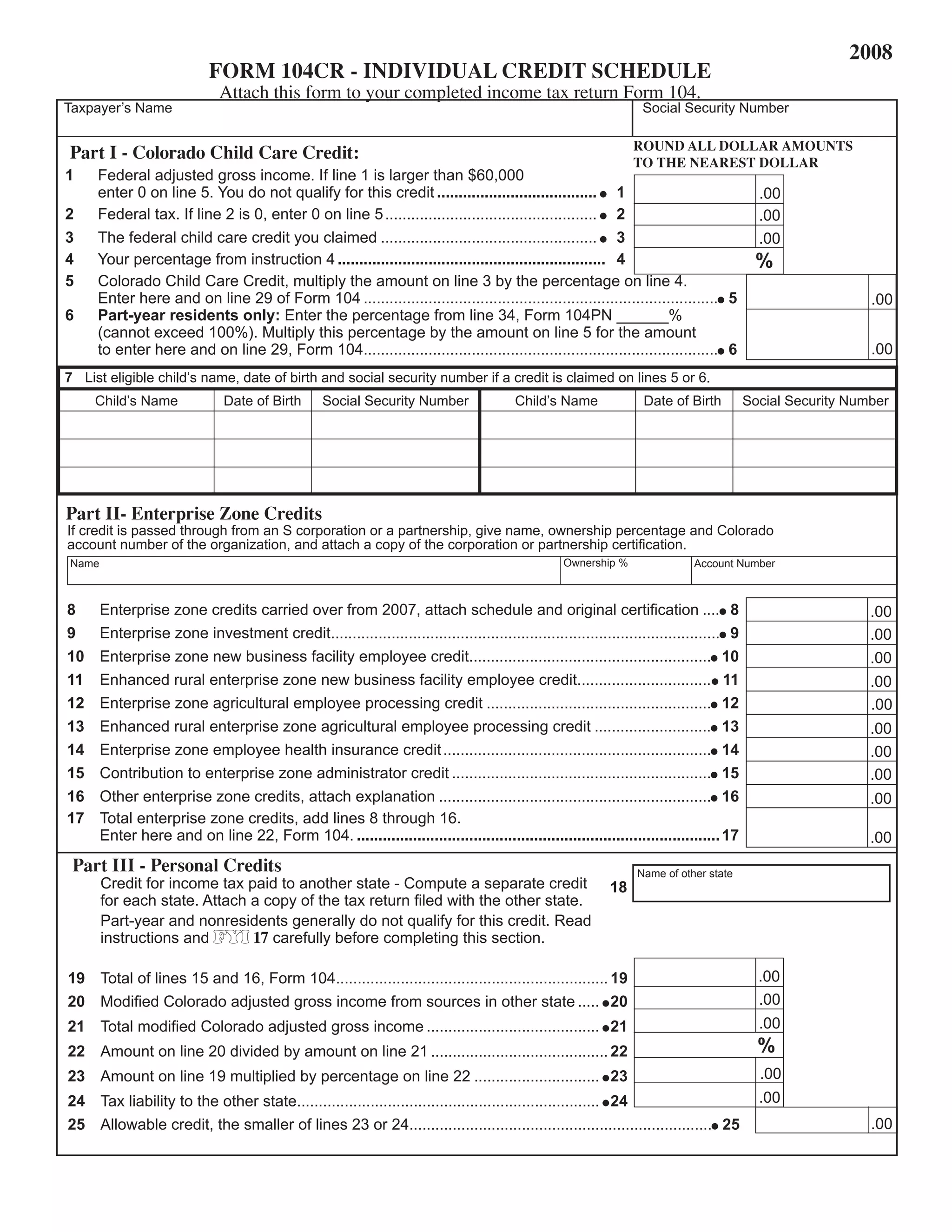

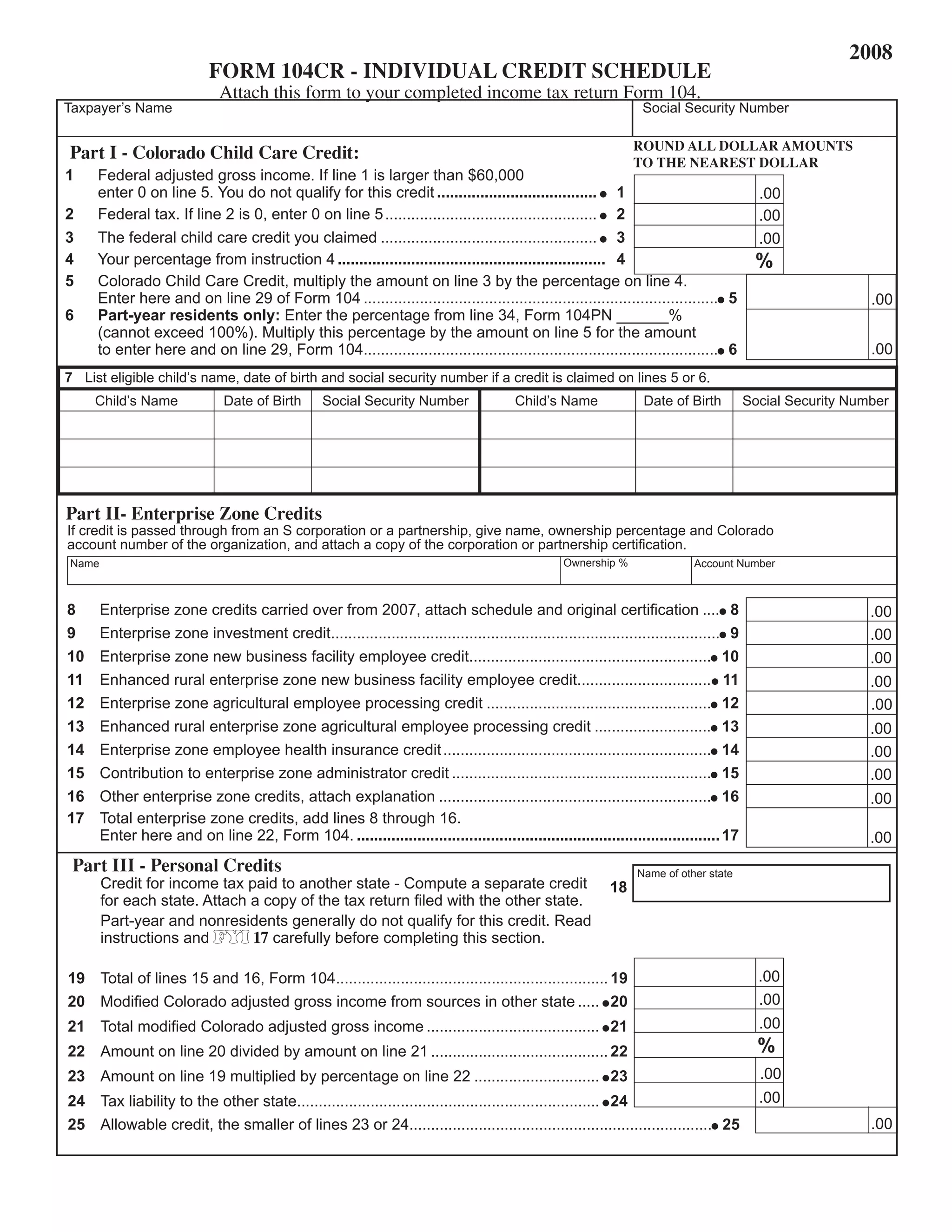

This document is an individual credit schedule form for a Colorado income tax return from 2008. It contains information about calculating three types of tax credits: (1) the Colorado child care credit, (2) enterprise zone credits, and (3) personal credits. For the child care credit, it lists details on calculating the credit amount based on the federal child care credit and adjusted gross income. For enterprise zone credits, it provides lines to list amounts for various zone-related credits. For personal credits, it includes lines for credits related to income tax paid to other states, recycling investments, historic preservation, and other state-specific tax credits.